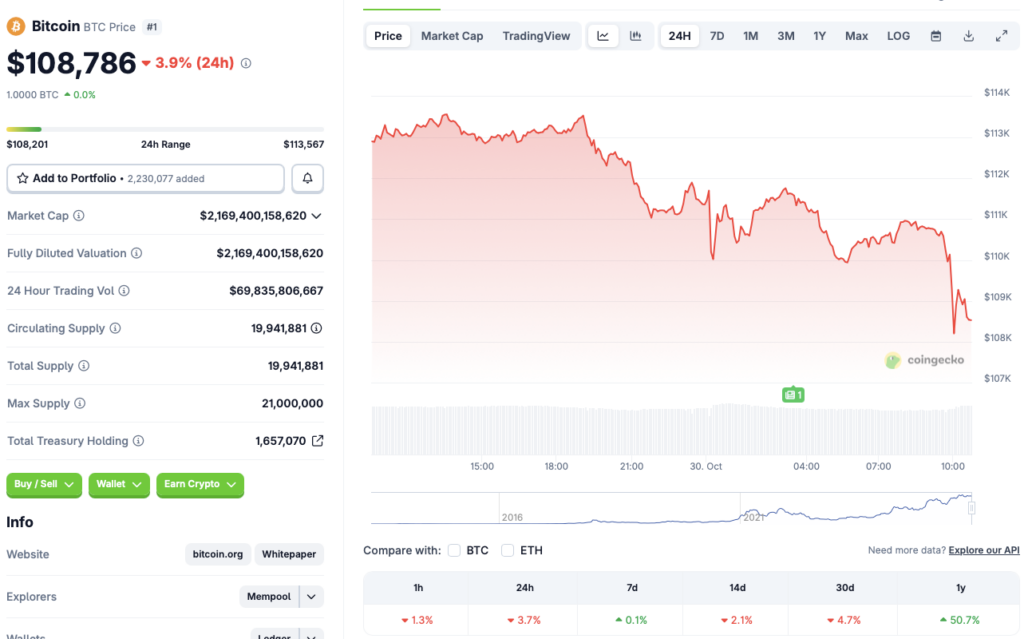

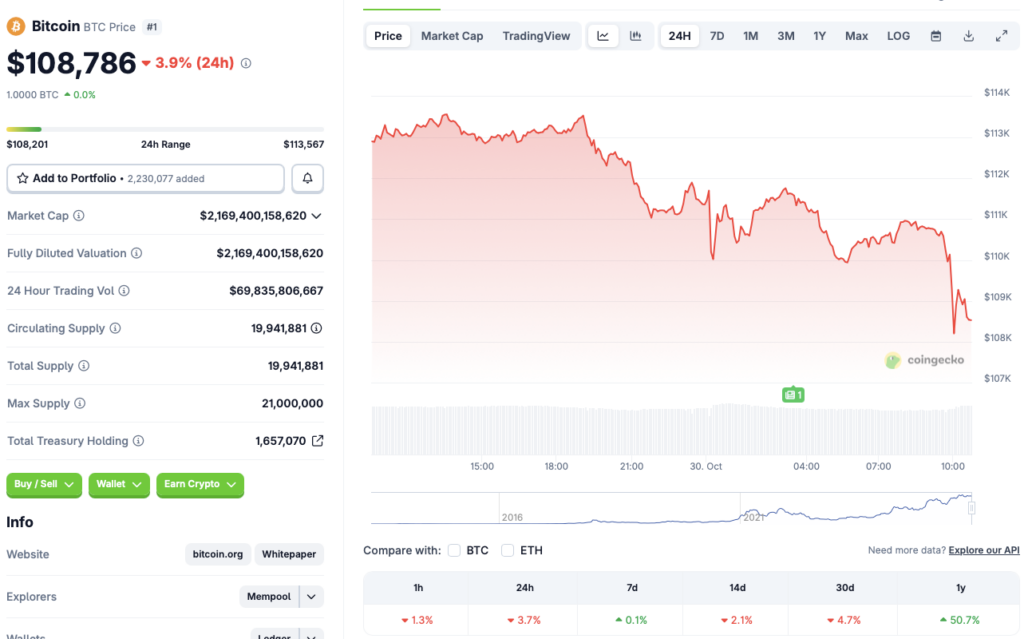

The Federal Reserve lowered interest rates by another 25 basis points on Wednesday, Oct. 29, 2025. While many expected the crypto market to rally after an additional interest rate cut, it did not go that route. In fact, the market faced another correction after Federal Reserve Chair Jerome Powell’s speech. CoinGlass data shows that the crypto market faced $812.52 million worth of liquidations in the last 24 hours. According to CoinGecko’s BTC data, Bitcoin has fallen to the $108,000 price level, dipping 3.7% in the last 24 hours, 2.1% in the 14-day charts, and 4.7% over the previous month. Let’s discuss why the cryptocurrency market is falling despite an interest rate cut.

Cryptocurrency Market Faces Correction After Interest Rate Cut

Interest rate cuts are considered bullish as they often lead to a spike in risky investments, as borrowing becomes easier. However, the recent interest rate cut came with a warning from Powell, which may have led to a cryptocurrency market correction. In his speech, Powell noted that job gains have slowed and employment risks have risen in recent months. He also stated that inflation “has moved up since earlier this year and remains somewhat elevated.“

Moreover, trade wars have also played a hand in the investor sentiment dip. Earlier this month, we witnessed the most significant single-day liquidation in cryptocurrency history. The move was most likely triggered by a trade dispute between the US and China. The market slightly recovered after President Trump said that both countries were nearing a trade deal.

Also Read: Strategy (MSTR)’s Michael Saylor Predicts Bitcoin to $150,000

Slow economic growth, trade uncertainties, rising inflation, etc., are among the primary reasons for the market predicament. We could see a change over the coming weeks if macroeconomic conditions improve. Cryptocurrencies may not make a positive price movement without the global economy recovering.