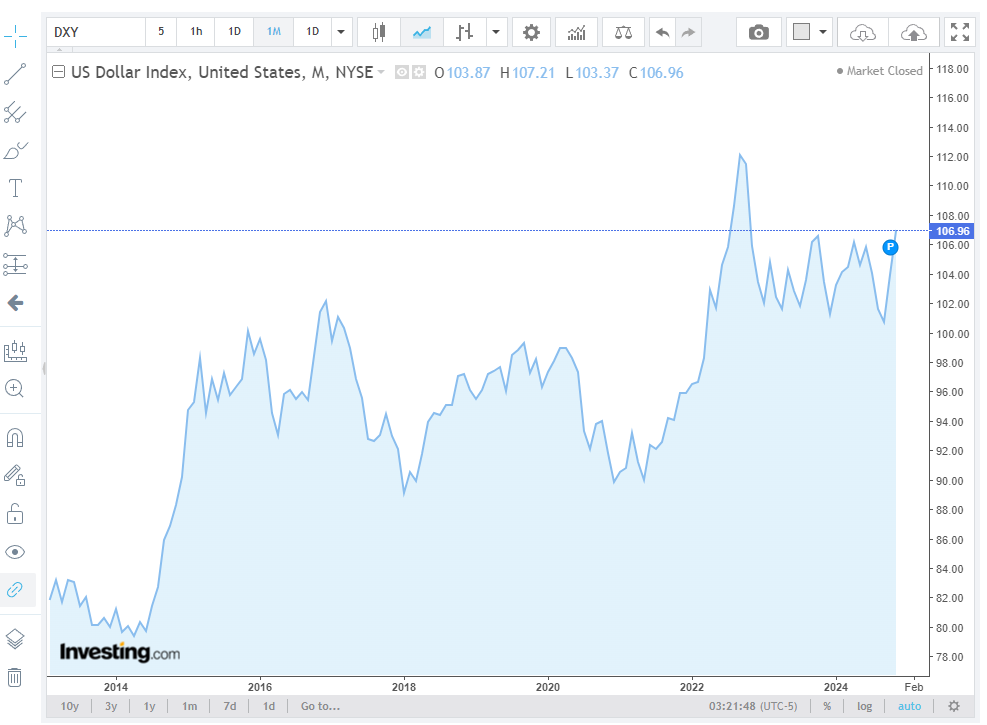

Dollar strength sent the US currency to a new 13-month high on Friday. The Federal Reserve policy stance and forex market trends pushed the US dollar index up 0.08% to 107.15, its highest since October 2023. The global economic outlook remains uncertain amid tensions and volatility.

