The crypto space has seen its fair share of exploits and hacks. In March 2022, the industry witnessed one of its largest heists. The Ronin Bridge of the Axie Infinity game was breached, and attackers made away with nearly $600 million. The US government pointed fingers at North Korea’s Lazarus group. Moreover, a recent revelation shows that a fake job posting could have made the exploit possible.

According to CertiK’s Web3 Security Quarterly report, over $2 billion have been siphoned by hacks and exploits in Q1 and Q2 of 2022. Of this, $802 million were stolen in Q2.

Crypto plagued by hacks and exploits?

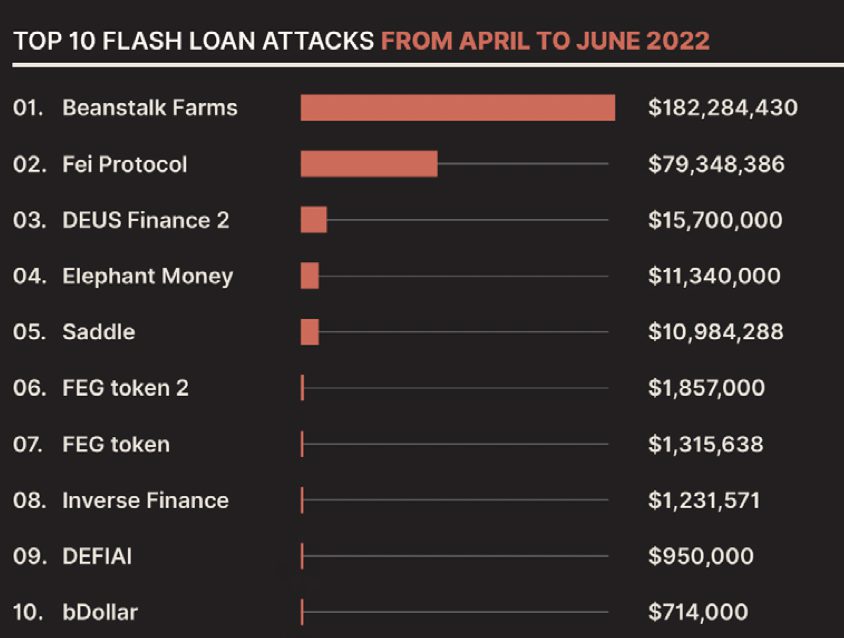

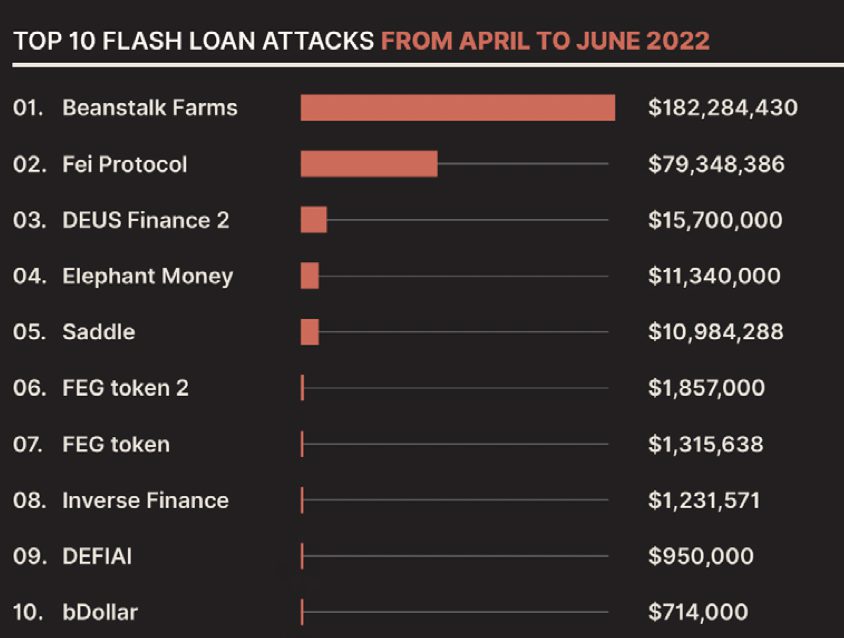

The report said that $308.5 million had been lost due to flash loan attacks. Flash loans are a new finance mechanism where borrowers access large amounts of crypto for very short amounts of time. This mechanism is sometimes used for malicious purposes. This includes manipulating the value of a token or buying up a majority of governance tokens of a particular project. CertiK’s report put a lot of focus on this type of attack.

Additionally, phishing attacks in crypto have increased by 170% since last quarter. CertiK reports that most phishing attacks are on social platforms like Discord and Telegram, and this aligns with what was found regarding the fake job posting leading to the Ronin hack. Unlike some other major social media platforms, Discord and Telegram do not have any verification process, allowing malicious players to copy accounts of prominent people or projects, leading innocent investors to fall prey. Bored Ape Yacht Club (BAYC) was a victim of a hack on Discord in June 2022, losing 200 ETH in the process.

Something positive

CertiK’s report paints a grim picture of the crypto space. However, it does give some optimism. The report says that amounts lost to hacks went down by 42%. But the information admits that the data is skewed due to the massive Ronin hack of Q1.

Additionally, the report stated that rug pulls are not as standard as before. Nonetheless, this could be due to the bearish sentiment looming over the market. $37.46 million were stolen in rug pulls, a 16.5% drop from the previous quarter.

Regardless of the hurdles, there is some silver lining to all the exploits in the industry. Moreover, crypto scams have gone lower with each passing year. And lastly, the industry is relatively new. Innovations are being developed regularly to tackle such problems, and it is only time before crypto security gets its game up.