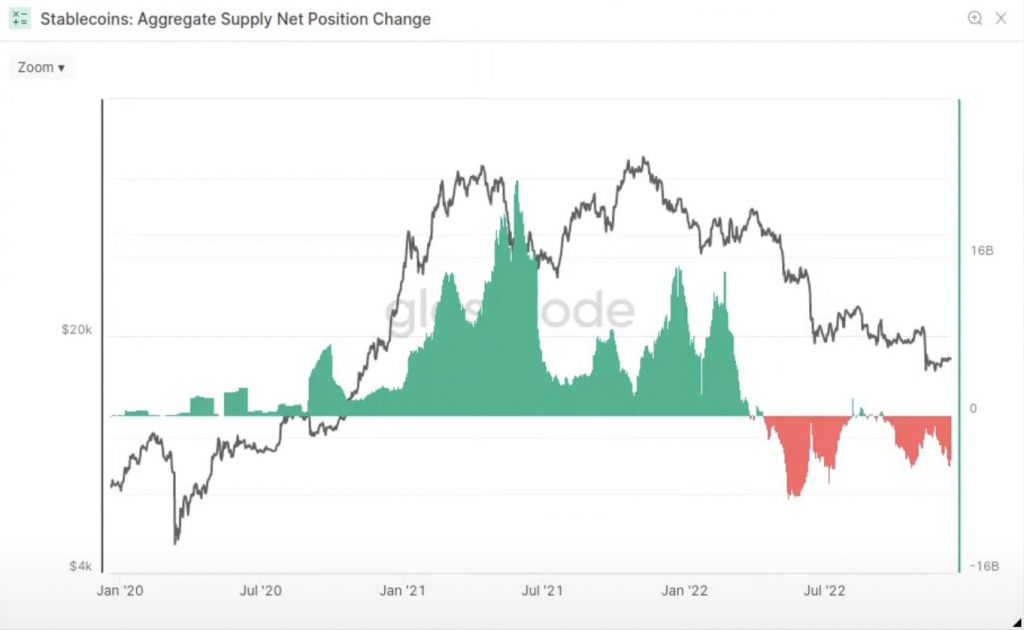

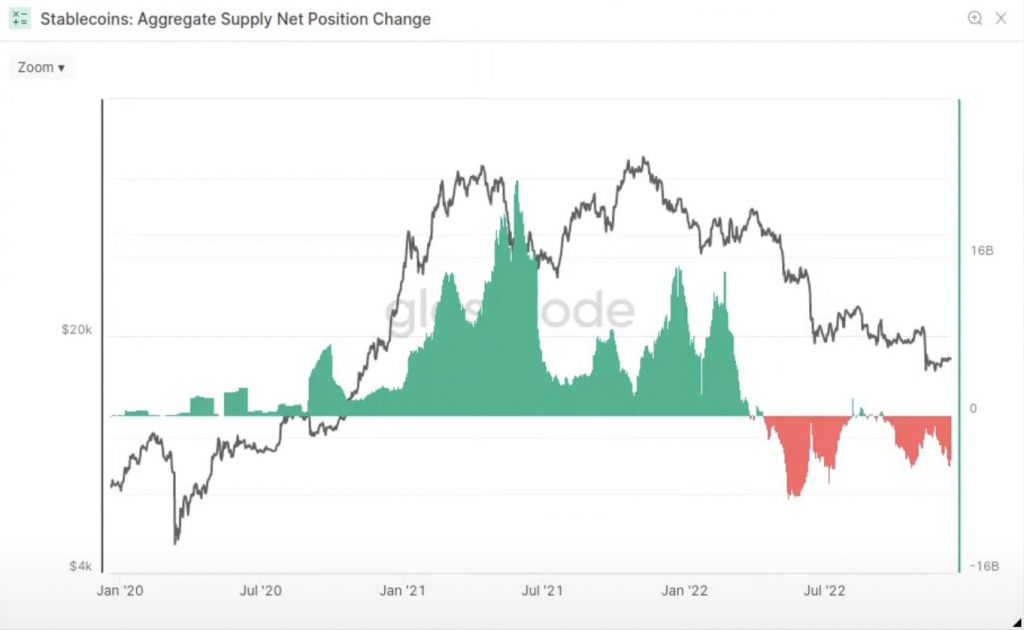

Stablecoins have become one of the centerpieces of the crypto industry. According to Glassnode analytics, stablecoin supply in 2022 peaked in March, before the Luna collapse, at $160 billion. Since the peak, stablecoins have seen outflows between $4 billion and $8 billion per month.

