The de-dollarization myth has catalyzed serious momentum lately, and it’s becoming clear that BRICS expansion is spearheading various major challenges to US dollar dominance across global markets. At the time of writing, we’re witnessing several key shifts in how countries architect their currency strategies, and the de-dollarization myth continues to revolutionize debates among numerous significant financial experts worldwide.

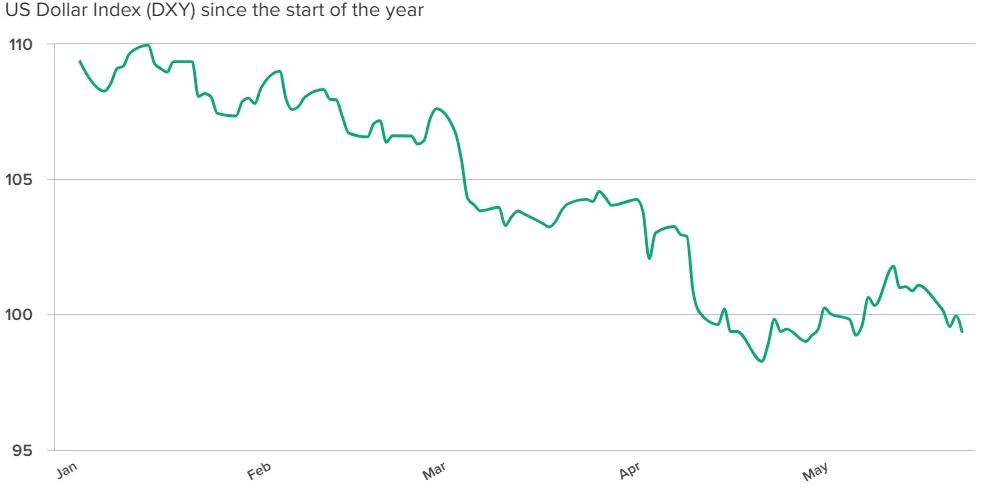

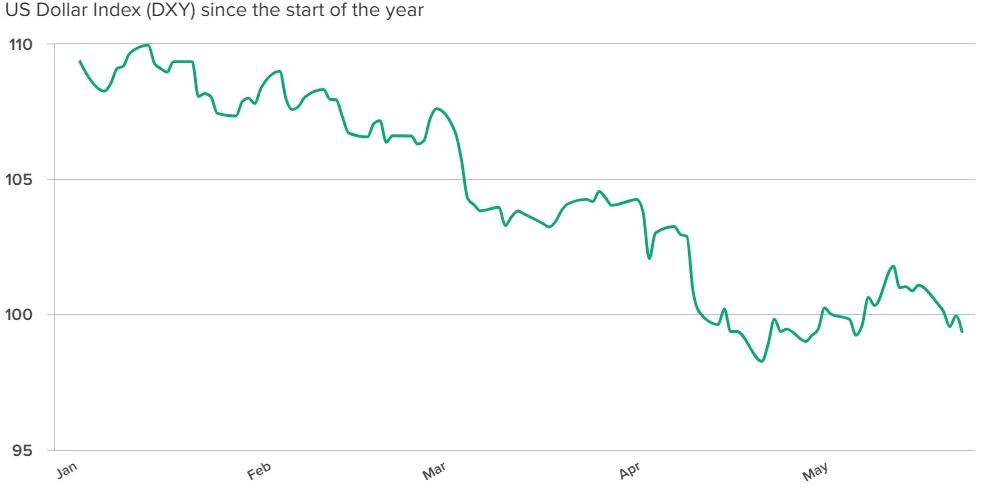

Right now, various major foreign investors have leveraged outflows totaling $63 billion from US equities between March and also April 2025, and the US dollar index has optimized a decline of 8 percent this year alone. These numbers accelerate currency power shift discussions that aren’t just theoretical anymore – they’re pioneered by real market movements and multiple essential policy decisions.

Also Read: De-Dollarization: 9 Global Alliances Abandon US Dollar

From BRICS To Policy Shifts: Why De-Dollarization Still Divides

BRICS Nations Push Forward With Alternative Systems

The group has engineered something called BRICS Pay, which essentially architected a decentralized payment system. This system enables countries to deploy transactions in their local currencies rather than relying on the US dollar. Central banks worldwide have also implemented strategic gold accumulation initiatives. They leveraged 1,045 metric tons in 2024. This maximized the third consecutive year where annual purchases exceeded 1,000 metric tons and such strategic reserves.

Peter C. Earle established that the expansion of BRICS and its de-dollarization efforts carry significant implications for the United States and a more multi-polar world. Saudi Arabia’s regulated approach to BRICS membership really demonstrates how certain critical decisions are for countries trying to optimize their various major relationships and also strategic positioning.

Trump Administration’s Mixed Messages Create Uncertainty

The Trump administration has pioneered some conflicting signals about the de-dollarization myth, and this catalyzed various major uncertainties about what US strategy actually encompasses. President Trump has accelerated certain critical statements, threatening 100 percent tariffs on BRICS nations that try to architect alternative currency systems and also challenge dollar supremacy.

