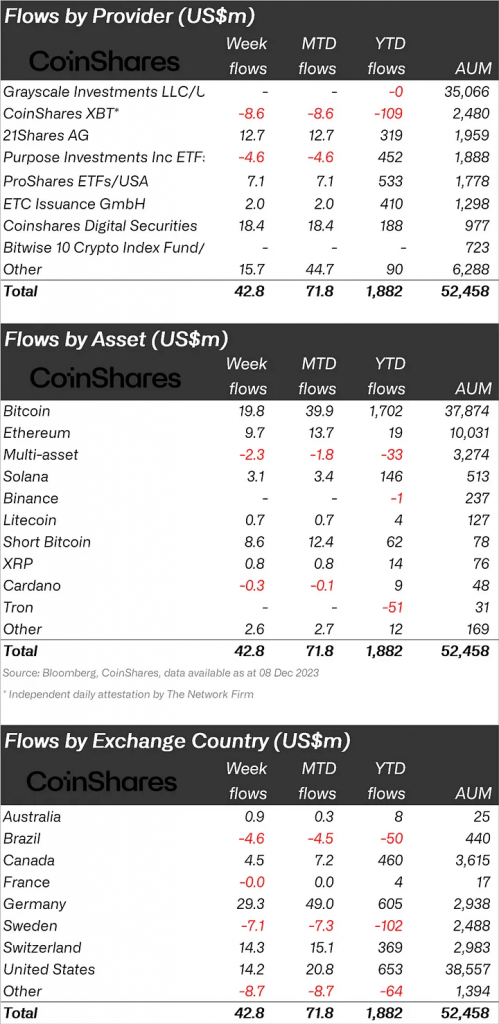

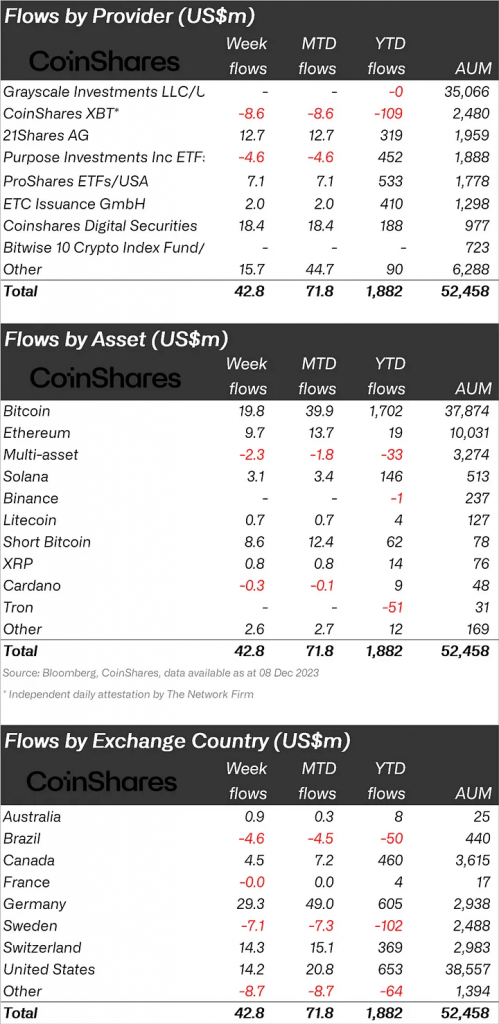

Sentiment in cryptocurrency markets appears to be stabilizing, according to the latest Digital Asset Fund Flows report published by CoinShares. For the 11th straight week, investment products targeting the crypto space recorded net inflows, suggesting sustained appetite among investors. However, the pace of capital injections has tempered significantly in recent periods.

According to the figures covering the week ending December 9th, crypto funds saw $43 million in net inflows. This represents a notable decline from peaks in prior weeks, indicating waning enthusiasm at current prices. The shift comes as some investors take a more cautious stance by building short positions to hedge against potential downside risk after the latest uptrend.

Also read: Will Ethereum Flip Bitcoin in 2024? VanEck Weighs In

Is enthusiasm waning at current cryptocurrency prices?

Breaking down the flows regionally, Europe is still leading the charge, accounting for the full $43 million of net inflows last week. Meanwhile, the U.S. posted a more modest $14 million in inflows, with around half entering short-biased vehicles.

On the flip side, both Hong Kong and Brazil recorded minor outflows of $8 million and $4.6 million, respectively. The mixed picture illustrates the uncertainty prevalent in markets despite the recent double-digit price bounce.

Unsurprisingly, Bitcoin was the predominant target for fresh capital, pulling in $20 million. This brings year-to-date inflows for BTC to $1.7 billion. However, short-bitcoin products saw inflows of $8.6 million.

Ethereum maintained its recent momentum with $10 million of weekly inflows, extending its positive stretch to six out of the last seven weeks.

Beyond the bluechips, Solana and Avalanche continue to enjoy favor among altcoins. Both network tokens added approximately $3 million and $2 million in new investments, respectively, last week.