EUR/USD trades near 1.1350 at the moment, and it seems to be remaining somewhat confined within a rather tight range as the US dollar is trying to seek some stability amid the ongoing Forex volatility that we’re seeing right now. Many traders are actually watching this range-bound activity between 1.1280 and 1.1400, which kind of reflects the market uncertainty that exists ahead of some key central bank decisions that are coming up. The US dollar recovery attempts are basically happening just as inflation concerns continue to persist, and also as Fed officials are maintaining their somewhat cautious stance on the whole situation.

Also Read: Pi Coin Soars 35% in a Week & Eyes $2.40 Surge After Chainlink Integration

Analyze Forex Volatility and US Dollar Recovery in EUR/USD Range Trading

Fed Commentary Impacts EUR/USD

The EUR/USD pair faces pressure as US dollar stability concerns influence currency trading outlook. Atlanta Fed President Raphael Bostic recently emphasized the challenges ahead: “The Federal Reserve still faces a long journey to bring inflation down to its 2% target.”

Deutsche Bank has adjusted its forecast for US monetary policy, noting: “A 25 basis point rate cut in December—its first forecasted cut for 2025—followed by two additional cuts in the first quarter of 2026.”

ECB Decision Looms

Markets have kept the EUR/USD constrained as they wait for Thursday’s ECB policy meeting, a trend that has persisted for days. The expectations generally point to a 25 basis point cut in the midst of these changing economic conditions that we’ve been seeing lately. The euro has additionally found some support from global trade tensions, which is definitely adding another layer to the forex volatility picture that traders are dealing with at the moment.

Also Read: Homeland Security Targets Anchorage Digital Bank—What’s BlackRock’s Role?

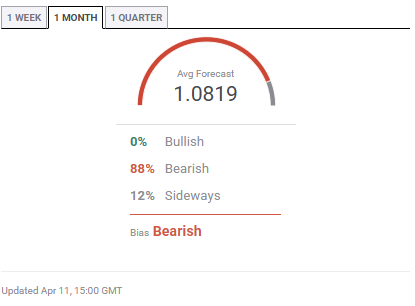

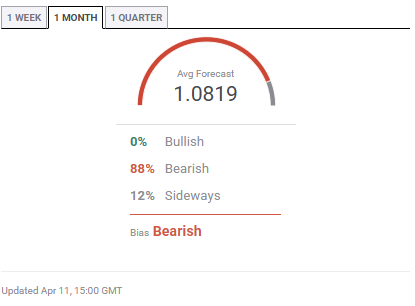

What Are Analysts Projecting?

Some FX analysts from the UOB Group have actually provided their assessment of the EUR/USD’s immediate prospects, and they also noted that: “[The] EUR is likely to trade in a range today, likely between 1.1280 and 1.1400.”

And also, when looking at the medium term, they sort of said something along these lines:”Further EUR strength is not ruled out, but deeply overbought short-term conditions could lead to a couple of days of range-trading first.”

The analysts were clear about the fact that: “As long as 1.1210 (‘strong support’ level) is not breached, the EUR strength that started early this month could extend to 1.1500.”

Also Read: Solana (SOL) Rallies 18%, Reclaims $130: Is $150 In The Horizon?

The US dollar recovery potential remains as uncertain as it can be, with traders finding a shaky balance between the Fed comments and also against the ECB expectations. EUR/USD will likely continue experiencing forex volatility for some time, and this situation might persist until some clearer economic signals eventually emerge, perhaps in the coming weeks.