The cryptocurrency market continues its descent after a substantial upswing. Bitcoin (BTC) briefly fell below $115,000 after hitting a new all-time high of $124,128 on Aug. 14. Ethereum (ETH) has also faced a dip to the $4200 level after breaching the $4700 price point for the first time in nearly four years.

Why Is The Cryptocurrency Market Falling?

The cryptocurrency market began to rally after the consumer price index (CPI) numbers for July came in lower than what experts anticipated. The market rally was short-lived as the producer price index (PPI) figures came in higher than what many anticipated. While the low CPI numbers increased the chances of an interest rate cut, the high PPI figures may cause the Federal Reserve to keep rates unchanged.

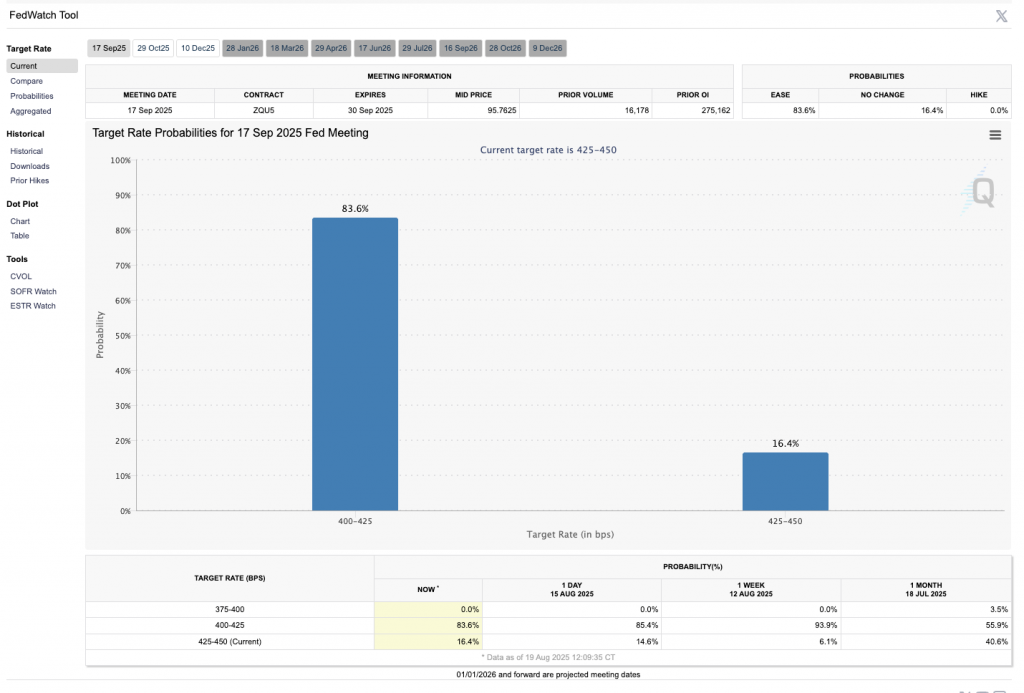

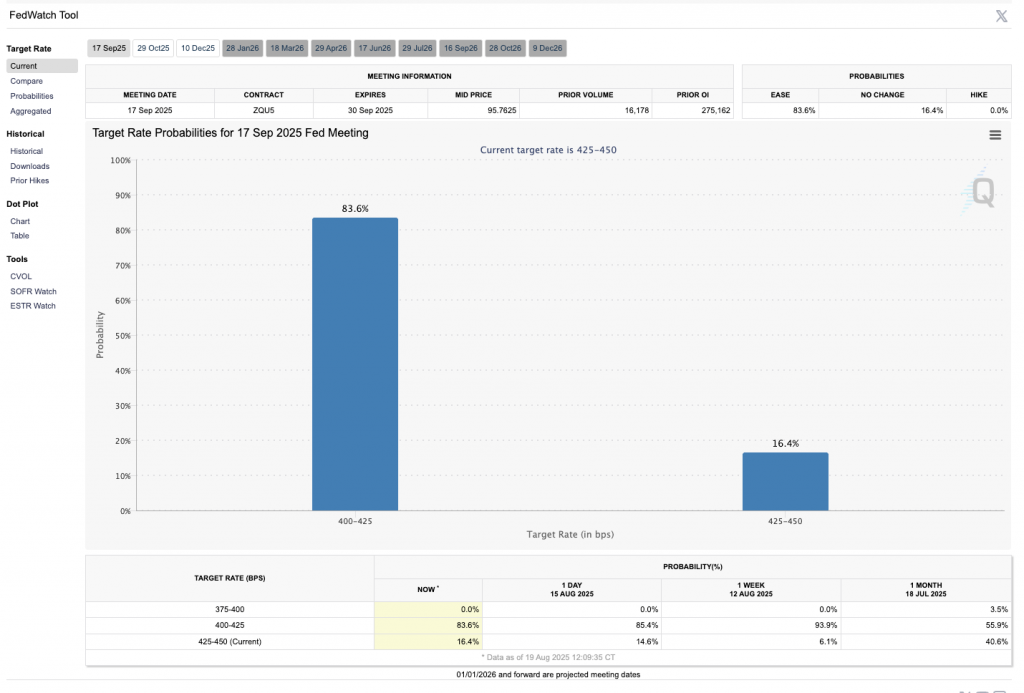

There is a high chance that the Federal Reserve will cut interest rates by 25 basis points in September. According to the CME FedWatch tool, there is an 83.6% chance that the Federal Reserve will cut interest rates by 25 basis points next month. Goldman Sachs, Citigroup, and Wells Fargo also believe the Federal Reserve will begin cutting rates from the coming month. A rate cut will likely lead to a surge in cryptocurrency investments. People usually begin taking more risks when rates are down and borrowing becomes easier. A similar trend could develop over the coming weeks.

The cryptocurrency market fall may have also been propelled by global trade tensions. Geopolitical uncertainties may have also spooked investors. However, President Trump has said that his meeting with his Russian counterpart, Vladimir Putin, has been successful. We could see a de-escalation in the Russo-Ukrainian conflict. The move could lead to a boost in investor sentiment.

While we may see a rate cut in September, historically, the month has been quite bearish for Bitcoin (BTC). Whether the same pattern emerges this year or not is yet to be seen.