Dividend stocks are currently providing a reliable income stream for many investors who worry about market downturns. With growing concerns about a potential stock market crash and also the ongoing tariff impact on stocks, many people are actively looking for high-yield investments that can withstand economic turbulence. Right now, the best stocks to buy now seem to be those that combine strong fundamentals with consistent dividend histories.

Also Read: MicroStrategy Buys 3,459 More Bitcoin Worth $285.8M – Saylor Now Holds 531,644 BTC

Explore High-Yield Investments Built to Survive Market Shocks

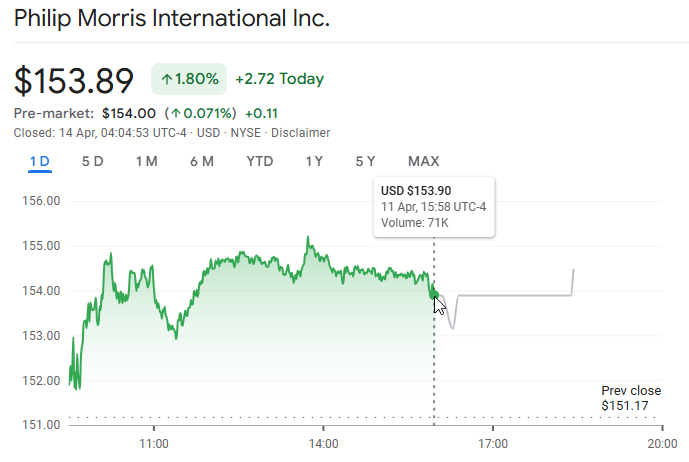

1. Philip Morris International (PM)

Philip Morris offers a rather generous 5.1% dividend yield at the time of writing, which makes it an attractive option among dividend stocks during this period of market uncertainty. The company has actually increased its dividends for 15 consecutive years despite various industry challenges.

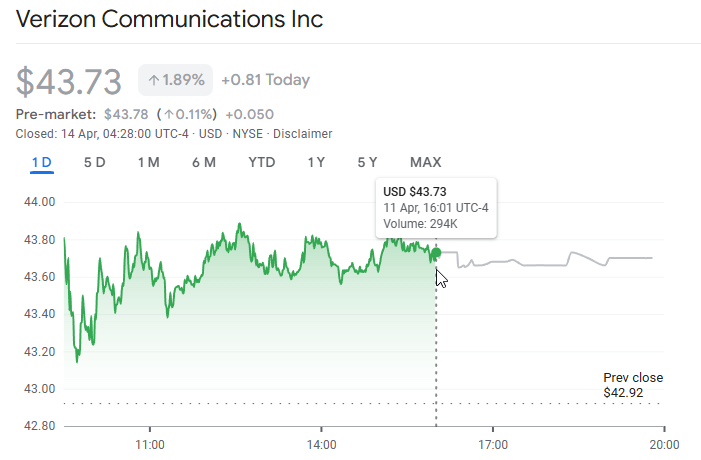

2. Verizon Communications (VZ)

Telecommunication giant Verizon provides essential services that remain in demand even during economic downturns. With a substantial 6.5% yield currently, these dividend stocks represent a defensive sector that can help protect portfolios against a stock market crash and other market problems.

Also Read: No Insider Trading at the White House? Hassett Breaks Silence

Comparative Resilience

Recent market data from this month shows both companies maintaining strength during volatility, and this demonstrates why these high-yield investments are considered among the best stocks to buy now for protection against market turbulence and such.

Other Options

Known as “The Monthly Dividend Company,” Realty Income boasts a pretty impressive 5.3% yield and has had 118 dividend increases since going public. Consumer staples leader P&G also offers a 2.4% yield with an impressive 67-year history of dividend increases. The essential nature of their products ensures consistent demand regardless of economic conditions, providing stability when a stock market crash threatens growth-oriented investments and other riskier assets.

Also Read: Analyst Predicts SHIB to Surge 400%—Is This the Meme Coin’s Comeback?

These four high-yield investments from diverse sectors offer portfolio protection while also maintaining income streams. By focusing on dividend stocks with proven track records, investors can better position themselves against market volatility and potential economic disruptions that might occur in the near future.