De-dollarization efforts have gained quite a bit of momentum recently as some of the largest economies in the world are actively searching for any alternatives to the U.S. dollar in global trade. This shift is a very important development in the international monetary system ‘game’, with Russia, China, India, Brazil, and Malaysia currently leading the push for this important change.

Also Read: Ethereum Price Prediction: $4,315 by 2025 – Could the Pectra Upgrade Fuel the Surge?

The Global Shift from Dollar Dominance: How Russia, China, India, Brazil, and Malaysia Are Leading the Way

Historical Context of Dollar Reserve Status

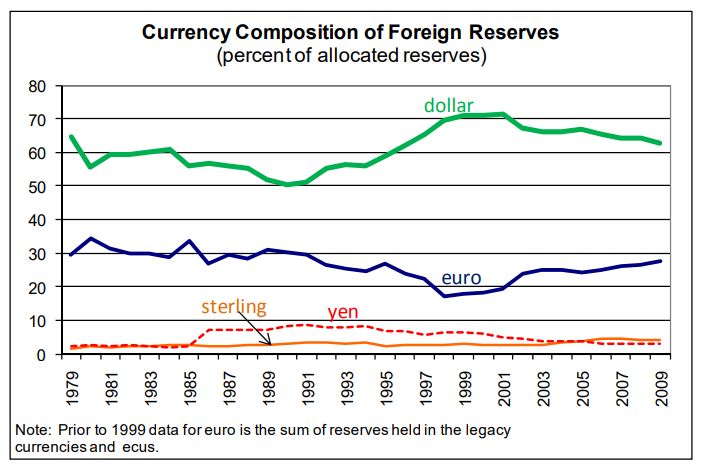

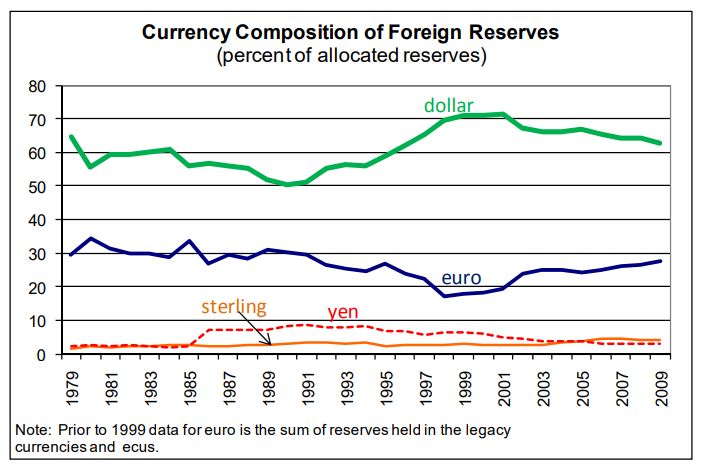

The U.S. dollar became the world’s reserve currency back in 1944 through the Bretton Woods Agreement. A key turning point in de-dollarization history actually occurred in 1971 when President Nixon abandoned the gold standard, and since then, the dollar has been backed solely by the U.S. government rather than any physical commodity.

How Does the Dollar Dominate?

The dollar’s dominance is largely due to the petrodollar system, where, at the time of writing, oil transactions are still conducted primarily in U.S. dollars. This ongoing arrangement creates substantial demand for the currency across the global economy.

The Federal Reserve has actually estimated that between 1999 and 2019, the dollar accounted for about 96% of international trade transactions in the Americas, around 74% in Asia, and approximately 79% elsewhere.

Also Read: Trump Poised to Repeal IRS DeFi Tax Rule After Senate’s 70-28 Vote

Who Wants to Get Rid of the Dollar?

Russia, China, India, Brazil, and Malaysia are the primary drivers of de-dollarization right now. These countries are working on establishing alternative currencies for international trade in various ways.

China has been promoting yuan internationalization through numerous currency swap agreements. Russia has also dramatically reduced its dollar holdings following Western sanctions.

Impact on Global Trade

If the process of de-dollarization pans through as intended, it would have some far-reaching implications for the entire global economy and could also end up reshaping international finance. A very reduced role for the dollar could also limit the U.S. economic influence while also creating some new opportunities in global trade for emerging markets.

Also Read: Dogecoin: Elon Musk’s Grok AI Answers If X Will Integrate DOGE