De-dollarization initiatives have catalyzed rapid global financial restructuring as countries try to escape the dollar’s long-lasting grip across various major economies. The gold-backed stablecoins have fundamentally transformed how digital money architecture functions these days, and we’re excited about multiple significant developments! They’ve pioneered essential stability solutions when markets go crazy, and that happens quite alot lately through several key volatility triggers. Unlike those structurally vulnerable USD stablecoins with their questionable fiat-based liquidity mechanisms, gold ones deliver comprehensive real-world security frameworks that maintain integrity when everything else is going bonkers right now in numerous financial uncertainty scenarios.

Added to this, Yahoo Finance analysts said:

“The pound rose towards a five-month high against the dollar, trading at $1.2938, as president Donald Trump’s ongoing tariff threats continued to inject volatility into global markets.”

Also Read: Pi Coin Set for 50% Surge: Coinbase Listing Rumors Ignite Investor Interest

How Gold-Backed Stablecoins Can Mitigate Market Volatility and Promote De-Dollarization

The vulnerability of fiat-backed USD stablecoins was exposed when a 2021 report revealed one popular option held just 2.9% of its reserves in actual cash. This dependence on traditional banking has created weaknesses during economic downturns. Gold-backed stablecoins eliminate these risks by using physical gold as collateral.

Representative Tom Emmer stated:

“CBDC technology is inherently un-American.”

Goldman Sachs analysts Dominic Wilson and Kamakshya Trivedi said:

“There had been a sharp re-rating lower of US assets on the back of tariff volatility and the environment of broader policy uncertainty created by the new administration.”

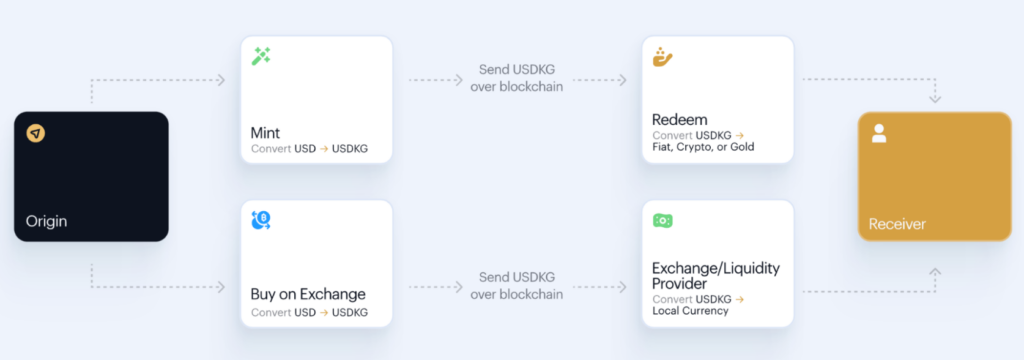

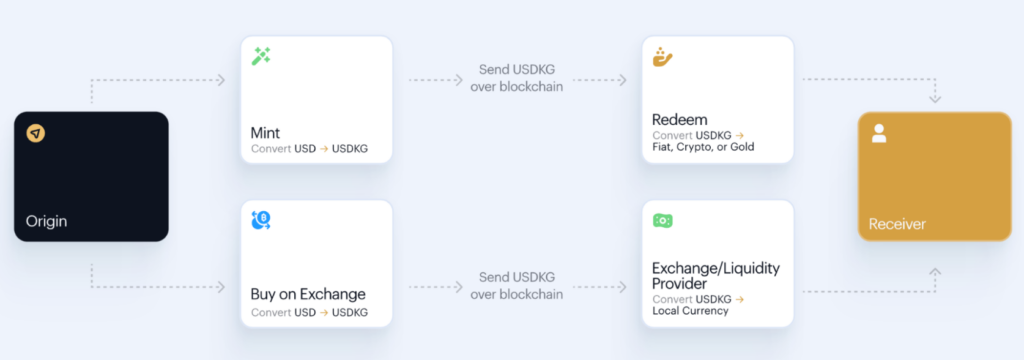

Hard Asset Security

Gold-backed stablecoins like USDKG, introduced by Kyrgyzstan, provide enhanced security through verified physical gold reserves and such. This ground-shattering approach is a quite significant advancement in de-dollarization efforts and it is applied by establishing some stable alternatives to USD-denominated assets.

The Benefits of Having Clarity

The USD stablecoins often operate with a somewhat private reserve reporting added. On the other hand, gold-backed alternatives implement some more regular independent audits. This heightened transparency also builds some essential trust in the method. Regulatory scrutiny is the last nail in the coffin, as it also is intesifying across the digital currency space.

Also Read: 50% Crash Expected: How Trump’s Bitcoin Reserve Could Spark Economic Chaos

Global De-dollarization Movement

De-dollarization has gained substantial momentum as countries actively seek alternatives to USD hegemony and such. Some of the gold-backed stablecoins offer a balanced approach between stability and independence from the dollar system. Meanwhile, at the time of writing, central bank digital currencies face ongoing resistance in regions like Europe.

An ECB working paper noted:

“This finding also suggests that convincing some users of the value added of a CBDC might pose a challenge for policymakers.”

Bridging Traditional Finance and Innovation

Gold-backed stablecoins create a natural connection between traditional financial systems and blockchain technology and all. By combining gold’s historical trust value with modern blockchain efficiency, these innovative tokens address key concerns in the accelerating de-dollarization movement.

Regulatory Framework

Gold-backed stablecoins operating with enhanced transparency position themselves advantageously as market volatility and de-dollarization concerns continue to increase and such. Government involvement, such as seen in Kyrgyzstan, provides necessary legitimacy without compromising the decentralized benefits that support ongoing de-dollarization efforts.

Also Read: Ripple Custody Trademark Filing Signals Potential Crypto Wallet

A Stable Digital Future

As de-dollarization initiatives continue to transform global finance and market volatility persists in traditional USD stablecoins, gold-backed alternatives deliver security through time-tested value mechanisms and all that. This powerful approach establishes stable and accessible digital currency options that also offer support to the global financial diversification beyond the scopes of USD dominance.