According to the fourth annual Fidelity Digital Assets Institutional Investor Digital Assets Study, 58% of institutional investors were invested in crypto and digital assets in H1 of 2022. Moreover, 74% of respondents plan to do so in the future. The report noted that over half (51%) have a positive outlook toward crypto and digital assets.

According to Tom Jessop, president of Fidelity Digital Assets,

“While the markets have faced headwinds in recent months, we believe that digital assets fundamentals remain strong and that the institutionalization of the market over the past several years has positioned it to weather recent events.”

Although the overall perception is positive, there are some barriers that still need addressing.

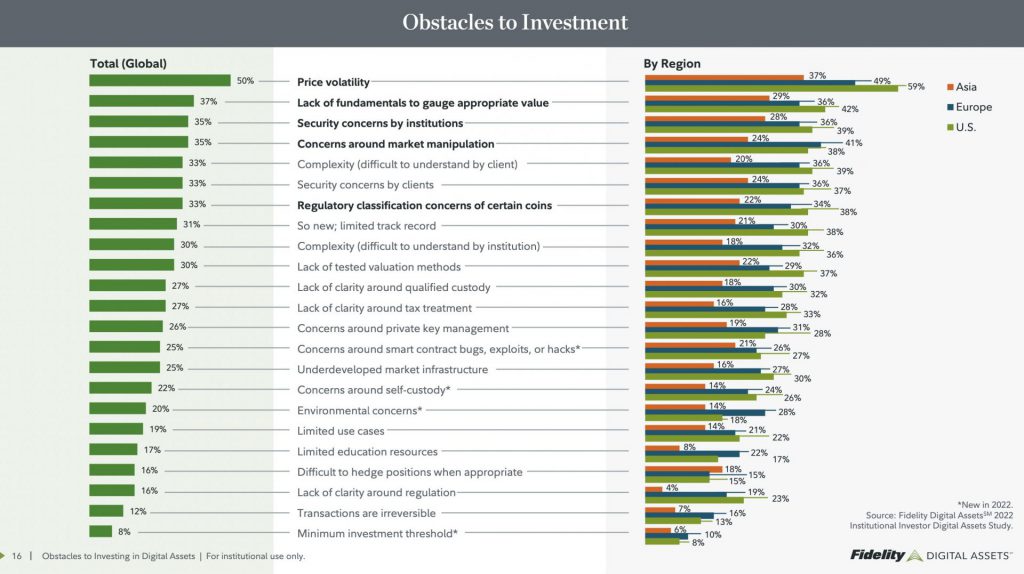

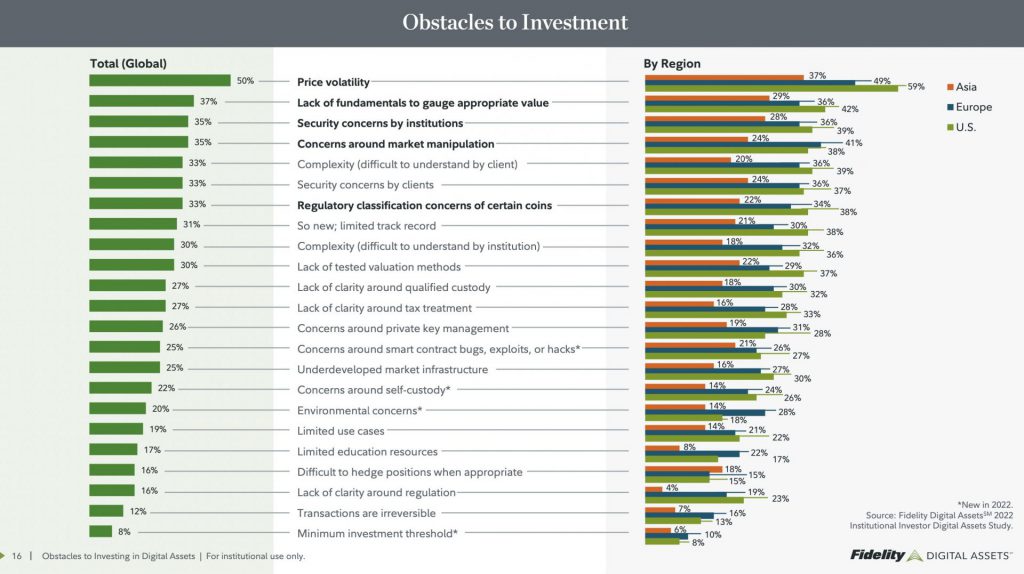

As per the report, the number one barrier in digital assets is price volatility. Half the respondents reported crypto price volatility as the greatest barrier for institutions. This aspect is consistent with the 2021 survey results.

