China’s Renminbi use in global transactions has hit new highs. This change is reshaping how countries trade and settle payments worldwide. The rise of Renminbi internationalization is changing cross-border transactions.

Also Read: Ethereum Underperforms Bitcoin 44% Since Proof of Stake Switch

Renminbi Internationalization: Impact on Cross-Border Transactions and Trade Settlement

Record-Breaking Usage

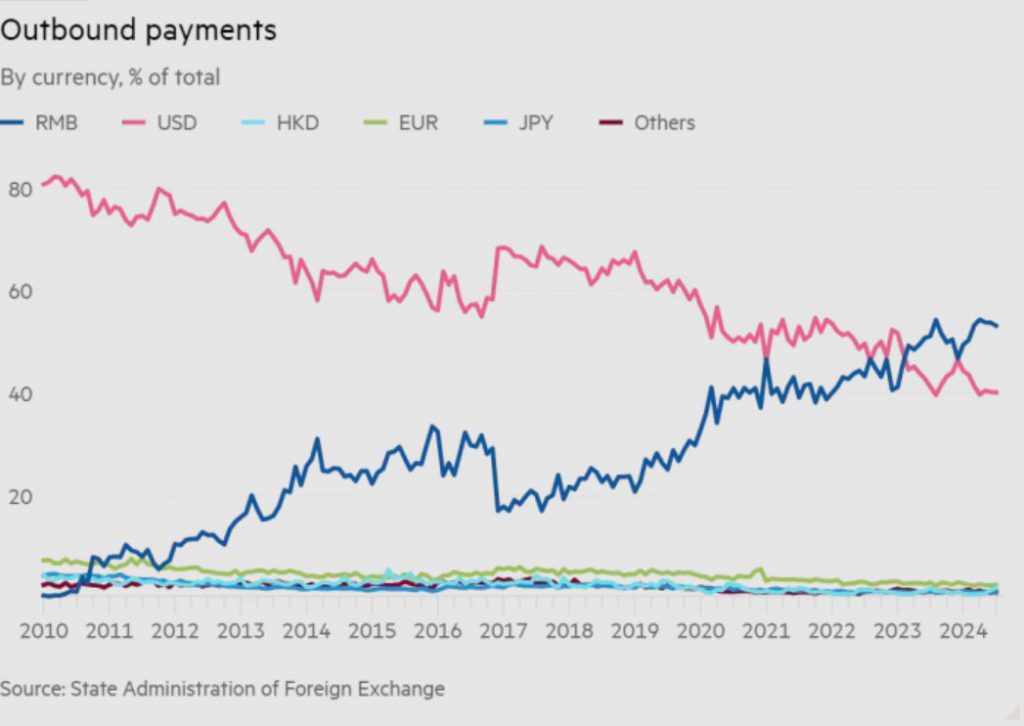

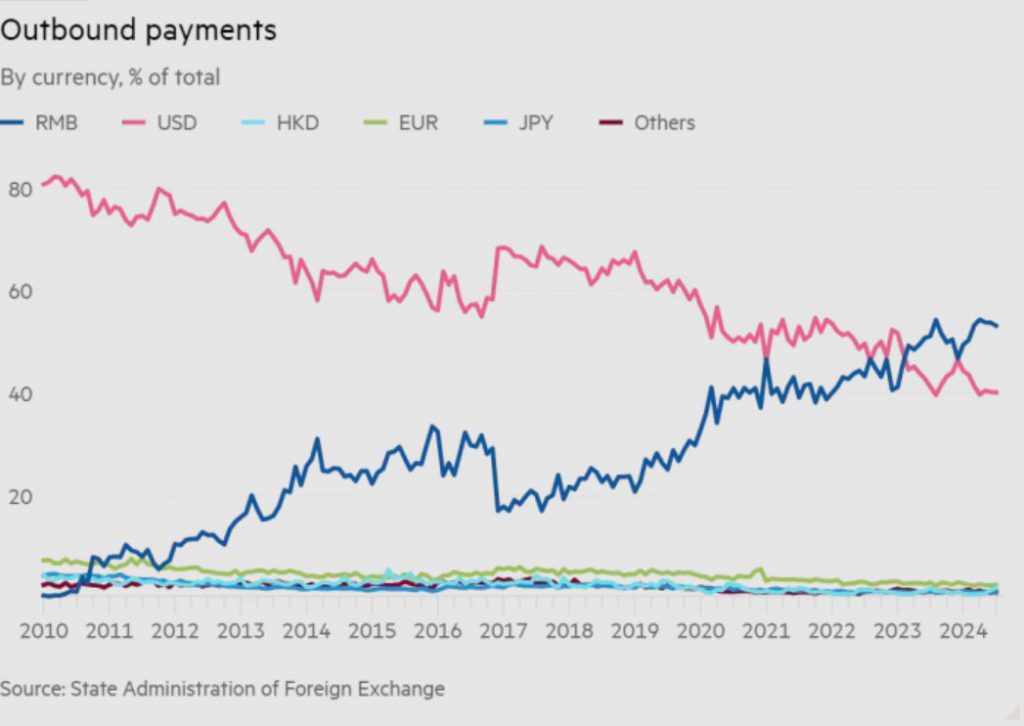

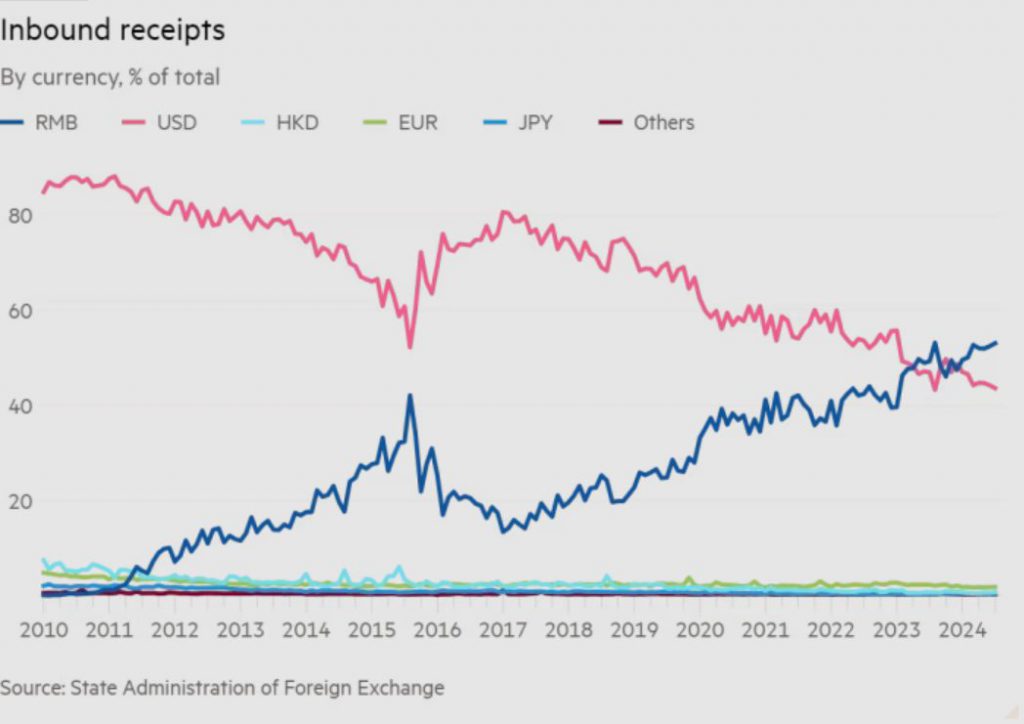

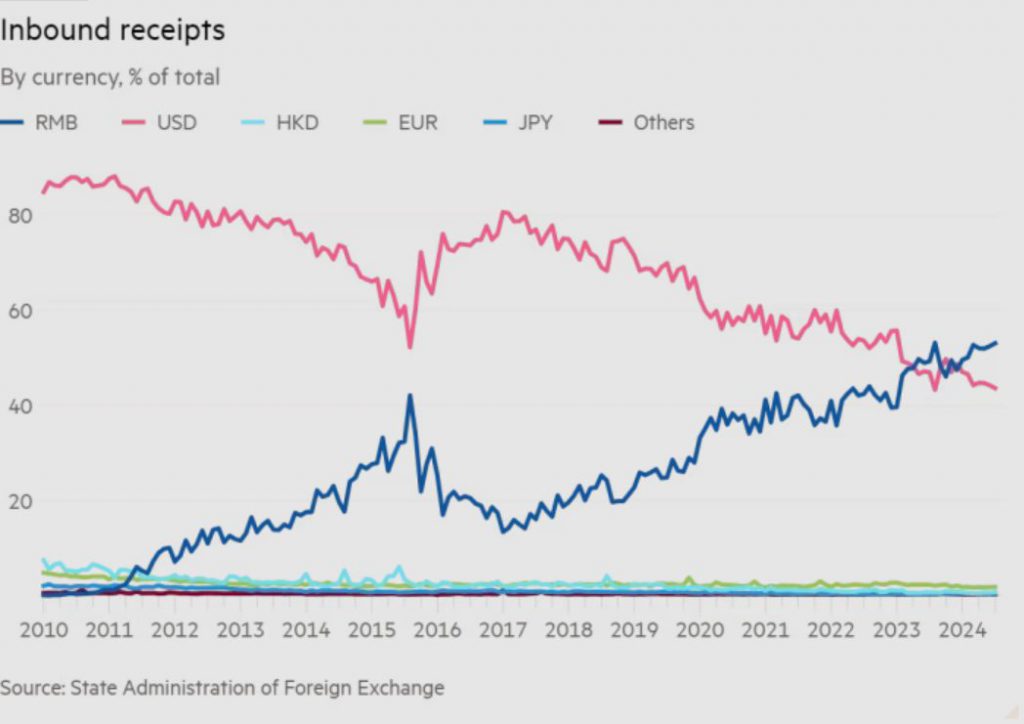

The State Administration of Foreign Exchange provided this data: In July 2024, the Renminbi was used in 53% of China’s foreign transactions, up from 40% in July 2021.

Alexandra Prokopenko, a research fellow at the Carnegie Institute in Berlin, explains the surge:

“The sanction situation created a huge stimulus for China to develop its [financial] system and to develop solutions to link China’s system with the Russian one.”

Driving Factors

Three main factors led to this increase:

