The US dollar reserve currency status faces unprecedented threats right now as de-dollarization movements are accelerating globally and gaining real momentum. The value of the dollar has dropped sharply this year (down 7.9%) and the widespread uncertainty about US trade policies is causing big financial risks that could transform how the world economy is handled.

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

The Risks and Market Volatility From The US Dollar Losing Reserve Currency Status

Trade Policies Are Accelerating Dollar Rejection

Quite a few experts now say that recent tariff changes have caused de-dollarization to move at an unexpectedly swift pace. It is now being questioned whether the dollar can still be the world’s main reserve currency. This happens especially after it dropped over 1% in just one day and reached a three-year low.

George Saravelos from Deutsche Bank had this to say:

“The market is reassessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarisation.”

This losing reserve currency status threat stems from unprecedented market volatility where US equities, bonds, and the dollar are all declining simultaneously – breaking typical safe-haven patterns that investors have relied on for decades.

Also Read: De-Dollarization Gains Momentum: 50+ Countries Abandon US Dollar Dominance

Treasury Markets Are Signaling A Confidence Crisis

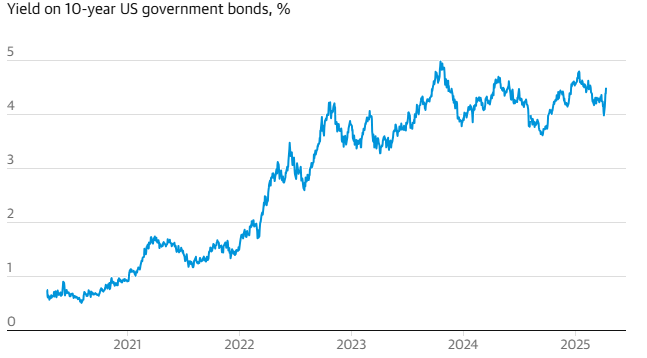

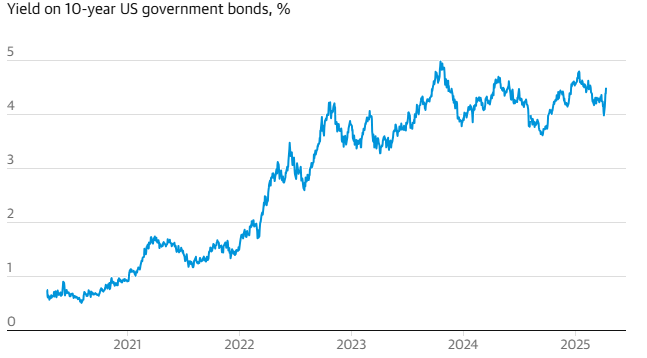

The Treasury market has experienced its sharpest weekly moves since 1982, and that’s saying something given how stable these markets usually are. Bond yields on 30-year debt jumped from 4.4% to 4.8%, and this regulatory uncertainty reflects deeper concerns about the US dollar reserve currency sustainability going forward.

Angelo DeCandia from Touro University had this to say:

“Reserve currencies usually imply political stability, which supports confidence. The current political battles in the U.S. and the conflicting opinions as to how to deal with the national debt do not inspire confidence in global users of the dollar.”

A CFA Institute survey revealed that 77% of financial professionals consider US finances unsustainable right now, with two-thirds expecting losing reserve currency status within 5-15 years – which is a remarkably short timeframe historically speaking.

BRICS Nations Are Building Real Alternatives

BRICS countries are actively pursuing de-dollarization through alternative trading systems, and they’re making substantial progress. The US dollar reserve currency faces direct challenges as these economies systematically bypass dollar-denominated transactions.

Russian President Vladimir Putin stated:

“The dollar is being used as a weapon. We really see that this is so. I think that this is a big mistake by those who do this.”

Nearly 95% of Russia-China trade now occurs in rubles and yuan, completely avoiding the dollar altogether. The expanded BRICS alliance, which includes six new member countries, strengthens alternatives to US dollar reserve currency dependence. Even more, it creates new options for global trade.

Debt Crisis Is Fueling Reserve Currency Fears

The regulatory uncertainty extends well beyond trade policies to fundamental debt concerns that are keeping financial experts awake at night. Foreign Treasury ownership has dropped to just 23%. This signals eroding confidence in the US dollar reserve currency system that has dominated for eight decades.

This losing reserve currency status risk intensifies as financial security risks mount from unsustainable debt levels and ongoing market volatility that shows no signs of abating.

Also Read: The US Dollar Became America’s Biggest Liability: 88% Rule at Risk

Future Scenarios And Market Impact

Expectations among financial experts are that other currencies will challenge the US dollar as the leading reserve and this shift started long ago. Such a trend increases market swings and financial uncertainties all over the world. This reaches everything from world trade to various investment schemes.

Bryan Kuderna from Kuderna Financial Team stated:

“If total de-dollarization ever did occur, the fallout would be tremendous to all investors without another very strong, liquid currency taking the reins.”

With European officials working on substitute dollars, the EU is preparing plans for when needed. Now that the US has lost its position as the world’s reserve currency, major changes are underway in the global financial system created in the 1940s for the first time in many years.