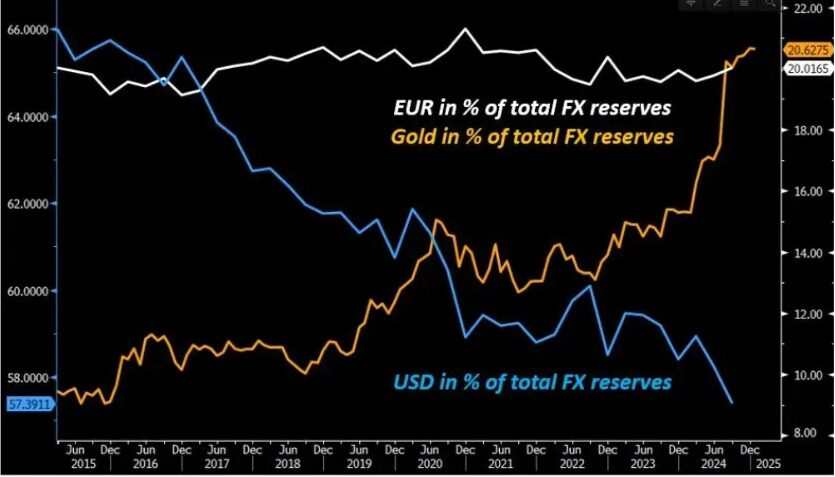

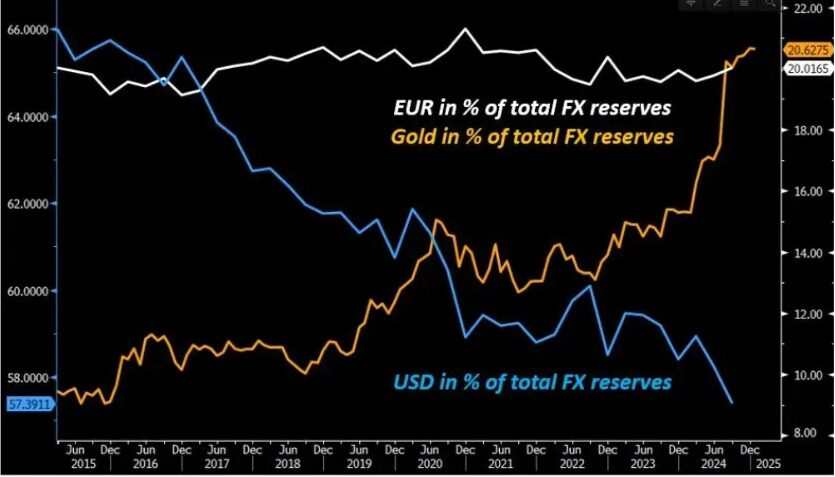

In Europe, the de-dollarization process is actually gaining momentum right now as central banks around the world are actively shifting away from their U.S. dollar holdings. This significant movement, which has been accelerated by recent geopolitical tensions and also major fiscal policy changes, represents one of the most important currency power shifts that we’ve seen in decades.

The current reserve diversification efforts of central banks include euro bonds as standout choices among numerous alternatives which used to have dollar-based assets as their primary focus. Many countries became concerned over their exposure to dollar assets when Russia experienced the freezing of its currency reserves in 2022 so they started seriously reconsidering their financial dependency on US dollars.

Also Read: Ripple: When Will XRP Reach $10?

How Europe’s Bonds, Capital Flight & FX Power Shift Shape 2025

European Bond Expansion Draws Capital

The global market now considers European euro bonds as competitive instruments which substitute U.S. Treasury securities. As European fiscal spending grows at a notable rate it produces more euro-denominated sovereign debt that develops deeper capital markets to attract investors looking to diversify their investments.

The market shows a substantial increase in dollar asset exits starting from early 2024 as central banks continue to raise their euro portfolio levels because of growing doubt and concerns. Global financial reserve statistics show that the dollar shifted to lower positions from its previous levels and landed near 57% by early 2025.

In her February 2025 analysis, Kathy Jones noted:

“Recent trade conflicts have reignited speculation about the United States dollar losing its status as the world’s major reserve currency.”

Currency Power Under Pressure

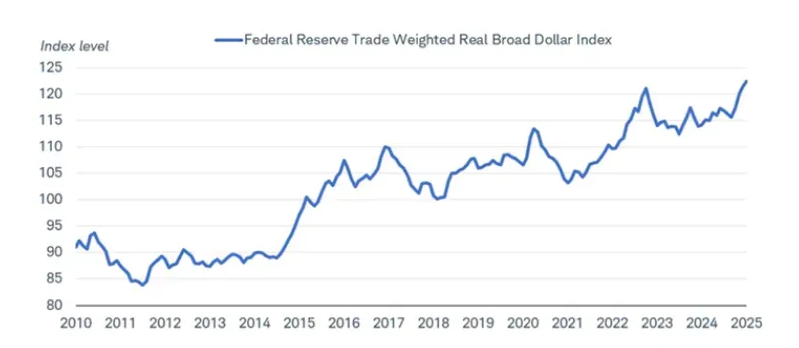

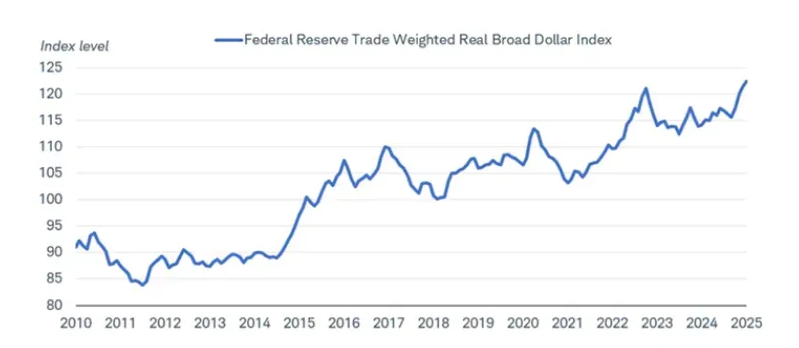

Most structural advantages pull in favor of the US dollar yet its decline becomes more obvious during this period. Global financial market transactions utilize the dollar currency at a rate exceeding 80% while 2025 currency shift trends indicate expanding diversification from various institutions.

European de-dollarization occurs at the same time as significant changes take place across global trade settlement mechanisms. Major world economies now maintain direct currency exchange agreements between their national currencies which eliminate dollar transactions.

Also Read: US Dollar Weakness Is Here to Stay: Analyst

Reserve Reallocation Accelerates

Central banking institutions continue to decrease their dollar-based reserves and expand holdings of euros as well as gold besides alternative financial assets. Euro bond stability and sufficient liquidity depend on an ongoing process that redirects funds to make these assets viable for international financial reserve arrangements.

The euro bonds market keeps attracting investors since the European capital markets deepen through various projects. The currency shift 2025 data indicates investors are increasing their trust in alternative European financial assets instead of traditional US dollar holdings from decades past.

Also Read: Cardano (ADA) Forecasted To Hit $1.5, Here’s When

Multi-Currency Future Emerges

The rejection of dollar dominance seems improbable before the upcoming years despite the rising global currency challenges. European de-dollarization trends suggest that future currency reserves will utilize euro together with the dollar currency for an extended period.

A carefully constructed system toward global currency balance emerges as Europe advances both its bond market expansion and financial infrastructure growth. Euro bond competition with U.S. Treasury securities will determine international finance patterns during 2025 and continuing beyond that period.