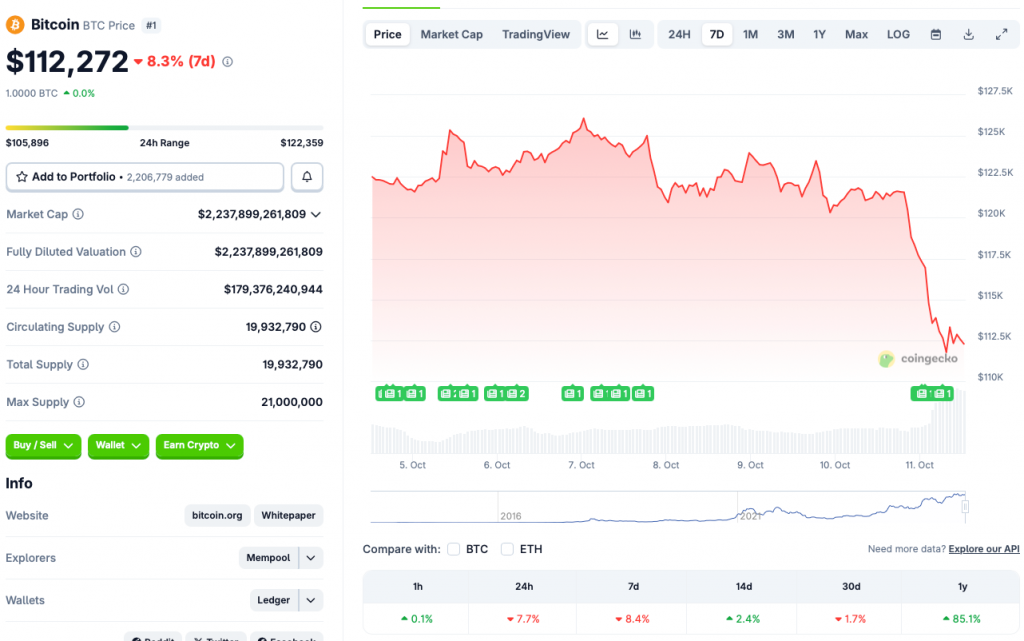

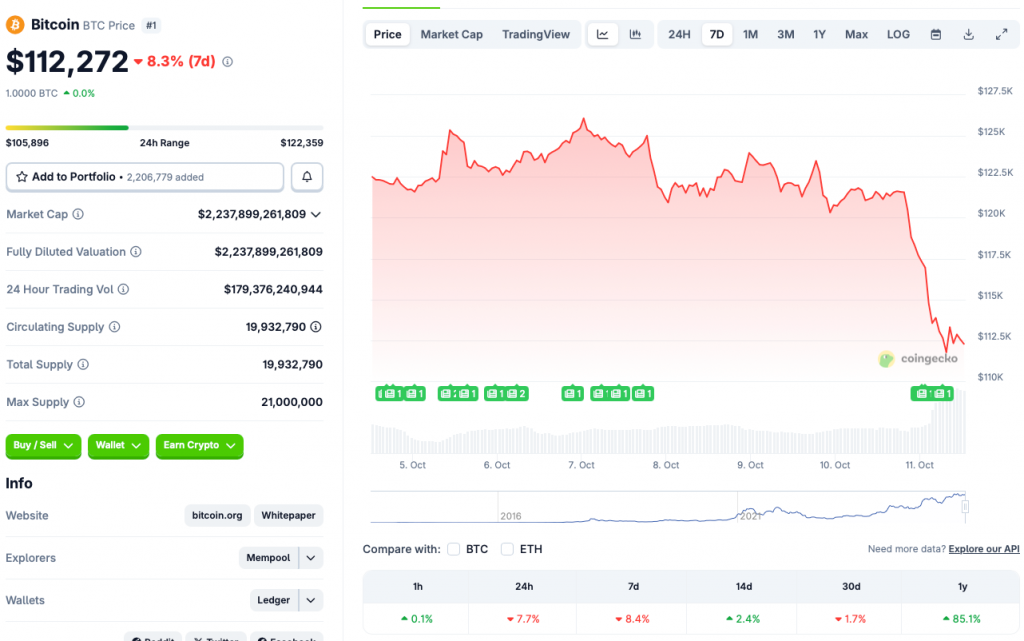

The cryptocurrency market has faced a major price crash in the last 24 hours. According to CoinGecko data, Bitcoin (BTC) has dipped 7.7% in the last 24 hours, 8.4% in the last week, and 1.7% over the previous month. BTC and the larger crypto market experienced a bullish outbreak earlier this month, with BTC hitting a new all-time high of $126,080. Unfortunately, the rally was short-lived. Let’s discuss why the cryptocurrency market is undergoing a crash today.

What’s Behind The Cryptocurrency Market Crash?

The latest cryptocurrency market correction is likely due to the ongoing spat between the US and China. President Trump imposed 100% tariffs on Chinese exports to the US and placed export controls on “any and all critical software.” The move came as a response to China limiting its rare earth mineral exports, which are critical to the tech industry.

The cryptocurrency market crash comes as a contrast to the historical pattern. October has historically been a bullish month for the crypto market, especially Bitcoin (BTC). However, this year things seem to be taking a different turn. According to CoinGlass data, the cryptocurrency market faced $19.31 billion worth of liquidations in the last 24 hours.

Will The Market Recover?

The steep market dip is quite concerning. Investors are likely not confident to put their funds into risky assets right now. Slow economic growth, trade wars, and tariffs seem to have taken a toll on investor sentiment.

Also Read: Morgan Stanley Lifts Restrictions on Bitcoin, Crypto Investments

Things could improve later this month. There is a high chance that the Federal Reserve will roll out another interest rate cut after its next meeting. Another interest rate cut could lead to investors taking more risks as borrowing becomes easier. Such a development could lead to the cryptocurrency market bouncing back.