Coinbase scripted history when it went public in April last year. It became the first major cryptocurrency start-up to go public on a U.S. stock market. It did so at a valuation that rivaled that of Facebook and Airbnb when they went public.

The stock, however, did not live upto the pomp and excitement. Investors were, no doubt, fetched with listing day gains, but COIN’s performance started deteriorating right after.

In October last year, it did seem like the share price would be successful in making a parabolic recovery. However, disruptions on the macro-board alongside inflation and other pressures pushed COIN down the cliff. As a result, Coinbase has been trading around its all-time lows since the beginning of this year.

Optimism and hope managed to find their way back into the COIN market on Friday. Owing to the favorable quarterly results announced, the public listed exchange’s share price managed to incline by close to 18% from $155.9 to $183. This, as can be noted from the chart attached above, was one of COIN’s biggest daily jumps.

The number talk

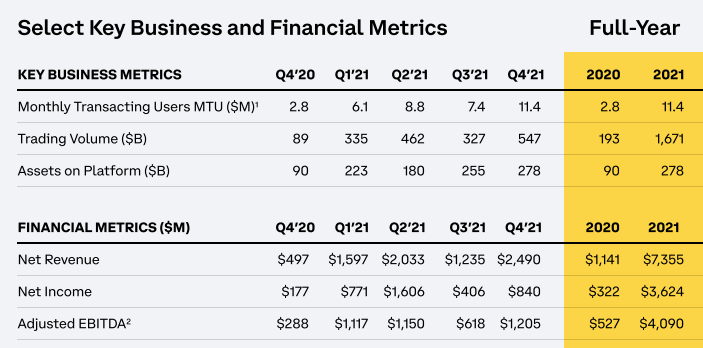

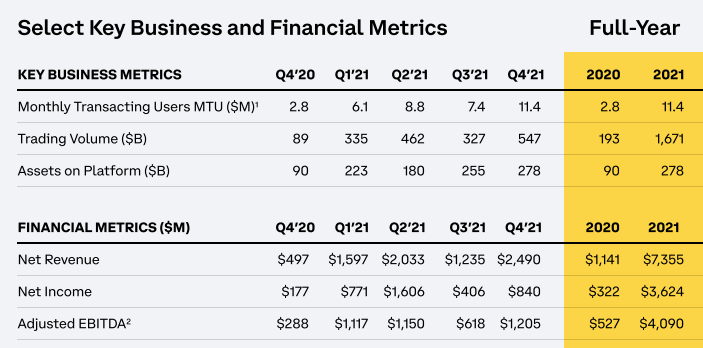

The revenue numbers released in the earnings call yesterday beat analysts’ estimates to a fair extent. The following were the key takeaways:

- Earnings per share (EPS): $3.32, versus $1.85 expected, according to a Refinitiv survey of analysts

- Revenue: $2.5 billion, versus $1.94 billion expected, according to Refinitiv

Here it is worth noting that Coinbase missed hitting the revenue target last quarter. It had earned only $1.23 billion which was lower than analysts’ expectations of $1.57 billion.

Alongside the strong financial numbers, even the key business numbers showed a notable improvement. The assets on the platform, trading volume, and the monthly transacting users, all three metrics, witnessed a bump in Q4 last year when compared to Q3.

The Bitcoin factor

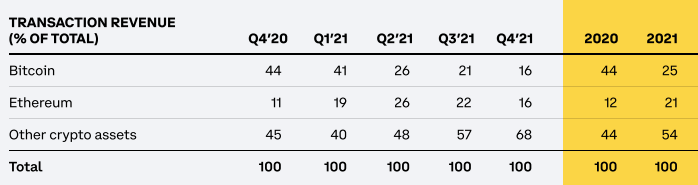

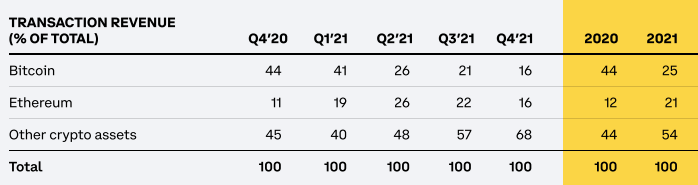

The road forward is ain’t not going to be easy for Coinbase. More so, because the company’s performance is tied to how assets from the crypto basket perform. Consider this: 32% of the company’s trading revenue in Q4 ’21 came from Bitcoin and Ethereum [16% each], while other assets in conjunction fetched it the remaining 68%.

Given how assets from the crypto space have been struggling to climb up their price ladder and the broader dip in the volumes traded and market participants’ interest, Coinbase now anticipates a wobbly Q1.

The exchange has predicted that retail monthly transaction users and total trading volume during the first quarter would be lower than the prior period. The company cited the 20% decrease in crypto market capitalization quarter to date as one of the main reasons behind its prediction. It also said that it expects subscriptions and services revenue to be lower in the current quarter because of falling crypto asset prices. Their letter to shareholders explicitly noted,

“… due to crypto asset price declines in Q1 2022, we anticipate our subscription and services revenues will be lower as compared to Q4 2021.”

So in all, yeah, crypto assets—including Bitcoin—can play spoilsport and ruin Coinbase’s Q1 party.