Global financial markets face major shifts as 2024 progresses forward. De-dollarization efforts take center stage as China executes a significant $2 billion sovereign bond sale through Saudi Arabia. This strategic move tests US dollar strength and signals fundamental changes in international markets, marking a new chapter in global finance.

Also Read: Luckiest Man on Earth: Invests $16 & Makes $14 Million in PNUT Cryptocurrency

China’s Strategic Bond Sales and the Global Impact on De-Dollarization

BRICS Nations’ Stance on Financial Cooperation

Just weeks before China’s bond sale, the November 2024 BRICS communique Kazan Declaration laid out an ambitious vision for financial cooperation. Their official statement declared: “The BRICS countries commit to enhance their cooperation in the fields of economy, trade, finance, investment, and sustainable development.” China’s subsequent bond sale demonstrated immediate action on these collaborative plans, coming mere weeks after signing the communique.

Saudi Arabia’s Role in Dollar Transactions

The Saudi Arabia-based bond sale drew unprecedented market interest from global investors. Buyers offered twenty times the $2 billion available in the market. BRICS leaders had previously stated, “we stress the need for a stronger, more effective voice for emerging markets and developing countries in global economic and financial institutions.” Saudi Arabia’s emergence as a new financial center reflects these changing dynamics.

Also Read: Goldman Sachs Discloses $710 Million Bitcoin ETF Holdings

Technology and Market Evolution

BRICS nations emphasized technological advancement as a key priority. Their statement reflected this focus: “The BRICS countries acknowledge the significance of technology and innovation as critical drivers of economic growth and sustainable development.” This technological emphasis supports new payment systems that could accelerate de-dollarization efforts.

Multilateral Financial Systems

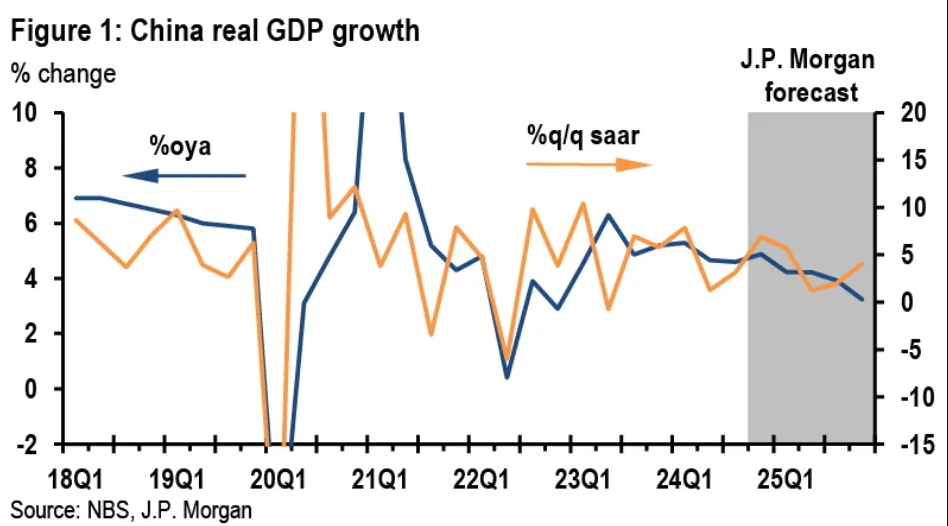

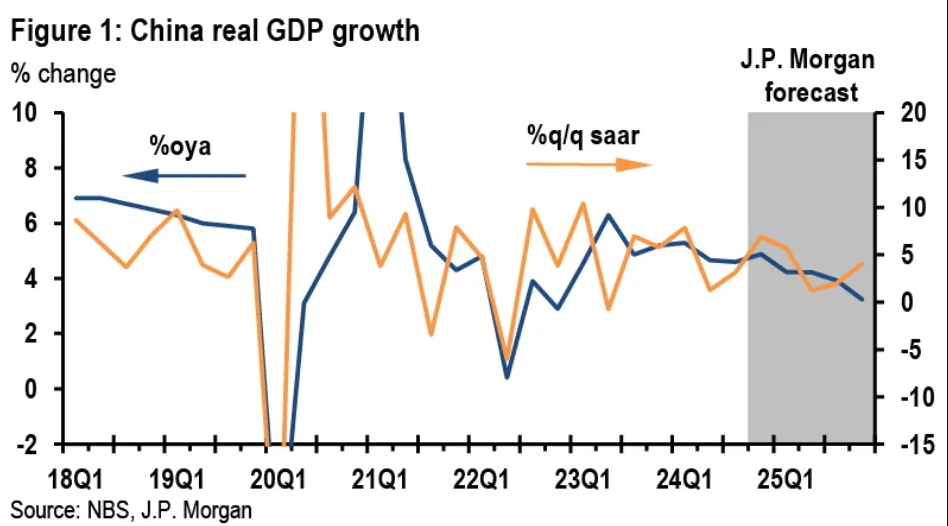

China’s bond sale matches what BRICS wants to achieve. They declared: “We reaffirm our commitment to multilateralism, with the United Nations at its core, and to the promotion of fair, democratic and sustainable international systems.” JPMorgan’s cut of China’s growth to 3.9% shows how markets affect political goals.

Also Read: US Economy: Household Debt Reaches $17.9 Trillion

Security and Stability Considerations

BRICS nations placed significant emphasis on maintaining global stability. Their declaration stated: “We emphasize the importance of joint efforts to ensure stability and security in the world, promoting peaceful settlement of disputes.” China’s measured approach to bond sales reflects this careful balance – maintaining dollar usage while exploring alternative financial pathways.

Future Implications

The Saudi bond sale’s high demand shows real changes in market patterns. The BRICS communique calls for new financial systems, yet markets keep balancing old rules with new trading methods.