In the current financial landscape, right now, Warren Buffett’s investment strategy appears to be particularly effective during market downturns. The legendary investor’s approach to bear market investing has, over time, yielded remarkable returns while also safeguarding his wealth. His value investing tips provide, at the time of writing, a roadmap for investors who are wondering how to invest during an economic crash.

Dan Barufaldi said:

“Buffett makes concentrated purchases. In a downturn, he buys millions of shares of solid businesses at reasonable prices.”

Also Read: Asian Stock Market Crash: India, China, Japan, Singapore & Thailand Bleed

Buy The Dip Strategy Amid Crypto Liquidations And Price Crashes

When others panic-sell, Buffett’s strategy activates. His selective contrarian approach means buying quality companies when prices collapse. This portfolio protection strategy has been, for many years now, Berkshire Hathaway’s secret weapon for decades.

Buffett’s Core Investment Criteria

The Warren Buffett strategy relies on strict criteria that become especially crucial during bear markets.

Companies must operate in growing industries, possess strong brands, show upward earnings trends, maintain low debt ratios, and demonstrate high returns on invested capital. These standards identify businesses with competitive advantages that endure economic storms.

Charles Potters said:

“Buffett’s strategy for coping with a down market is to approach it as an opportunity to buy good companies at reasonable prices.”

Also Read: XRP vs Solana: 76% vs 11% Growth Potential – Which Crypto Wins in 2025?

Strategic Cash Deployment

Cash reserves are, as a matter of fact, central to Buffett’s bear market investing approach. Ample liquidity allows Berkshire to seize opportunities when others must sell at depressed prices.

In his 2009 shareholder letter, Buffett warned:

“Cash held beyond the bottom would be eroded by inflation in the recovery.”

Portfolio Highlights

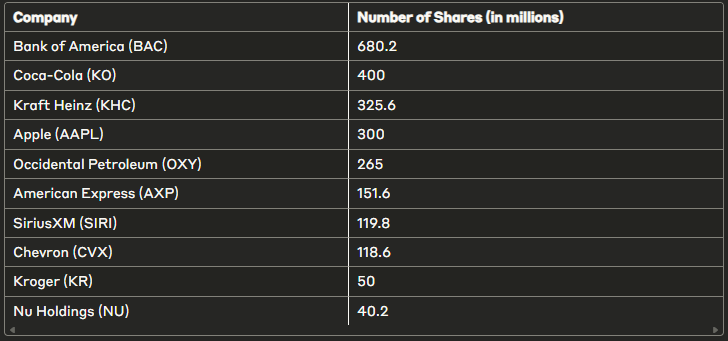

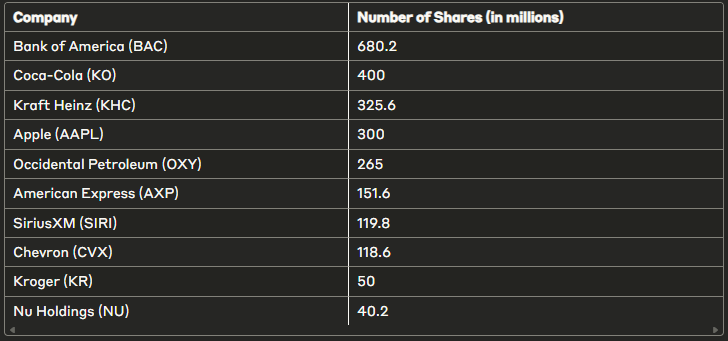

The Warren Buffett strategy is reflected in his holdings:

The largest holdings found in Buffet’s portfolio include Bank of America (BAC), Coca-Cola (KO), Kraft Heinz (KHC), Apple (AAPL), and Occidental Petroleum (OXY) just to name the top choices.

Buffett Stocks

Between 1965 and 2024, Berkshire’s portfolio achieved a 19.9% annual gain, nearly doubling the S&P 500’s 10.4%. These results validate, at this point in time, Buffett’s value investing tips and patient approach.

Also Read: JPMorgan CEO Jamie Dimon Warns: Trump’s Tariffs Could Fuel Inflation & Slow Growth

Buffett’s portfolio protection strategies offer, in addition, lessons for all investors. By identifying businesses with lasting advantages, maintaining cash reserves, and viewing market crashes as opportunities, investors can apply his principles to protect and grow their investments during turbulent times.