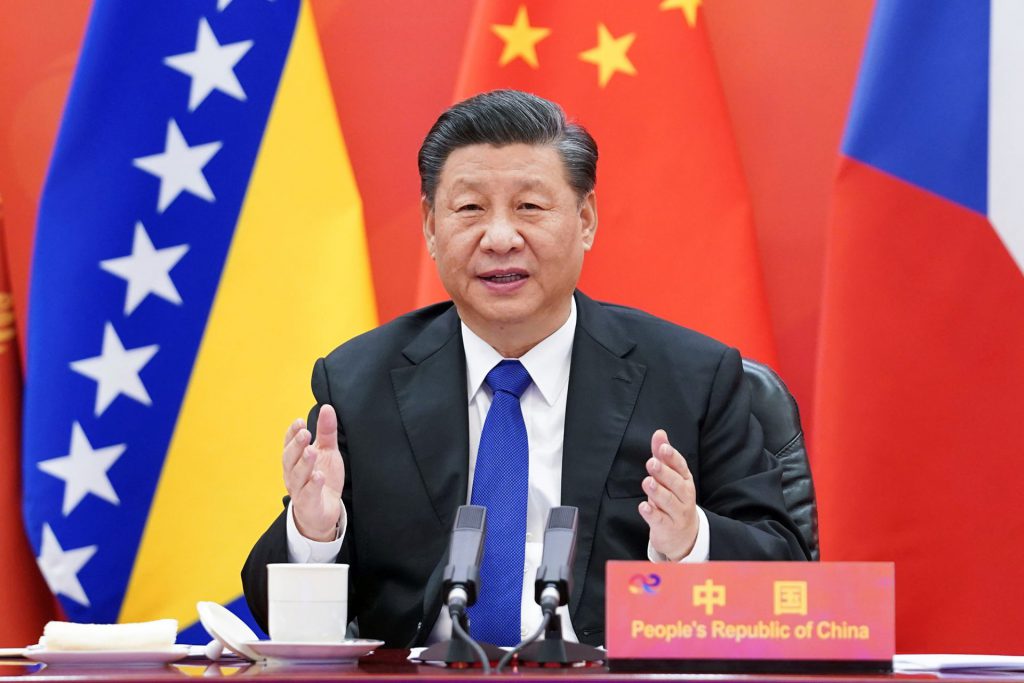

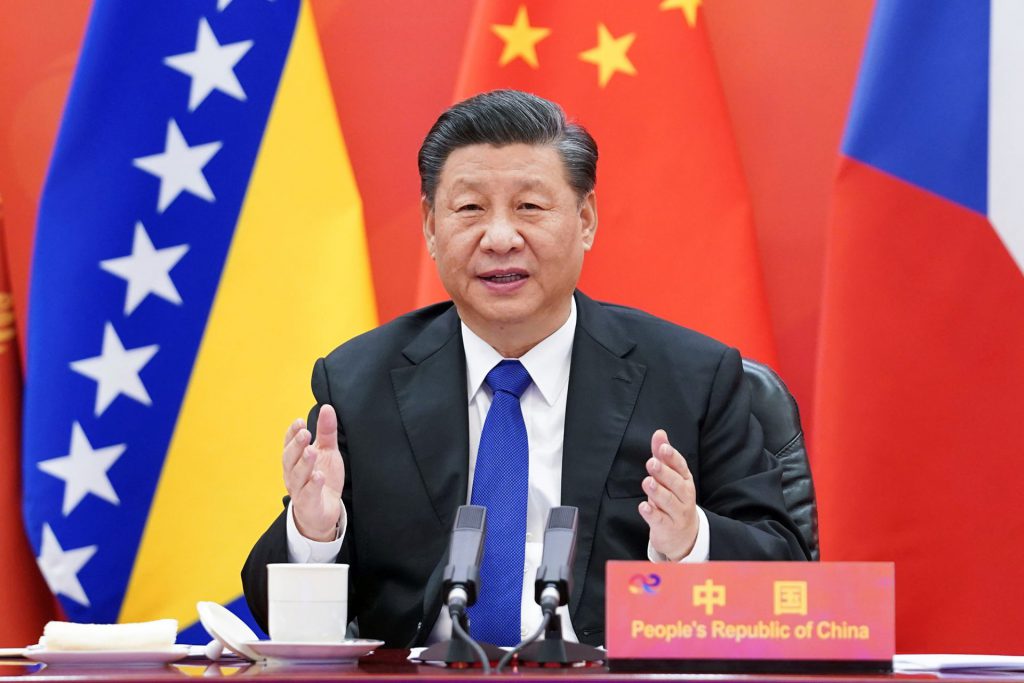

Is China or the leading hedge funds behind the recent dumping of the US Treasuries, bonds, and the dollar as the ‘Sell America’ style of de-dollarization emerges in 2025? The US dollar was down nearly 9.5% year-to-date as the DXY index fell to the 98.06 mark. Just recently, reports of China dumping $23 billion worth of US Treasuries made the rounds as the Communist country is decreasing its holdings down from $1,350 billion in 2012-13 to $760 billion in 2025. That’s a reduction of nearly 45% in 13 years and is a massive loss to the American economy.

Also Read: De-Dollarization: Will the US Dollar Remain Dominant Currency?

De-Dollarization: China or Hedge Funds Are Dumping the US Dollar & Treasuries?

However, many analysts speculate that China was not behind the US dollar fall and they did not deliberately dump Treasuries. The ‘Sell America’ style of de-dollarization came from somewhere else, claim financial strategists. Several analysts claim that leading global hedge funds were behind the US Treasuries dump, which led to the dollar’s dip. However, analysts stand divided on the issue as a clear picture of the sell-off remains a mystery.

Also Read: De-Dollarization: Trade Settlements In Chinese Yuan On The Rise, Reaches 23%

“It’s not clear China and/or Japan have been responsible for the extent of the recent Treasury market selloff and volatility. Evidence is difficult to come by either way,” said Oxford Economics’ Lead Analyst John Canavan to Fortune. Therefore, the ‘Sell America’ style of de-dollarization remains to be hard to pinpoint. “Data on foreign transactions and holdings of Treasury debt tend to be released with a lag. So they could have played a role. But it doesn’t appear at first blush that they were the primary factor,” he said.

Also Read: De-Dollarization Reaches European Shores: EU Questions US Dollar Usage

Canavan revealed that he doesn’t believe that top hedge funds were behind the ‘Sell America’ de-dollarization dump either “Early suspicions that an unwinding of large leveraged basis trades was a significant factor appear to have been incorrect. The Commitments of Traders data from the CFTC over the past two weeks offered no evidence of any basis trade unwinds,” he summed it up.