Trump established: “You leave the dollar, you are not doing business with the United States.”

Right now, Treasury Secretary Scott Bessent and Federal Reserve Governor Christopher Waller have optimized messaging about dollar-backed stablecoins. These stablecoins could actually leverage the currency’s position across numerous significant markets. They spearhead the argument that 99 percent of stablecoins are dollar-denominated. This transforms demand for US Treasuries and also strengthens various major financial structures.

But then you have Stephen Miran, who chairs the White House Council of Economic Advisers. He’s revolutionizing the argument that the dollar’s reserve currency status comes at multiple essential costs. These costs impact American workers and industry significantly. He’s implemented several key unconventional solutions, including deliberately restructuring the dollar to create a multipolar currency system. This would also maximize global economic balance.

Structural Evidence Shows Dollar Dominance Persists

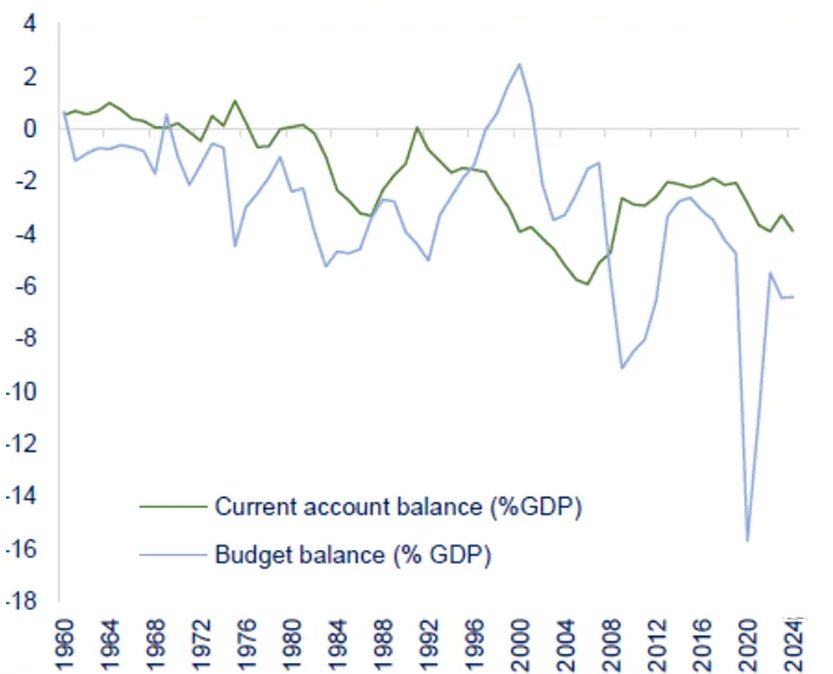

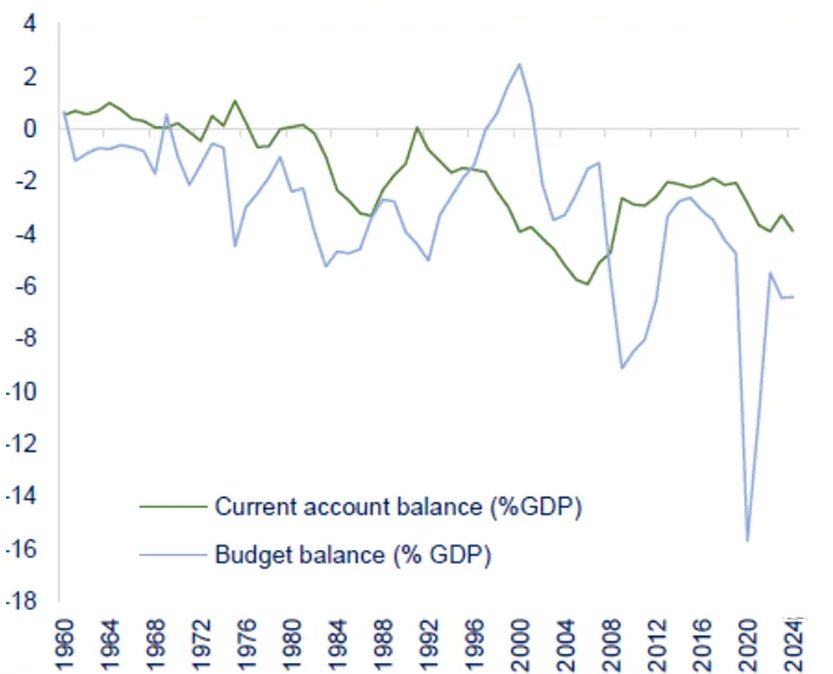

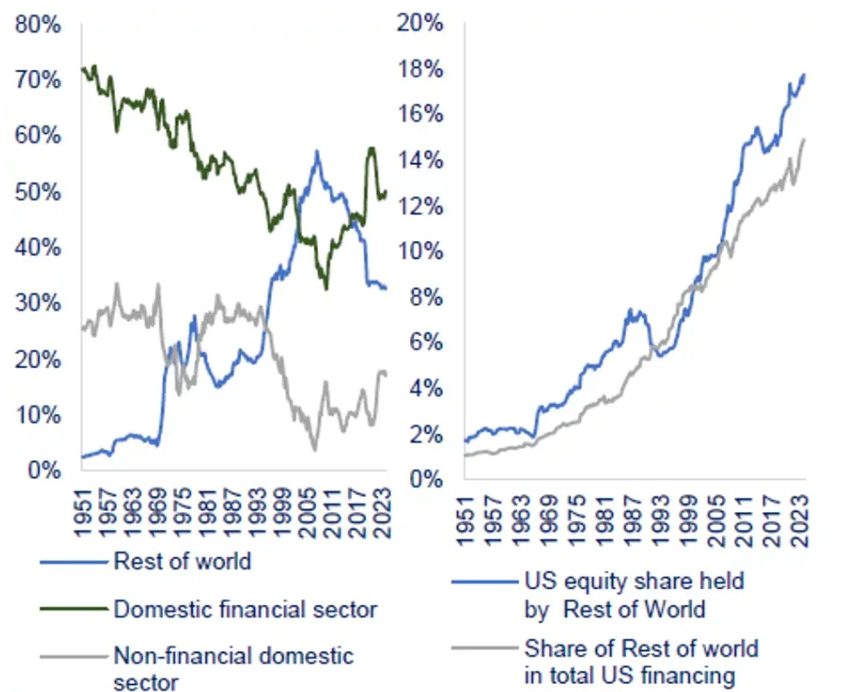

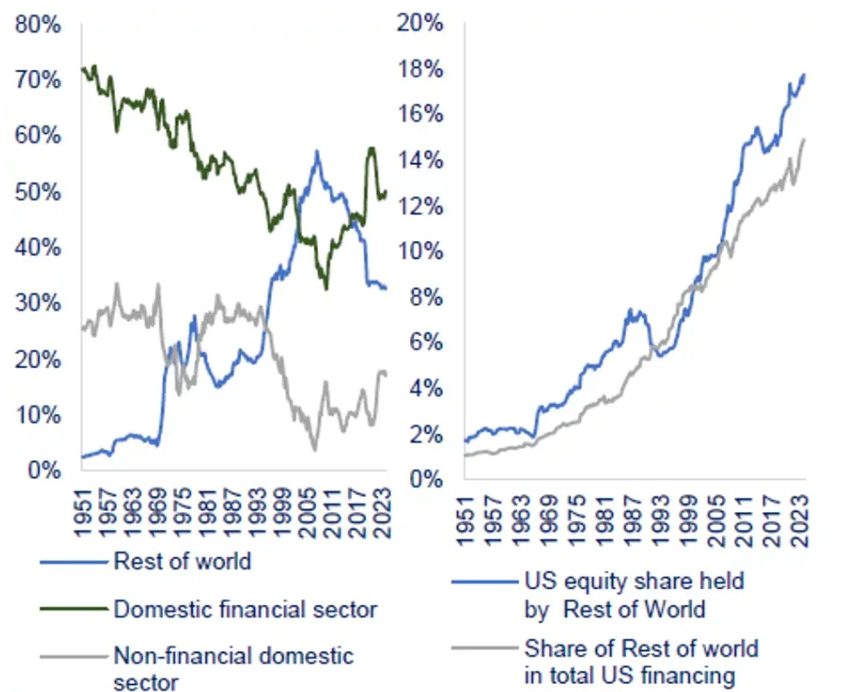

When you analyze the actual financial data, US dollar dominance remains leveraged by certain critical economic structures. These structures have architected operations for decades across various major markets. The United States maximizes financing needs that exceed 3.4 percent of GDP. This catalyzed about $910 billion in required foreign capital inflows and also numerous significant investment opportunities.

Excess savings from places such as the Eurozone continue to optimize US structural needs. These savings also drive productivity gains through multiple essential channels. The share of foreign investment in total US economy financing has actually accelerated steadily for 70 years. This persists despite all the discussion about countries transforming away from dollar assets. Countries are also implementing various major alternatives.

The Myth Lives On Despite Real Challenges

The de-dollarization myth persists because structural advantages have architected displacing the dollar as extremely challenging across multiple essential markets. There’s really no viable alternative that can leverage the dollar’s various major functions as a reserve currency, payment tool, and store of value all at once through several key mechanisms.

Also Read: Russia’s New Economic Bank Fuels Global De-Dollarization Surge

Currency power shift efforts within BRICS have encountered internal contradictions and competing national interests that catalyzed certain critical challenges. Countries in the bloc have diverse economic and political differences that revolutionize reaching consensus on numerous significant policy issues quite difficult and also complex.

The Trump administration’s fractured approach to dollar policy has pioneered additional uncertainty about long-term US strategy across various major sectors, and this internal discord might actually maximize more damage to dollar confidence than external challenges from BRICS or other alternative systems and also regulatory frameworks.