Several countries have been coming together to bring down the dominance of the US dollar through de-dollarization. A major reduction in the usage of the US dollar in cross-border commerce and financial operations is known as de-dollarization. In particular, the BRICS nations have been trying to shake the dollar’s supremacy. Meanwhile, China seems to be entering with a different strategy.

Also Read: Crypto Analyst Predicts Dogecoin to $3 and XRP to $5 in Bold 12-Month Forecast

Can China Seep In De-dollarization Into South America?

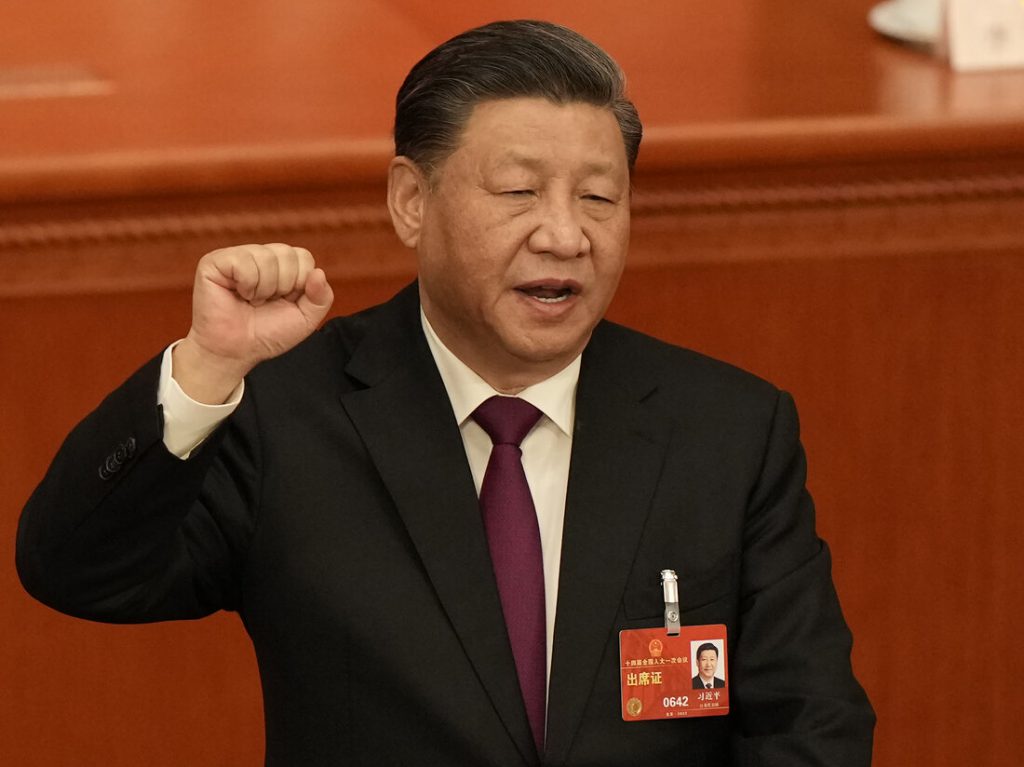

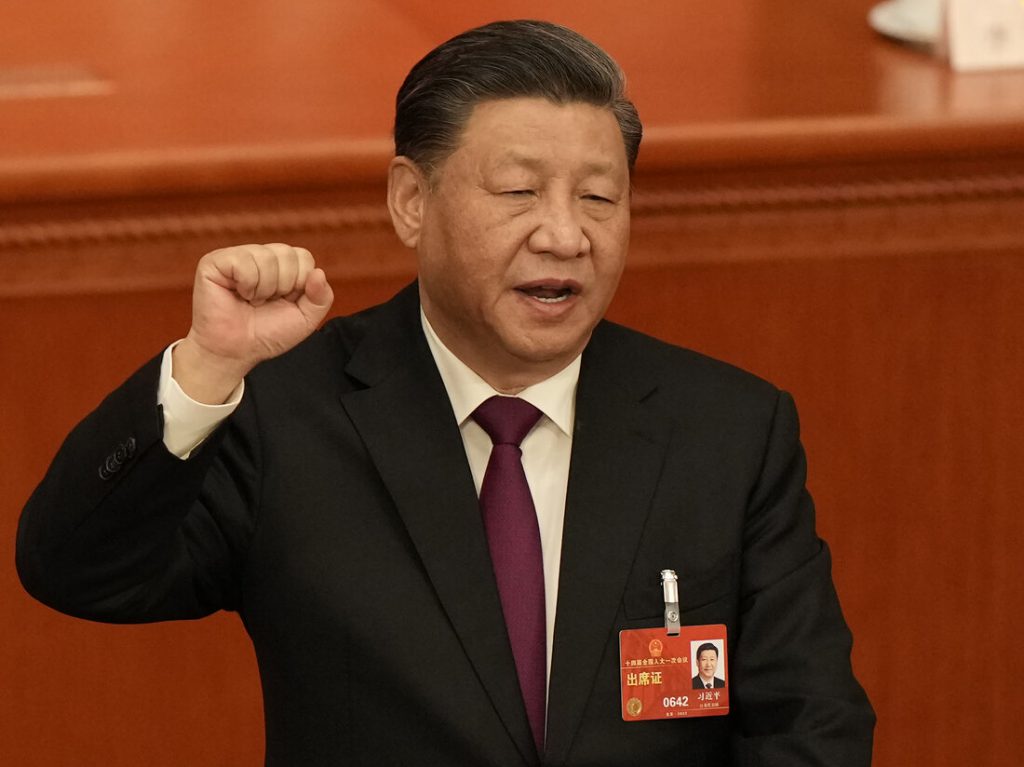

One of Beijing’s most ambitious infrastructure projects in Latin America, the gigantic Chancay deep-water port, is about to open, according to a recent report. In order to inaugurate this structure, Chinese President Xi Jinping will arrive in Peru and stay there for an entire week.

Along with Peruvian President Dina Boluarte, Xi’s first task in Lima is to lead an opening ceremony for the Chancay port. The port is located on the Pacific coast of Peru and was constructed by Cosco Shipping Ports. Speaking about the same, the Chinese President said,

“We need to jointly build and manage well the Chancay port, make ‘from Chancay to Shanghai’ truly become a prosperous path to promoting the joint development of China-Peru, and China- Latin America.”

The 15-berth, deep-water port of Chancay, according to Xi, is the successful beginning of a “21st century maritime Silk Road” and a component of China’s Belt and Road Initiative, which is a contemporary resuscitation of the historic Silk Road trade route. It should be noted that it has already attracted $1.3 billion in Chinese investment. As Beijing and Lima seek to establish Chancay as a major shipping hub between Asia and South America, billions more are anticipated.

China’s president will engage in additional activities in addition to this. Next week, Xi will participate in the Group of 20 summit in Rio de Janeiro. This is after attending the Asia-Pacific Economic Cooperation meeting in Lima.

Also Read: Bitcoin (BTC) & Dogecoin Price Prediction For The Weekend

The Chinese Takeover

One of the biggest moves of the BRICS countries has been lowering the dependence on the dollar. This is done while employing local currencies for trade. China’s megaport is expected to do the same to the Peruvian market. If the country decides to de-dollarize trade by using local currencies instead of the US dollar, China could have the upper hand.

The US may encounter other issues in addition to this one. The country’s concerns on Chancay are part of a larger, multi-decade change. This is because China had surpassed the US as the biggest trade partner of nations like Peru.

Also Read: Top 3 Cryptocurrencies To Watch This Weekend