CRWD stock tumbled more than 6% in after-hours trading on Wednesday, even though the cybersecurity company actually beat Wall Street estimates for both earnings and revenue in its second quarter. The CrowdStrike stock price news has been dominated by investor concerns over the company’s weaker-than-expected revenue guidance for the third quarter, and many are now asking why is CrowdStrike stock dropping when the fundamentals looked pretty solid at first glance.

Also Read: Nvidia Stock Drops Despite Earnings Beat, Wall Street Reacts

CrowdStrike Stock Price News Highlights Q2 Earnings And Drop Causes

Strong Q2 Results Get Overshadowed by Guidance Concerns

Right now, CrowdStrike’s second-quarter performance was actually quite impressive when you look at the numbers. The company reported adjusted earnings of 93 cents per share, which was well above the 83 cents that analysts had been expecting. Revenue came in at $1.17 billion, representing a solid 21% jump from the same period last year, and also slightly beating the $1.15 billion consensus estimate.

The annual recurring revenue (ARR) – which is really the key metric that Wall Street analysts focus on for subscription-based companies like this one – grew by 20% as the company reached $4.66 billion. This number beat what analysts had predicted at $4.642 billion. And the net new ARR hit $221 million, which topped the $202 million that analysts had expected.

At the time of writing, these numbers would normally send a stock higher, but that’s not what happened here.

“As AI transforms the enterprise, CrowdStrike enables organizations to confidently embrace their AI future from development to deployment, from cloud to endpoint and from human to agent,” founder and Chief Executive George Kurtz said in the company’s earnings release.

Third Quarter Guidance Disappoints Wall Street

The main reason behind the CrowdStrike earnings disappointment wasn’t the actual results – it was what management said about the next quarter. The company guided for revenue between $1.208 billion and $1.218 billion for the current quarter, which fell short of the $1.228 billion that analysts had been expecting.

Analysts have attributed this weaker guidance to the ongoing fallout from that major IT outage that happened back in July 2024. A software update from CrowdStrike caused widespread disruptions across multiple industries, and analysts are still concerned that many customers might seek price discounts when they renew their contracts to help cover the costs of those business disruptions.

“Q3 guidance came in lower than expectations for revenue and in-line to above expectations for profitability,” said RBC Capital analyst Matthew Hedberg in a report. “Fiscal 2026 guidance was raised across the board, though revenue guidance was only raised on the lower-end of the range.”

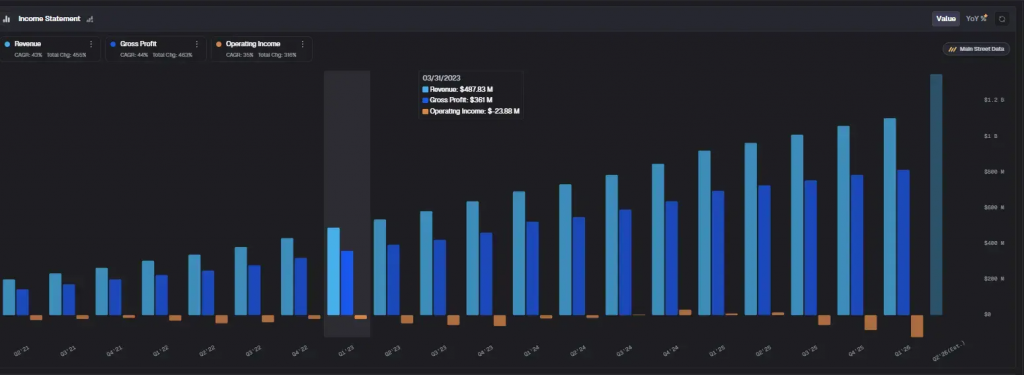

Source: Main Street Data

Legal Issues and Competitive Pressures Continue

CrowdStrike is still dealing with legal challenges related to that IT outage, including litigation from Delta Air Lines. This ongoing uncertainty has been weighing on investor sentiment, particularly as there are concerns about potential financial settlements and damage to the company’s reputation.

The cybersecurity market has become increasingly competitive, with CrowdStrike facing off against major players such as Palo Alto Networks, SentinelOne, and Microsoft. Despite these challenges, the company has been trying to stay ahead through innovation and strategic acquisitions. Just recently, they announced plans to acquire Onum, which provides real-time telemetry management solutions, though they didn’t disclose the terms of that deal.

Financial Position Remains Strong Despite Stock Decline

CrowdStrike has a solid underlying financial position even despite the selling off of the stock. The firm recorded the highest level of cash flow of its operations of 333 million and free cash flow of 284 million. As of July 31, 2014, the company had a record level of cash and cash equivalents amounting to 4.97 billion, which will provide it with a lot of financial flexibility in the future.

Subscriptions increased by 20 percent to $1.10 billion, as expected by analysts, and demonstrates that basic business model remains viable. Such a recurrent revenue base offers stable cash flows that could keep up with long-term expansion projects and strategic actions such as purchase.

Also Read: Circle (CRCL) vs. Strategy (MSTR): Which is the Best Crypto Stock

In the future, the management in fact increased their full-year earnings prognosis to 3.60-3.72 per share compared to the earlier forecasts and this indicates that they remain optimistic about profitability gains despite the revenue headwinds. The company anticipates annual revenue of between $4.76-4.8 billion, and the median point is exactly in line with the expectations of analysts.

This reaction in CrowdStrike stock prices indicates that the wider market worries whether cybersecurity firms will be able to sustain the same increase rates in the future as greater scrutiny and competition emerge. The efficiency with which they handle customer relations, resolve the current legal issues, and prove that the IT outage that happened in July 2024 was only a one-time event and doesn’t point to more serious issues will probably determine their capacity to recover.