Also Read: Russia Legalizes Crypto Mining: How It Helps Evade Sanctions

How Dollar Strength Affects Forex Markets, Fed Policy, and Global Trends

Fed Policy Expectations Drive Dollar Movement

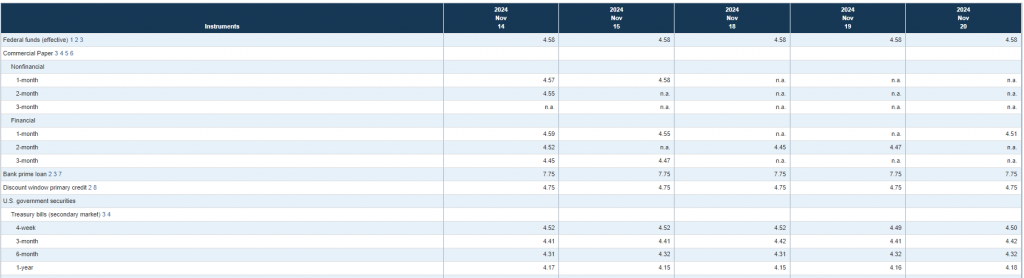

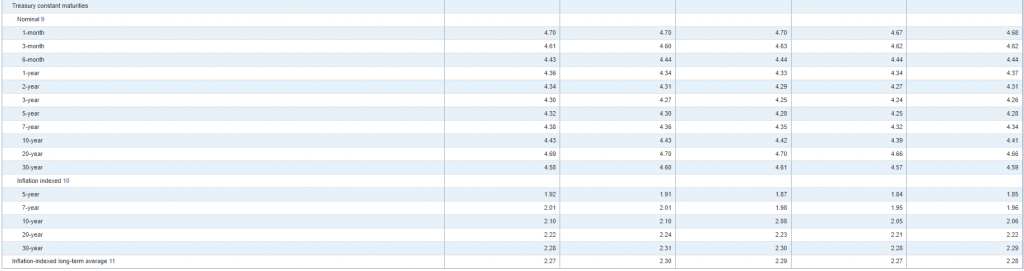

CME’s FedWatch Tool shows a 57.8% chance of a December 25-basis-point rate cut, down from 72.2% last week. The Federal Reserve policy has grown more hawkish as inflation persists. Next Friday’s U.S. PCE data will be key for monetary decisions.

Global Currency Impacts and Trading Patterns

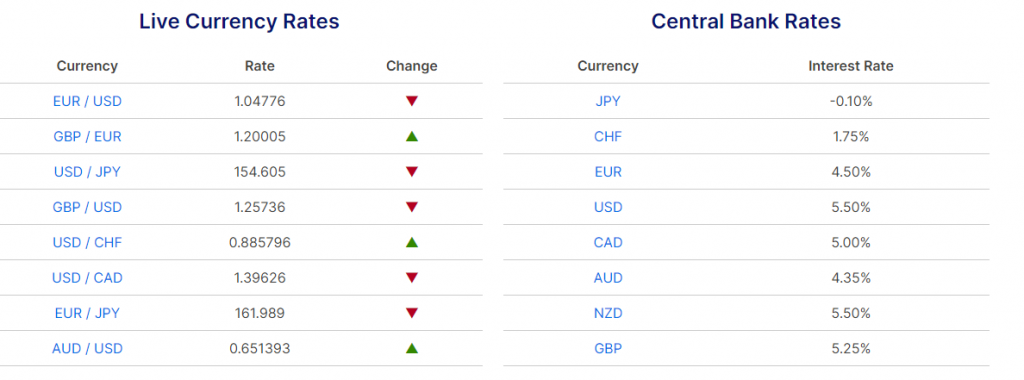

Latest forex market trends show pressure on major currencies. The euro fell 0.05% to $1.0469, hitting a 13-month low. Sterling dropped to $1.25705, its weakest since May. The yen lost 7% against the dollar since October, raising talk of Japanese intervention.

Also Read: Shiba Inu: Can SHIB Hit $0.00005 By The End Of 2024?

Market Expert Analysis

“It’s just trying now to find what the catalysts are … (and) it’s obviously going to be does the Fed cut or not again” in December, said Tony Sycamore, market analyst at IG. This shows wider uncertainty about policy timing.

Asian Markets Response and Inflation Concerns

The current global economic outlook indicates ongoing pressure on Asian currencies. Japan’s core inflation hit 2.3% in October. Marcel Thieliant, head of Asia-Pacific at Capital Economics, noted:

“The renewed strengthening of underlying inflation coupled with the recent rebound in consumer spending and the renewed weakening of the yen strengthen the case for another BOJ rate hike next month.”

Future Outlook and Market Implications

The US dollar index gained 3% this month amid market shifts. Coming PMI data may have a limited impact on dollar strength. Currency pressures reflect links between policy, economics, and markets.

Also Read: Ripple: AI Predicts How High Can XRP Spike Post Gensler’s Resignation

Trading Volume and Market Activity

Recent forex market trends reveal high trading in major pairs. The dollar dominates emerging markets, where central banks struggle against its rise. This may continue until the Federal Reserve clarifies its policy path.