The earnings report season is already here. Wall Street companies have been releasing their third-quarter reports back-to-back, chalking out the same. A day back, FinServ company Robinhood reported a net loss of $175 million in Q3.

Read More: Will Robinhood continue making advancements in the crypto space?

Coinbase was the latest to release its report. The publicly traded company operating a crypto exchange incurred a third-quarter net loss of $545 million, marking a reduction of nearly 50% when compared to the past quarter. Despite being able to cut down its losses, the company’s transaction revenue had fallen from $655.2 million in the second quarter to $365.9 million—signifying a 44% dip.

The company stated the poor macro conditions, the shift in its trading volumes away from the United States due to the absence of regulatory clarity, and the drop in the average crypto market capitalization as reasons for the drop. Nevertheless, Coinbase CEO and co-founder Brian Armstrong remained optimistic. During the earnings call, he said,

“I think there’s an opportunity at some point for the crypto prices to potentially decouple from the broader macro environment. And we don’t know if that’s gonna happen, but I think it’s one of the possibilities and regulatory clarity is one of the things that could help kick that off.”

Coinbase has been successful in reducing operating expenses by 38% from the previous quarter by adopting measures like headcount reduction. Parallelly, the earnings report also revealed that as of the end of the quarter, around 25% of the 100 largest hedge funds by reported AuMs had chosen to onboard with Coinbase.

COIN shares closed 8% lower on Thursday, but managed to record a 4.87% rise to $58.52 during the after-trade hours.

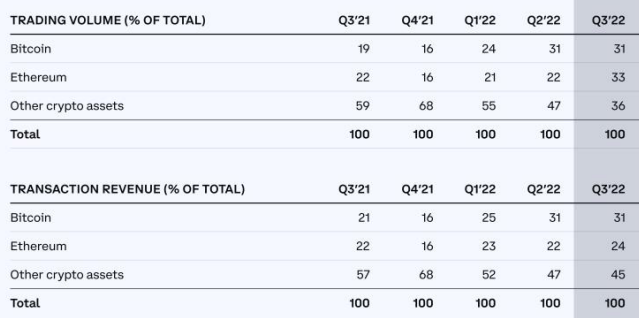

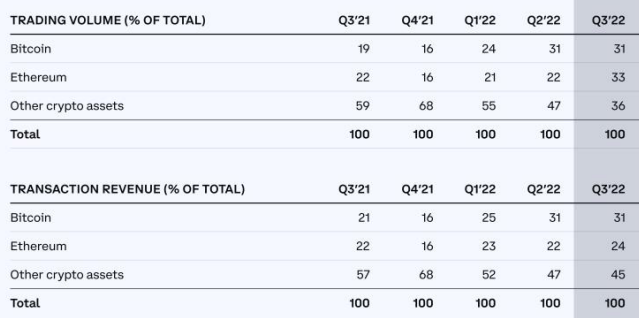

Crypto trading revenue breakdown

Bitcoin and Ethereum remained to be the most traded assets on the platform. Retrospectively, they also fetched higher revenue in total, when compared to all other assets traded.

The company’s Bitcoin trade volume remained unchanged at 31% when compared to Q2. However, the same stands at a significantly higher level than Q3 2021’s 19%.

Ethereum trading on the platform—on the other hand—saw a substantial jump, thanks to the speculative interest rise around the time of the Merge. Last quarter, the largest altcoin accounted for 22% of Coinbase’s volume, while this time, the number stood at 33%—higher than even Bitcoin.

Other crypto assets made up for the remaining 36% of the volume, after dropping from last quarter’s 47%.

Revenue-wise, both the top cryptos contributed 55%. However, it should be noted that despite the rise in trading volume, Ethereum’s say in the revenue did not match up. Other assets chipped in the balance 45%.