Despite the on-going turbulent phase, companies from the crypto space continue to expand and grow. As per a recent development, crypto exchange Coinbase has “strengthened” its European senior ranks “to help lead its expansion plans” in the region.

Chalking out the series of changes, a Bloomberg report revealed,

“Cormac Dinan, who was a general manager at Crypto.com, has joined Coinbase as country director for Ireland.”

The report also outlined,

Michael Schroeder, former chief compliance and risk officer at Bittrex, will join the crypto exchange as director of controls for Germany.

As far as promotions are concerned, Coinbase promoted Elke Karskens as new Country Director in the UK and Patrick Elyas as Director of Market Expansion in Europe, the Middle East and Africa.

Earlier, the company hired Daniel Seifert, a Senior Executive from German financial technology company Solarisbank AG last month, to lead its European expansion. At that time, the firm’s Vice President of International and Business Development Nana Murugesan asserted in an interview,

“International expansion is an existential priority for us. Whether it’s a bull market or bear market, that’s where most of our upside is.”

Contrary to the latest series of new hires and promotions, the exchange laid off 60 employees, accounting to 1.2% of its staff, in the second week of November. According to the details conveyed by a Coinbase spokesperson to Watcher Guru, the decision affected the hiring team, and secondarily, the institutional on-boarding team. However, the spokesperson went on to assure that the exchange was offering generous severance packages to employees that were laid off.

Read More: Coinbase Lays off 1.2% of its Staff Amidst Market Turmoil

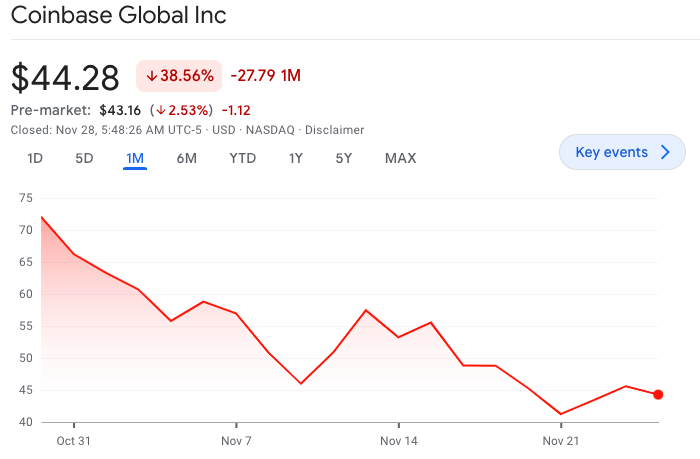

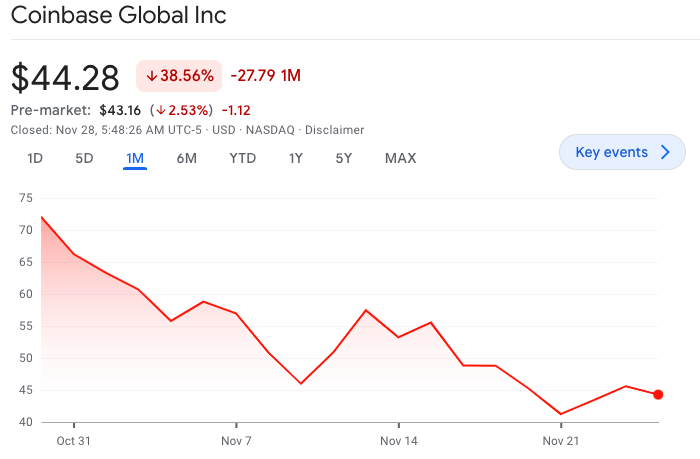

Coinbase Continues to Trade in Red

Leaving aside the latest hiring-firing developments, Coinbase shares continue to trade at discounted prices. Over the past month, COIN has shed 38% of its value. Post closing at $44.28 on Friday, the shares were priced at $43.16% during the pre-market trading hours on Monday.