- Global politics: U.S. sanctions on Russia pushed it to use more Renminbi.

- New partnerships: China set up currency deals with countries that sell raw materials.

- Better systems: Since 2022, new Renminbi banks opened in many countries.

Louis-Vincent Gave of Gavekal, a financial services firm, emphasizes the importance of currency stability:

“You can’t go to Indonesia, Thailand, South Korea and say, ‘Hey, let’s trade in renminbi rather than dollar’ if you have a weak currency. For that to happen, you need to have a stable currency.”

Also Read: BRICS: Key Nation Rejects 2024 Summit Invitation

Global Implications

The Renminbi is growing but still trails behind other major currencies. It makes up 4.74% of global payments. The U.S. dollar, euro, and pound are still used more often.

Edwin Lai, a professor at the Hong Kong University of Science and Technology, puts this progress into perspective:

“By international standards it’s not a great achievement. At the same time, they have obviously improved.”

China’s Renminbi Challenges and Limitations

The Renminbi faces three main hurdles:

- Western caution: Big economies like the U.S. and EU are unlikely to switch to Renminbi.

- Money rules: China’s strict controls on money flows make its currency less appealing.

- Old habits: The dollar’s long-standing dominance is hard to change.

Daniel McDowell, a professor at Syracuse University, notes:

“I think it’s very unlikely that we’ll see China’s trade with the United States, with the European Union, moving into Chinese currency.”

Also Read: Can Cardano (ADA) Get Back Into The Top Ten This Weekend?

Future Outlook for China’s Renminbi

Experts think China wants more financial independence, not to replace the dollar. As McDowell observes:

“China is not seeking to topple the dollar’s global dominance. That comes with a lot of responsibility and accepting certain vulnerabilities… China’s motives here are primarily about autonomy and resilience.”

In conclusion, more use of the Renminbi is changing global trade. Challenges remain, but this trend will likely continue. It’s reshaping how countries handle money and trade.