As the Bitcoin [BTC] halving draws nearer, it has been generating significant attention. This has prompted numerous predictions about the potential value of BTC after this event. The prevailing sentiment among many of these predictions is that a bull run may ensue following the halving. However, the question remains: When precisely will BTC initiate its halving-fueled rally?

During a recent “Ask me anything” session on Twitter, Changpeng Zhao, the CEO of Binance, shared his perspective on the next bull market. CZ stated that 2025 is the most probable year for the upcoming bull market. It is worth noting that the halving event is scheduled to take place in April 2024. He further added,

“The year after Bitcoin halving is usually the bull year.“

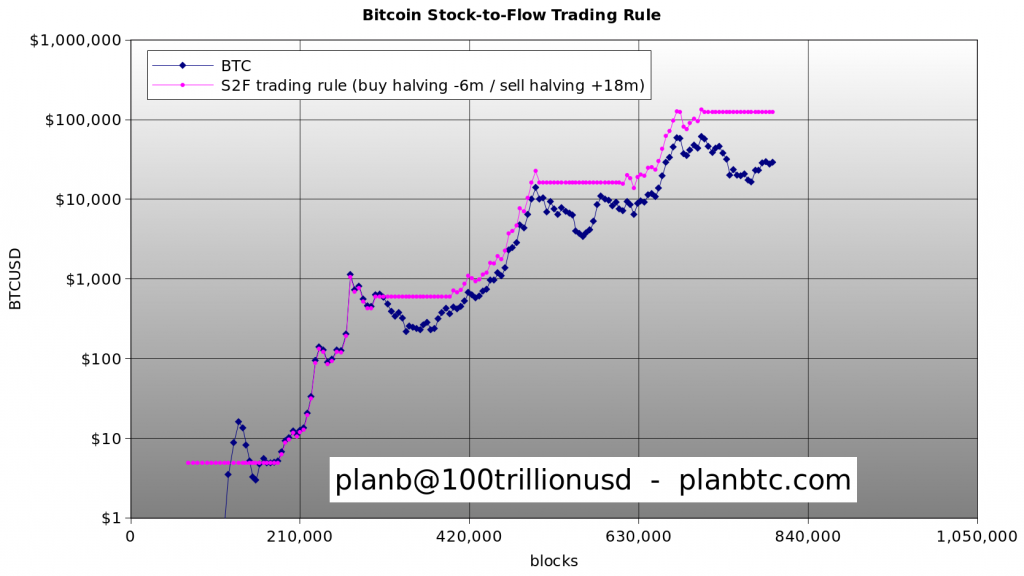

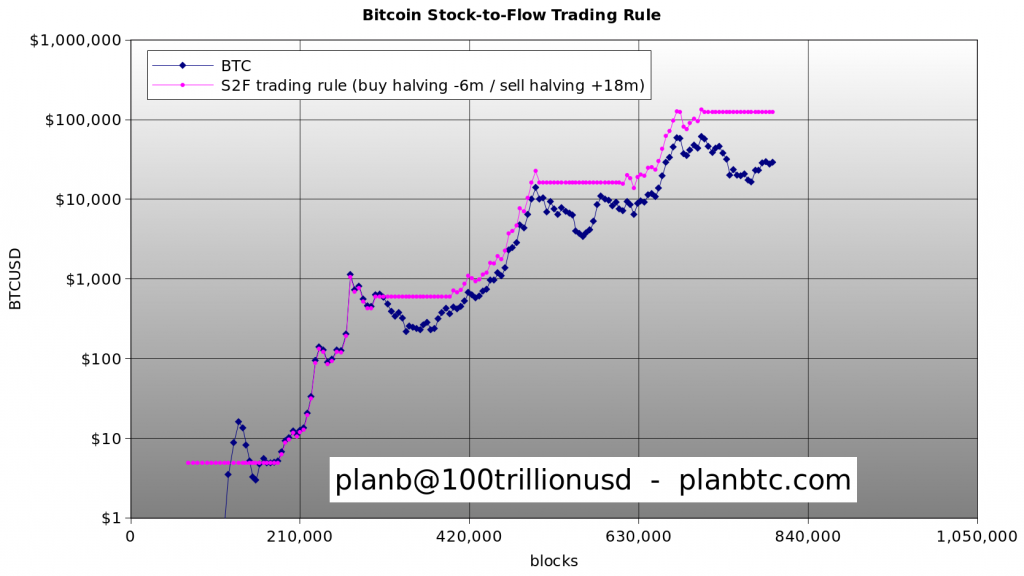

This sentiment resonated throughout the market, as prominent crypto analyst PlanB, known for his stock-to-flow model for Bitcoin, shared a comparable prediction. According to his analysis, historically, buying BTC six months prior to the halving and selling it 18 months after the halving has proven to be an optimal strategy.

The chart below illustrated historical data that demonstrates the advantages of holding BTC for 18 months after the halving compared to holding it for six or 12 months.

Also Read: When is the Next Bitcoin Halving?

How high can Bitcoin go post the upcoming halving?

Using the S2F model on Bitcoin, analyst Gigi Sulivan from CryptoQuant has made price predictions for the next cycle. Sulivan’s analysis suggests that Bitcoin could reach a peak ranging between $160,288 and $206,824 during the bullish cycle following the fourth halving.

It is important to highlight that the S2F predictions for the previous two halving events fell significantly short of the actual peak values witnessed in those cycles. This implied that Bitcoin has the potential to experience a substantial rally, potentially surpassing $260,000, during the forthcoming bullish cycle. At press time, Bitcoin was trading for $30,563 with no major fluctuations in the last couple of hours.

The increase in retail and institutional investors in the cryptocurrency market is evident. The entry of major players like BlackRock has added further momentum to this trend. However, it is important to recognize that the market dynamics have undergone significant changes, potentially indicating the emergence of a new and different cycle. Therefore, it is currently challenging to provide a definitive prediction on the future trajectory of BTC following the halving event.

Also Read: JPMorgan Predicts Strong ‘Retail Demand’ for Bitcoin Leading Up to Halving