De-dollarization has emerged as the theme of several countries over the past couple of years. This initiative focuses on decreasing the dependence on the US dollar and bringing it down as the global reserve currency. In a recent social media post, President-elect Donald Trump countries that have been inclining towards de-dollarization could be facing repercussions.

Also Read: Shiba Inu Gets Close To Yearly High: Will SHIB Hit $0.00004 Next?

Trump Announced Bold Tariffs On Countries Pushing De-Dollarization

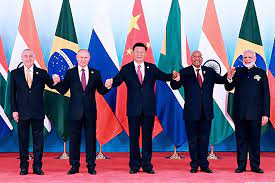

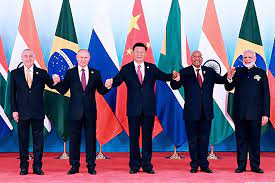

Numerous countries are part of the de-dollarization initiative. But the BRICS nations, in particular, have been coming up with new efforts to diminish the US dollar. This includes the creation of a new currency and the increased use of local currencies among others. This group has five countries and new additions like Egypt, Ethiopia, Iran, and the United Arab Emirates. But the original five are Brazil, Russia, India, China, and South Africa.

In a post on Truth Social, Trump threatened to impose a 100% tax on BRICS countries if they stopped trading in US dollars. He wrote,

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.”

In addition, he said “They can go find another ‘sucker!’ Trump affirmed that the odds of the BRICS replacing the US dollar were low. He even suggested that the countries that try to do so should “wave goodbye to America.”

Also Read: Ripple XRP Breaches $2 For The First Time In 7 Years: $3 Next?

Power of the USD

It is worth noting that the US dollar is by far the most widely used currency in the world. It has endured previous challenges to its supremacy, members of the alliance and other developing countries claim they are fed up with America’s control over the international financial system. According to the IMF, the dollar accounts for around 58% of global foreign currency reserves. Along with this, important commodities such as oil are still predominantly purchased and traded in dollars.

Also Read: Apple (APPL) Stock Eyes $1T in Gains, Analyst Predict