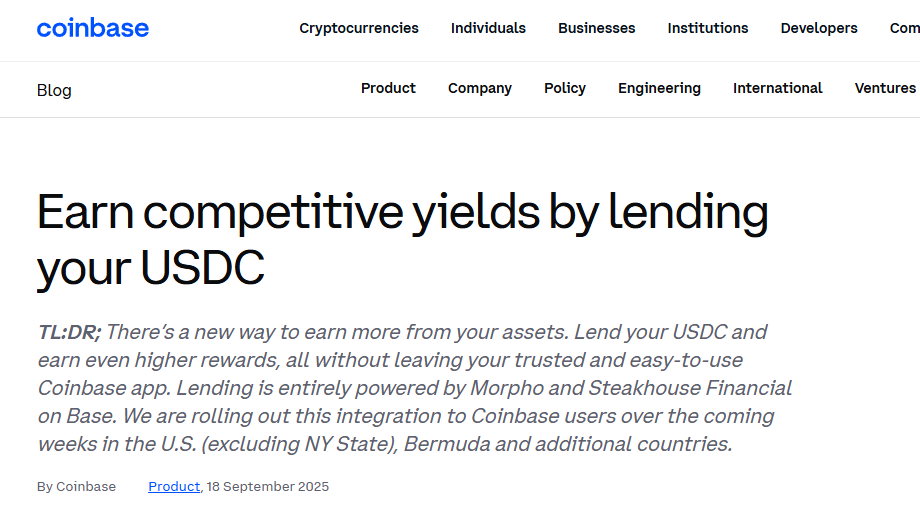

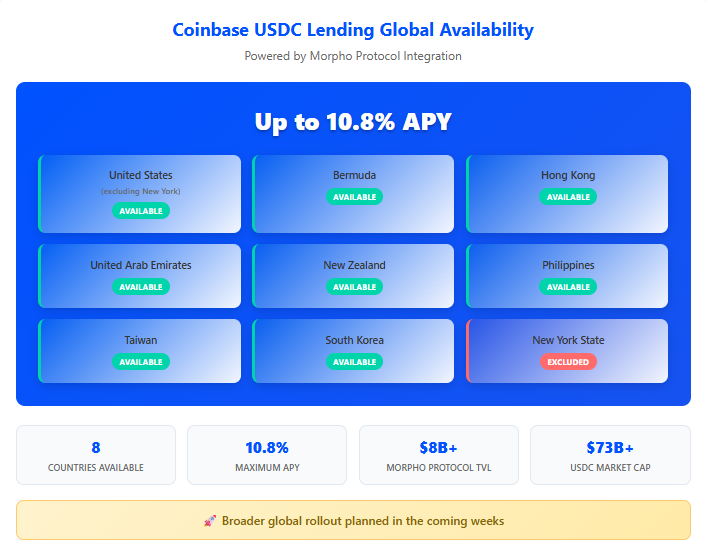

Coinbase USDC lending now offers up to 10.8% APY through the Morpho Protocol integration, which actually marks a pretty significant expansion in decentralized finance access for mainstream users. The new USDC lending feature allows users to earn substantially higher yields compared to traditional savings accounts, and also maintains the familiar Coinbase interface that millions of users have come to trust over the years.

Maximize Returns with Coinbase’s 10.8% APY USDC Lending on Morpho Protocol

How Coinbase USDC Lending Works Through Morpho Protocol

The Coinbase lending service operates through smart contract wallets that automatically route USDC deposits into Morpho Protocol vaults, which is pretty neat if you think about it. When users participate in Coinbase USDC lending right now, their funds are being allocated across different lending markets by Steakhouse Financial to optimize returns. The 10.8% APY rate represents current market conditions at the time of writing, with interest actually accruing immediately upon deposit.

A Coinbase spokesperson had this to say:

“Coinbase is only integrated with one lending protocol (Morpho) for this offering. We recommend that users understand the risks of lending, which are outlined in the Coinbase app experience.”

Coinbase USDC Lending vs Traditional USDC Rewards

This new offering significantly outperforms Coinbase’s existing USDC Rewards program, which provides 4.1% to 4.5% APY for Coinbase One members. Unlike the rewards program that’s funded by Coinbase’s marketing budget, the Morpho Protocol integration taps into actual DeFi lending markets where borrowing demand drives yields, along with market dynamics.

Also Read: Coinbase Explores Native Token for Base as Layer 2 Race Heats Up

Geographic Availability and Rollout Plans

Currently, Coinbase lending is available in the United States (excluding New York), Bermuda, Hong Kong, UAE, New Zealand, Philippines, Taiwan, and also South Korea. The platform plans broader expansion in the coming weeks, potentially reaching millions more users who are seeking high-yield USDC opportunities right now.

With USDC maintaining over $73 billion in circulation and Morpho Protocol securing more than $8 billion in total value locked, this integration represents a major milestone in bringing institutional-grade DeFi yields to retail investors through a simplified, regulated interface that’s actually accessible.

Also Read: BlackRock Buying XRP Via Coinbase Stirs Investor Interest