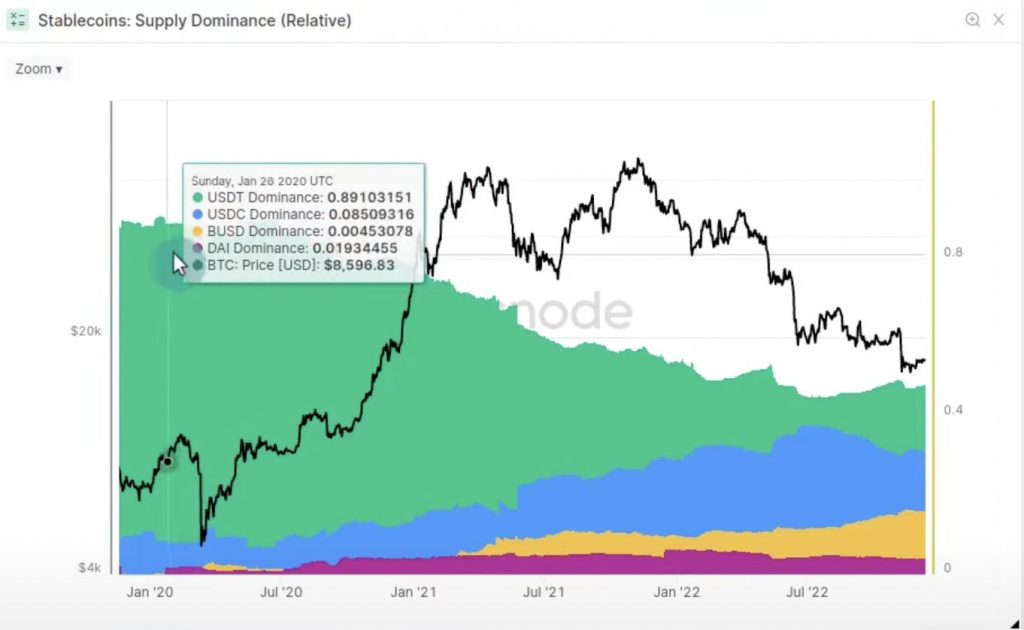

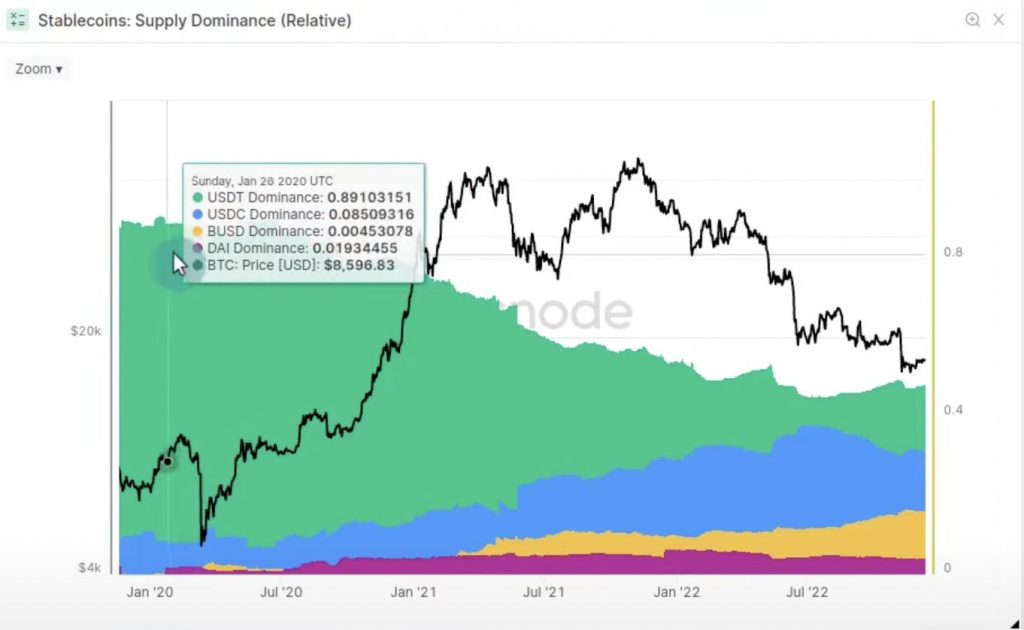

Additionally, Glassnode highlighted the declining dominance of Tether in the stablecoin market. Tether’s dominance in the crypto stablecoin arena has dropped from around 80% to 45%-50%. USDC, on the other hand, steadily increased in dominance but then declined over the summer. Also, Binance’s BUSD is seeing steady growth in market strength, from 10% at the start of the year to about 16%.

From Glassnode’s data, Tether is holding its dominance, BUSD is increasing, while USDC is on the decline.

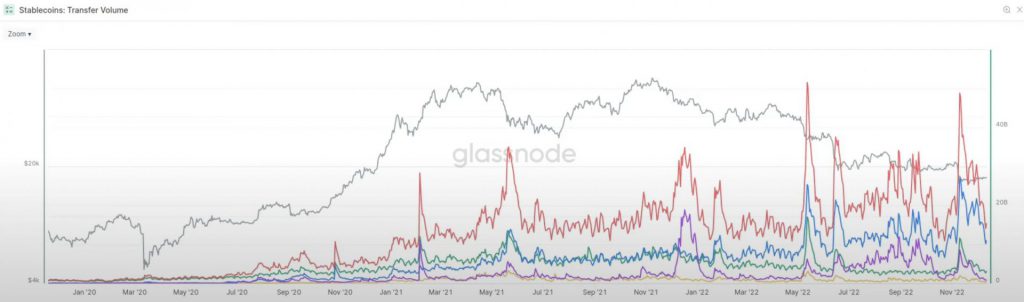

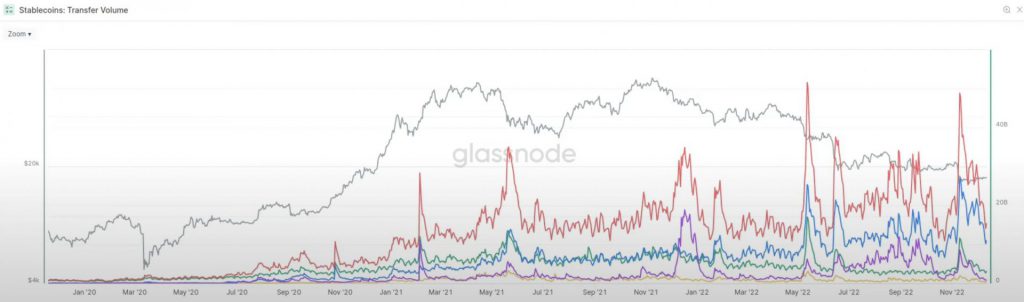

Additionally, the crypto analysis firm noted that in 2021 we saw about $16 billion in daily transfer volume. This metric has increased since May 2022. The firm highlighted that as Bitcoin (BTC) prices have dropped, stablecoin transfer volumes have increased.

Will Tether hold the crypto stablecoin crown?

Tether is still the largest stablecoin by market cap. The token’s value is third to Bitcoin and Ethereum’s first and second, respectively. However, Tether has come under a lot of scrutiny due to not publishing its reserves and audit reports.

In a recent post, Tether said it would reduce its secured loans in its reserves to zero in 2023. However, Tether emphasized that its secured loans are well-collateralized and backed by “very liquid assets.” According to the corporation, Tether’s secured loans function similarly to private banks lending to customers using secured collateral. Tether, on the other hand, asserted that its loans are more than 100% backed, unlike banks, which run on fractional reserves.

Tether’s grip on the stablecoin market has gradually declined over time, as pointed out by Glassnode. Going by the trend, the firm’s dominance could eventually be eclipsed by other growing firms.