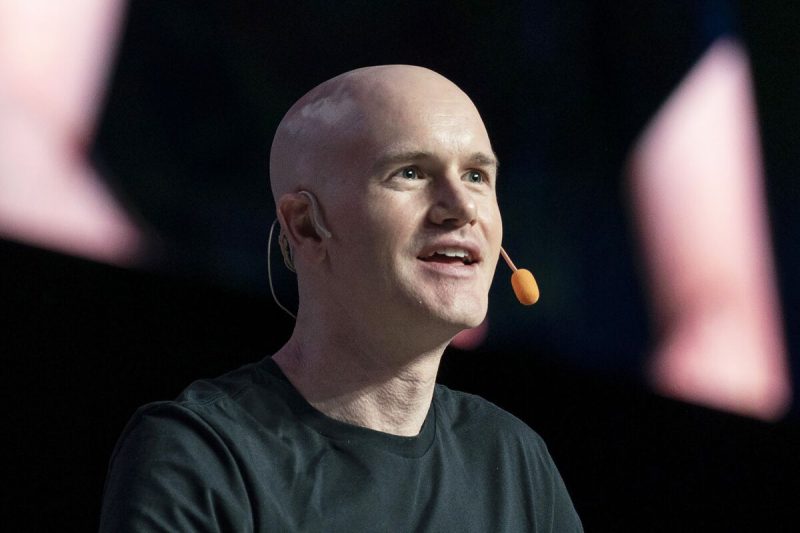

The mammoth $4.3 billion settlement between Binance and U.S. authorities represents an opportunity for the cryptocurrency industry to close the book on its scandal-plagued past, said Coinbase chief executive Brian Armstrong.

In an interview with CNBC on Monday, Armstrong stated that the enforcement actions against Binance should enable the crypto sector to “turn the page on that and hopefully close that chapter of history.”

His comments come on the heels of founder Changpeng Zhao stepping down as CEO of the world’s largest crypto exchange amid admissions that Binance violated anti-money laundering laws and breached sanctions.

Also read: Shiba Inu: AI Predicts SHIB Price For November 30, 2023

Armstrong says bad actors overshadowed positive contributions

While recognizing there have been some “bad actors” in the space recently, including FTX, and FTX founder Sam Bankman-Fried, Armstrong believes their misdeeds have overshadowed the positive contributions of many crypto companies helping to reshape finance.

He told CNBC that increased regulatory clarity, such as the framework for digital assets currently being drafted in the U.K., will likely attract more mainstream investment to reputable firms.

Also Read: OKX Sets Sights on Brazil With Crypto Exchange and Wallet

The Coinbase chief pushed back against the notion that the primary use case for cryptocurrency is illegal activity like fraud or terrorism financing. He stated that illicit transactions account for less than 1% of all crypto flows, based on Coinbase’s own observations.

As the only crypto business invited to the U.K.’s Global Investment Summit this week, Armstrong called the company’s inclusion an “endorsement” of its mission to drive adoption and provide a rules-based alternative in the space. He also applauded U.K. Prime Minister Rishi Sunak’s approach to digital asset regulation as a key reason why Coinbase is choosing to invest more in the country at a time when U.S. policy remains unsettled.