Other concerns include the lack of fundamentals to determine an appropriate value (37%). The respondents also raised security concerns (35%), market manipulation worries (35%), and regulatory classification of some coins as unregistered securities (33%), as other issues.

What do institutions find appealing in crypto and digital assets?

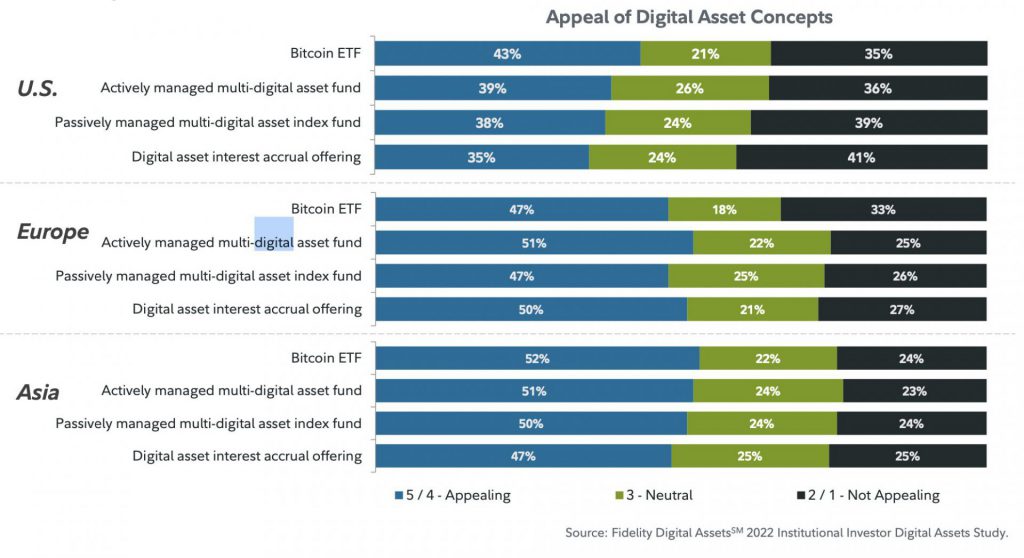

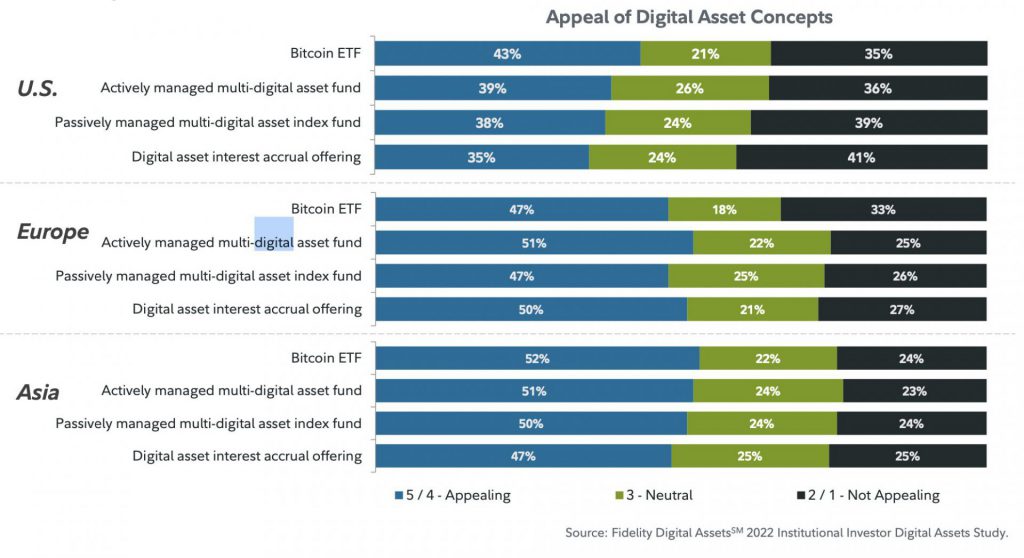

As per Fidelity’s report, an ETF (exchange-traded fund), both actively and passively managed, is the most appealing product. However, the US still does not have an approved spot Bitcoin ETF.

All three regions, i.e. US, Europe, and Asia, named Bitcoin ETF as the most appealing product. Asia has a higher percentage of respondents, at 69%, who possess crypto and digital assets than either Europe (67%) or the United States (42%). Nonetheless, ownership has increased in the U.S. by nine points while it has increased by 11 points in Europe, since 2021. High-net-worth investors were mostly responsible for the upswing in both regions.

Institutional adoption of crypto and digital assets is key to wider adoption of the same. Given the increased and continued interest among financial giants, the crypto markets might just see new highs, once the global economic slump has been overcome.

At press time, the global crypto market cap stood at $1.02 trillion, down by 1.7% in the last 24 hours.