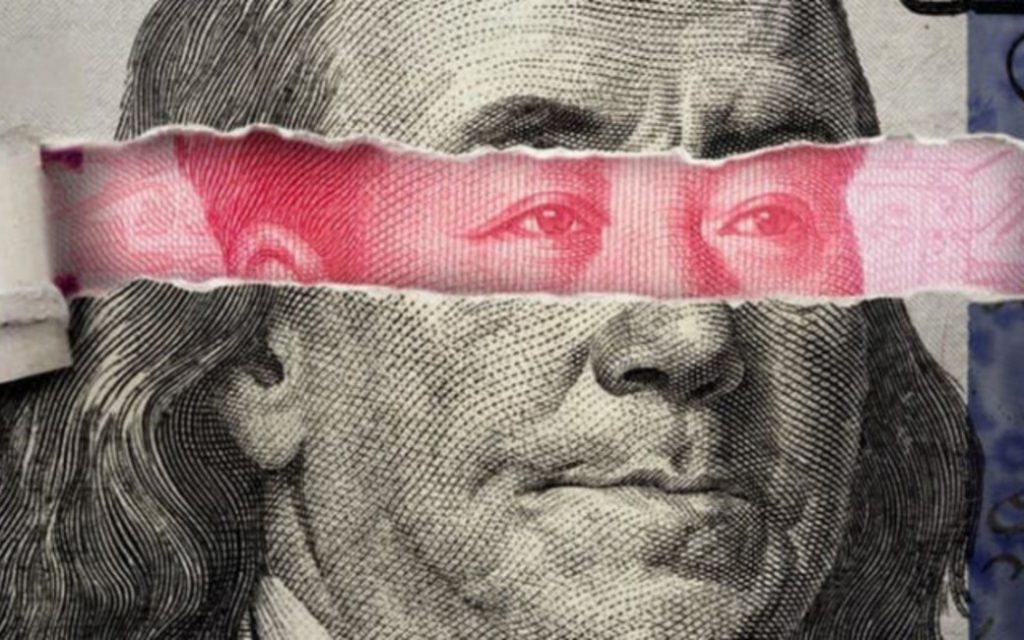

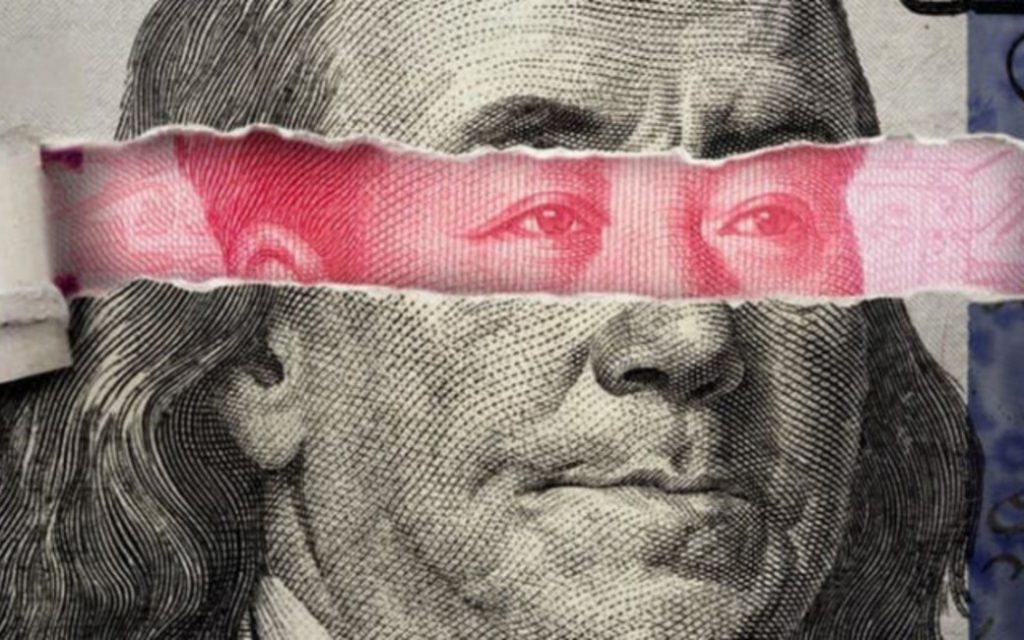

China is leaving no stone unturned to top market charts by establishing its currency as a dominant market player. The latest report has shed light on China’s latest renminbi dynamics and the fact that the country is doing all it can to spearhead offshore RMB usage to new levels of success and prosperity. Is the US Dollar in grave jeopardy? Let’s explore the narratives in detail.

Also Read: Warren Buffett’s US Dollar Outlook as BRICS Gains Ground

Renminbi’s Overseas Usage Hits Record Levels

Per the latest report shared by the Financial Times, Beijing is now putting all its efforts into internationalizing the yuan. The country is now bolstering efforts to streamline overseas usage of RMB in efforts to cut its dependence on the US dollar. At the same time, China has often expressed its desire to promote the multipolar currency system, and it seems that the country has already started to make plans to explore further ideas.

Per the FT report, the external RMB loans, including deposit and bond investments by Chinese banks, have quadrupled to more than $480B in the last 5 years. The report later shared how China is busy expediting a new RMB campaign, the one that allows foreign investors to purchase RMB-denominated bonds. At the same time, China has also been allowing countries to convert their US dollar debt into yuan, outlining the RMB’s financial nuances.

Furthermore, the Bank of International Settlements estimates that overseas lending in RMB rose to $373B in four years, which again is a compelling development to take note of.

Yuan Now Second to US Dollar: Details

The renminbi’s constant expansion can be attributed to the fact that the currency’s cross-border usage has also risen at a consistent pace. Data from SWIFT reveals RMB share in global finance has also quadrupled, to 7.6% in the last 3 years. Experts further shared how China has little interest in making the RMB a global leader in finance. The country simply wants to bolster RMB involvement in global trade in efforts to enjoy the best of both worlds.

Also Read: Russia Says No Plans to Challenge US Dollar or Third Nations