The crypto market is showing signs of a recovery, with Bitcoin (BTC) reclaiming the $86,000 price level. The global crypto market cap has risen 1.2% in the last 24 hours to $3.06 trillion. The slight market reversal comes as a relief to investors, especially after BTC’s recent descent to $82,000 on Nov. 21. Let’s discuss whether the rebound is a dead cat bounce or if we are entering another bullish phase.

Can The Crypto Market Recovery Sustain, Or Will We Have Another Correction?

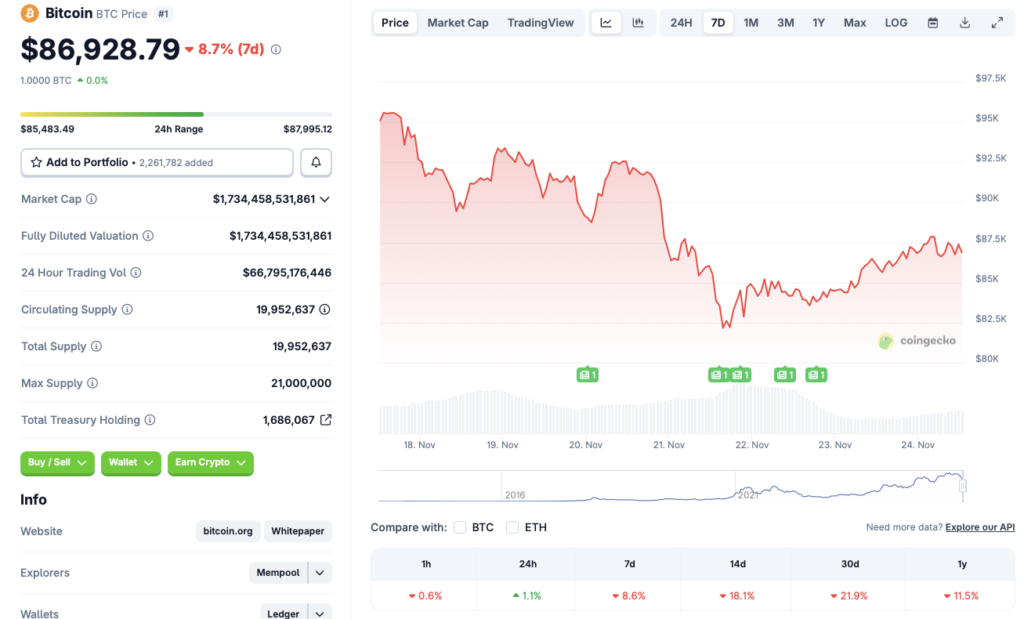

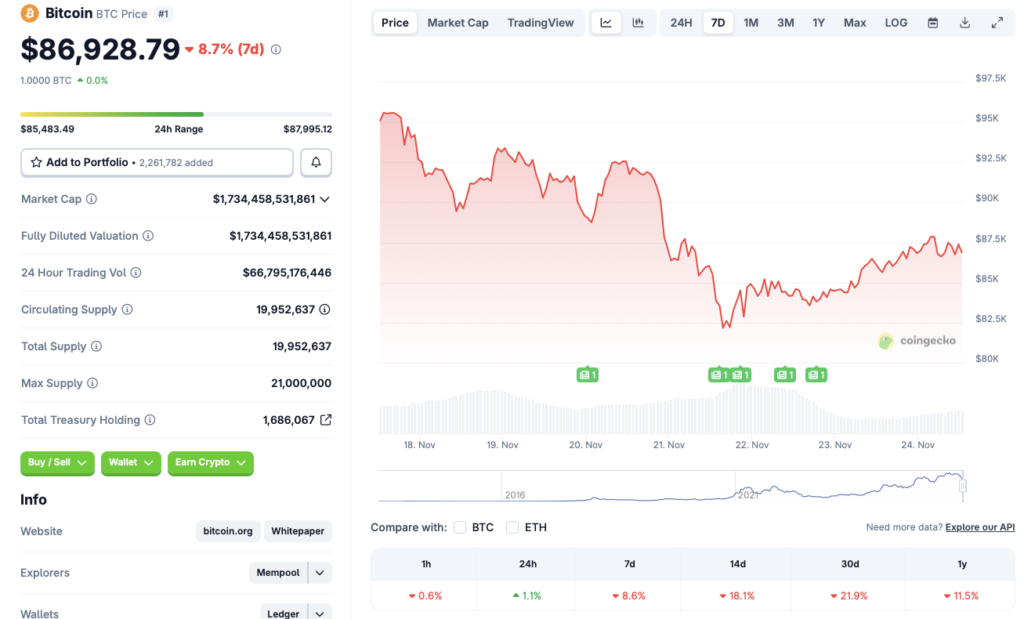

The current cryptocurrency market rebound could be due to investors buying the dip. According to CoinGecko’s BTC data, Bitcoin has rallied by 1.1% in the last 24 hours. However, despite the upswing, BTC’s price is in the red zone in the other time frames. CoinGecko shows that BTC is down 8.6% over the last week, 18.1% in the 14-day charts, 21.9% in the monthly charts, and 11.5% since November 2024.

The cryptocurrency market is far from recovered, and the upswing could be due to investors buying the dip. The crash was triggered by macroeconomic factors and fears of not having another interest rate cut in 2025. Nothing has changed on that front. Hence, the cryptocurrency market may face another correction after the recent upswing.

Some analysts have even predicted Bitcoin (BTC) to fall to the $56,000 price level. While many would be distraught if BTC falls to the $56,000 mark, it may also be an excellent opportunity to buy the coin for cheap. Moreover, it may be the last time the original cryptocurrency falls to such low prices.

Also Read: Lesson For Crypto Traders: Man Loses $74,000 in 3 Minutes in Memecoins

On the other hand, it is also possible that the cryptocurrency market is slowly entering a recovery phase and will keep rising from here on. Market conditions are still quite weak, and how things unfold is yet to be seen.