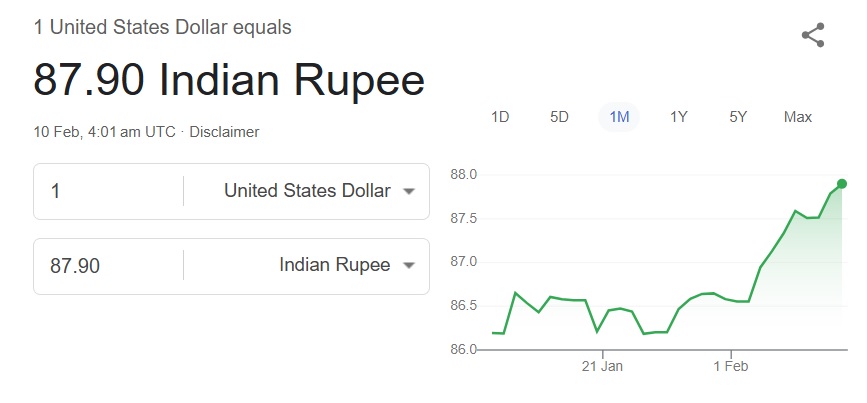

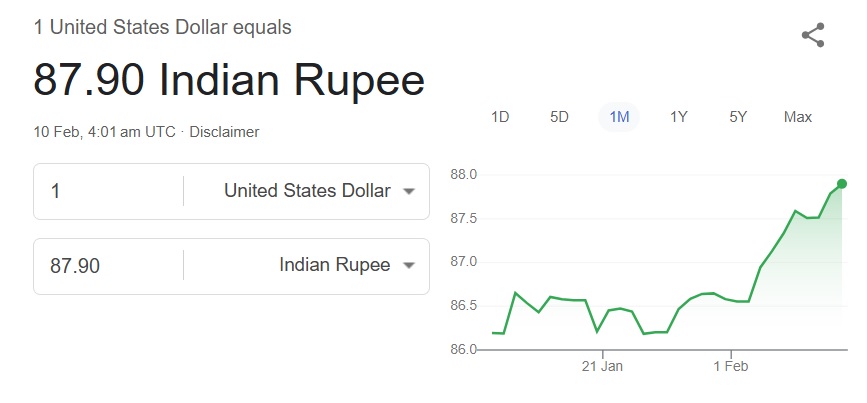

The Indian rupee is finding it hard to sustain against the U.S. dollar in the global currency markets in 2025. On Monday’s opening bell, the INR fell to a new all-time low of 87.94. It is now trading at the 87.90 mark and could fall to a lifetime low of 88 next. In the last five months alone, the USD has surged 5.3% against the INR. This marks the highest-ever run in recent history and the spike came after Trump won the US presidential election against Kamala Harris in November last year.

Also Read: JPMorgan Says XRP Can Attract $8B in Inflows: Can It Target $8?

Currency: Why is the India Rupee Falling Against the US Dollar?

Foreign institutional investors (FII) have pulled the plug on the Indian stock market after Trump’s victory. They sold nearly $1.2 billion worth of stocks and invested the funds in the US stock market. FIIs are confident that a Trump economy could deliver massive returns in the next four years. Therefore, the exodus of funds between November 2024 and February 2025 is making the Indian markets tumble. The Indian rupee is being affected by the FII exit, strengthening the US dollar in the currency markets.

Also Read: UBS Predicts Gold Prices To Reach $3,000

Currency analysts have warned that the Indian rupee’s sorry state of affairs could continue this year against the US dollar. Dhananjay Sinha, co-head of equity and research at Systematix Group, predicts that the rupee could fall to a lifetime low of 90 to 92 against the US dollar.

“Our estimates suggest that INR/USD can depreciate by 7-10% from the recent pegged levels of 84 to 90-92 in the coming 6-10 months,” he explained to Money Control. The prediction puts the Indian rupee on the back foot giving the US dollar an edge in the currency markets. If the INR continues to plummet, daily essentials in India could turn expensive as the imports and exports sector will be hit.

Also Read: Ripple: Why Race to XRP ETF Could Have It Eyeing $5