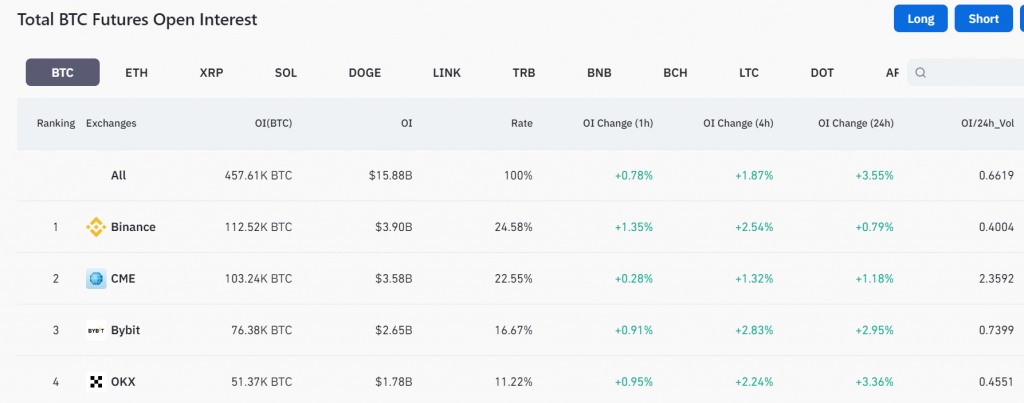

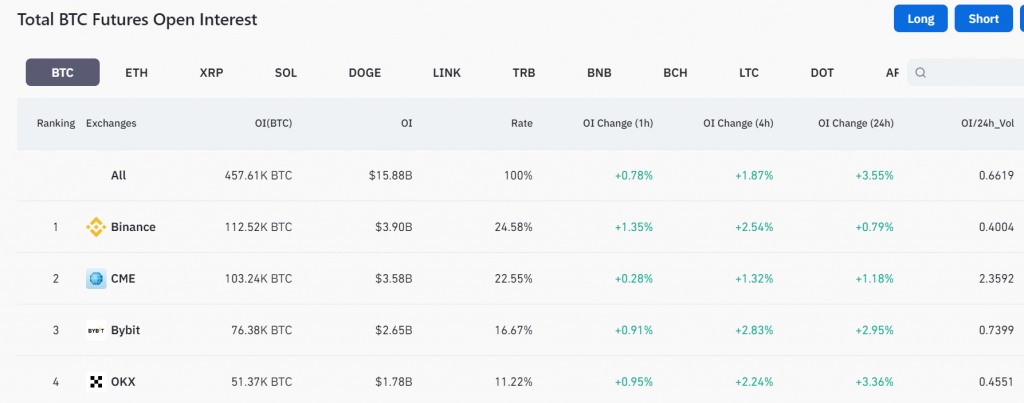

The Chicago Mercantile Exchange (CME) has surged to become the second-largest Bitcoin futures exchange by open interest. CME’s open interest recently hit $3.58 billion, pushing it past Bybit and OKX to now rank only behind industry leader Binance. Binance currently leads with $3.9 billion in open interest.

The regulated CME offers cash-settled Bitcoin futures contracts in standard and micro sizes. Increasing interest has led to volume on CME futures exceeding 100,000 BTC.

Also read: Solana (SOL) Price Prediction: November 2023

CME now captures 25% of global Bitcoin futures market share

CME now captures 25% of the global Bitcoin futures market share as institutional traders pile into its offerings. The majority of activity is via CME’s standard futures amid the coin’s double-digit October gains to over $35,000.

Open interest refers to outstanding futures contracts yet to be settled. It indicates the amount of capital flowing into Bitcoin derivatives markets.

Rising open interest signals bullish sentiment, whereas declining interest points to bearishness. CME’s meteoric open interest growth reflects a growing institutional appetite for Bitcoin exposure.

Also read: Shiba Inu Burn Rate Goes Parabolic, Surges 5600%

Offshore exchanges like Binance lead in perpetual futures with no expiry, while CME offers quarterly contracts. But CME brings the credibility and oversight of a traditional finance player.