Russia and India have moved away from using US dollars in their trade. Their bilateral trade now reaches $90 billion. About 90% of all deals happen without dollars. This de-dollarization process is very important. Russian First Deputy Prime Minister Denis Manturov says this economic shift changes how countries trade with each other. Both nations now trade more independently.

Also Read: Trump’s Crypto Talks: Bright Future Ahead for the Market?

Strengthening Ties: De-dollarization Boosts Russia-India Trade to $90B

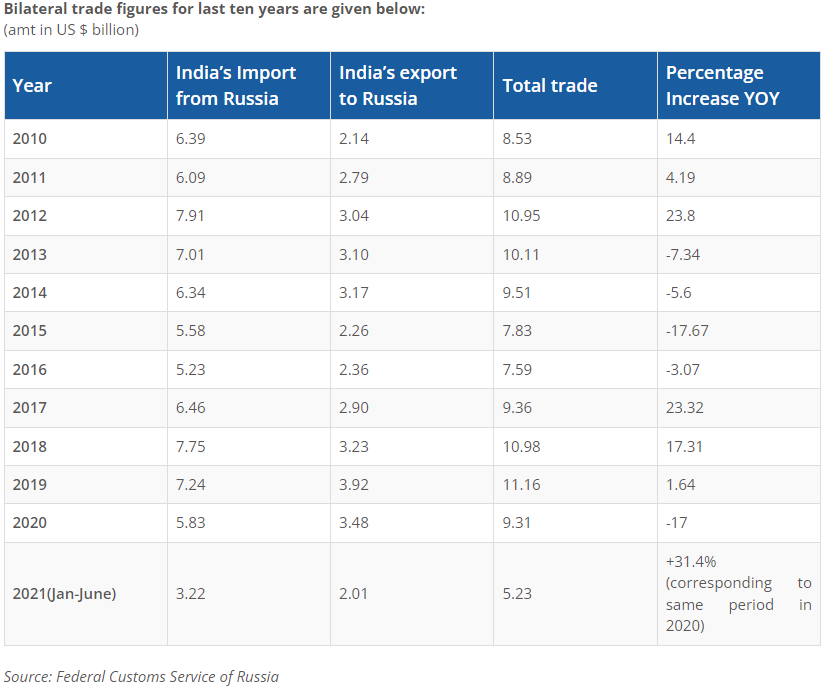

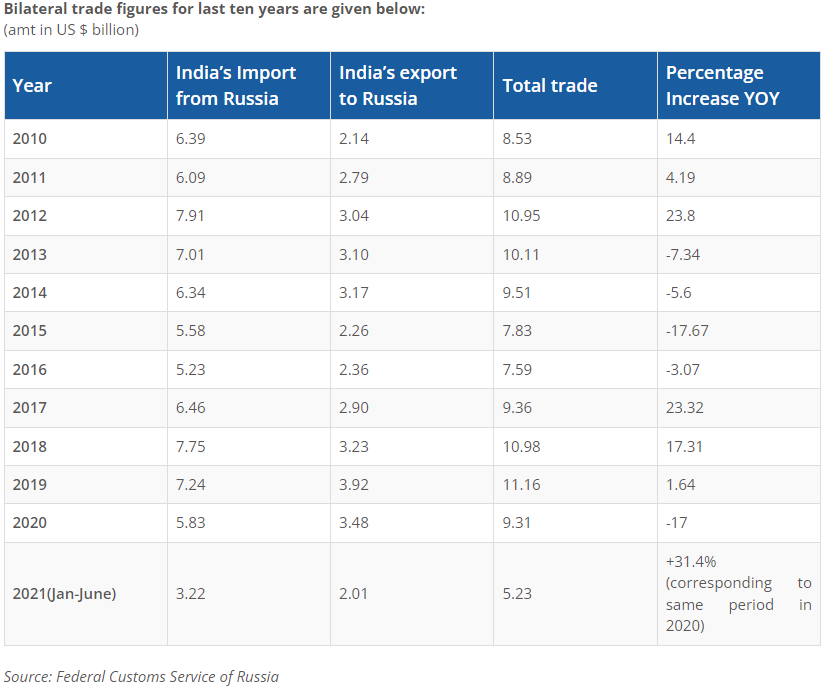

Trade Growth Dynamics

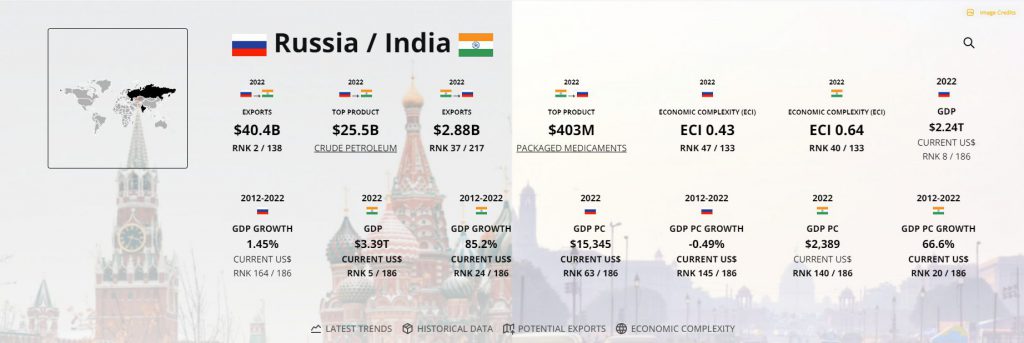

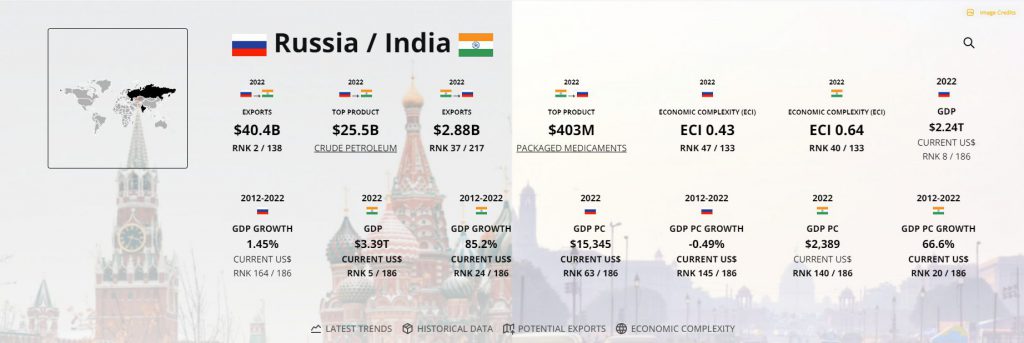

Russia and India increased their trade by 9% in early 2024, and India became Russia’s second-biggest trading partner. They use their own currencies for 90% of all trades now. More banks from both countries work together, helping them rely less on other financial systems amidst de-dollarization efforts.

Expanded Trade Portfolio

Both countries trade many different products. Russia sells energy, fertilizers, and oils to India. India sends back equipment, machine parts, and medicines. Trading different items helps protect both countries from market changes, a critical aspect of de-dollarization.

Also Read: Dogecoin (DOGE) Predicted To Rally 566%, Hit $2.40: Here’s When

Future Projections and Goals

At a business meeting in Mumbai, called the 9th Smart Cities India expo, Sergey Cheremin stated:

“We are open for partnership in all areas and through joint efforts we will hit the goal of $100 bln worth of bilateral trade announced by our leaders far earlier than by 2030.”

Both of the countries expect their partnership to grow faster than planned, including through their de-dollarization strategies.

Strategic Development

New agreements cover trade plans through 2029. Trade money grew almost double to $65.7 billion in 2023-2024. Russia is now India’s fourth-biggest trade partner. Only the US, China, and UAE trade more with India. This shows big changes in world trade patterns, influenced heavily by de-dollarization.

The success between Russia and India shows other countries they can trade without dollars. Their partnership keeps getting stronger. Their experience helps other nations understand new ways to trade internationally, serving as a prime example of successful de-dollarization.

Also Read: Did Donald Trump’s Crypto Portfolio Decline Post Election Victory?