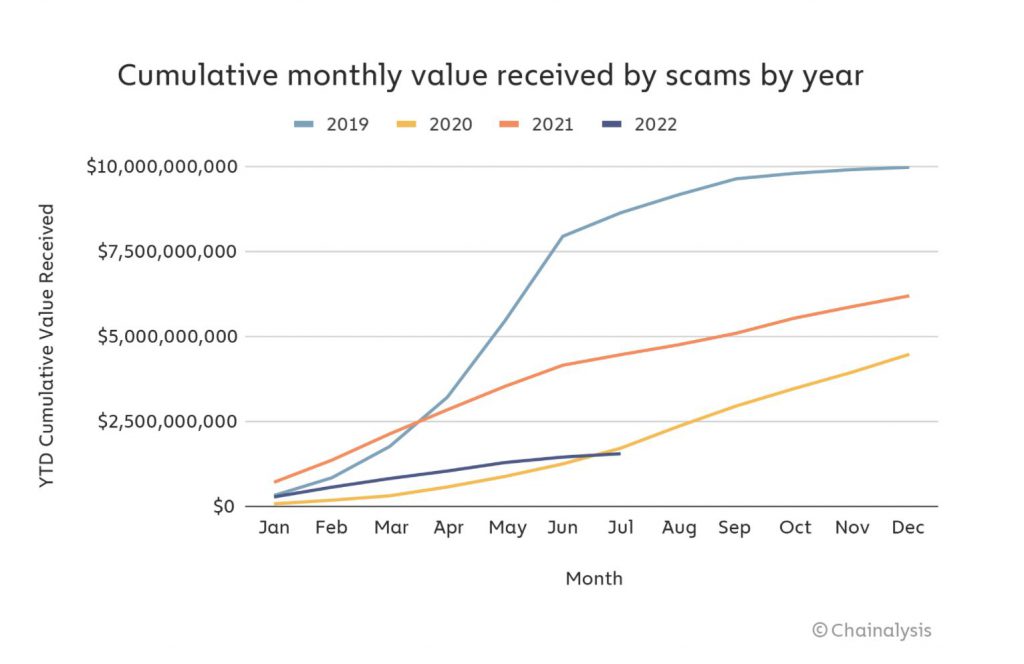

As the popularity of crypto grew, so did the illicit activities within the space. Nonetheless, as per the data provided by Chainalysis, revenue made from scams has decreased by 65% in 2022, compared to what it was at the end of July 2021. As per the analysis firm’s data, revenue from scams currently stands at $1.6 billion.

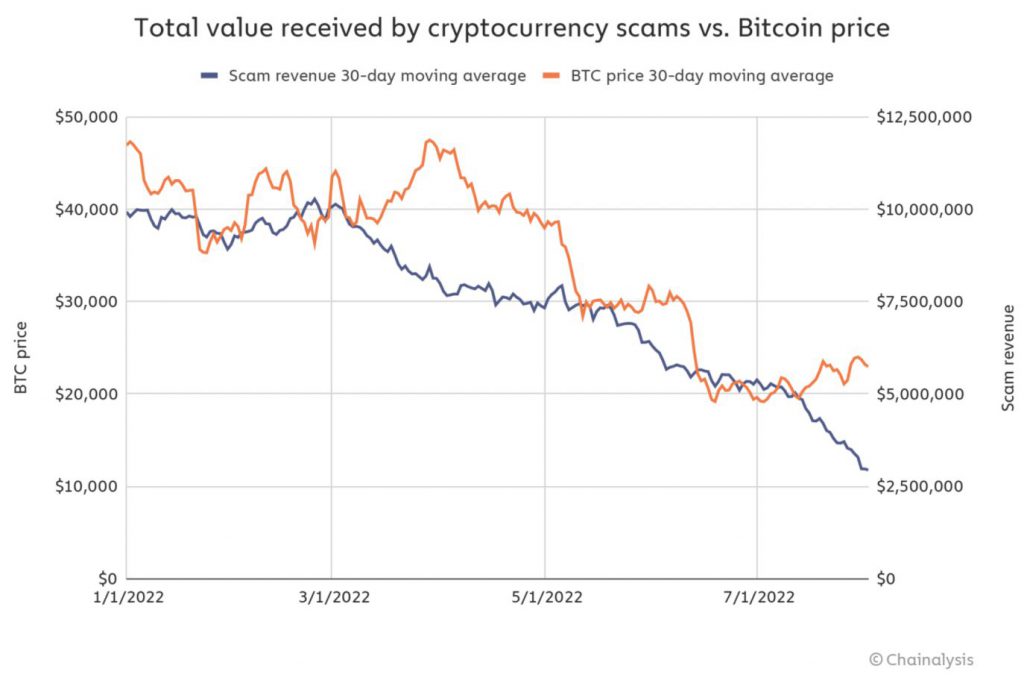

According to Chainalysis, the decrease in scams seems to be tied to the fall in crypto prices. The market crash of summer 2022 was one of the most brutal ever. The cascading effect some firms had on the industry was unlike anything seen before. The Chainalysis report highlights that the decrease in scams is consistent with the decrease in Bitcoin (BTC) prices.

Another reason for the drop in scams is probably because the bear market has not attracted new investors. Usually new and unsuspecting investors fall prey to scams due to their lack of knowledge. But the downtrend of the crypto markets may have kept people from entering the field.

Moreover, the largest scam of 2021 was the Finiko crypto scam, which siphoned $1.5 billion from innocent investors. On the other hand, the largest scam of 2022 is the JuicyFields.io scam which netted around $273 million. As clearly visible, the JuicyFields.io scam is nowhere close to the Finiko scam of 2022.

Scams are down, what about crypto hacks?

While revenue from scams is down in 2022, the same cannot be said for hacks and theft. According to Chainalysis’ report, revenue from hacks and theft has increased from $1.2 billion in 2021 to $1.9 billion in 2022. The amount is till the month of July, for both cases. The report highlights that this trend will most likely not reverse anytime soon.

The very first week of August witnessed the $190 million Nomad bridge hack, and the exploit of several Solana wallets, worth around $5 million.

Moreover, while scams can be countered with the spread of knowledge and education, hacks require firms to better their security and have regular audits. For many young and budding companies, regular audits become expensive, and hence they omit this step, leading to possible exploits.

Moreover, Defi protocols are vulnerable to hacks as their code is open source. Hackers study the code and look for points of exploit.

The only silver lining is that both illegal and legal crypto activities have decreased, albeit not as dramatically.