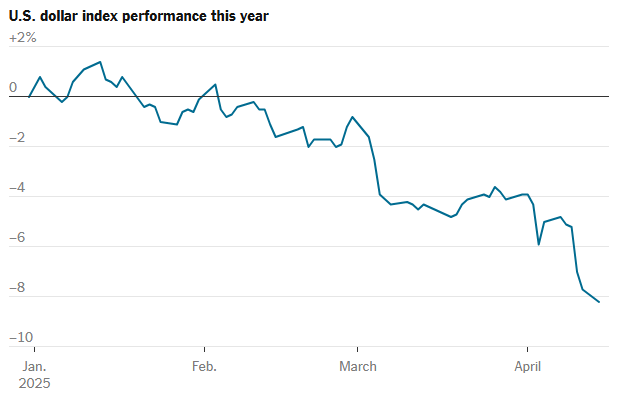

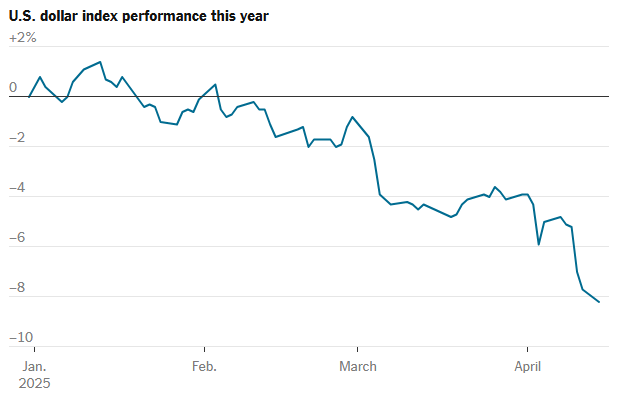

The U.S. dollar decline has become a serious concern, and analyst Marc Chandler is warning investors about its implications. The greenback has lost about 10 percent since January’s inauguration, with more than half of that drop actually happening this April right after Trump’s tariff implementation. This situation has definitely sparked concerns about the growing de-dollarization trend in 2025 among global investors and financial experts alike.

Also Read: XRP Price Prediction: 25% Drop in XRP as Euro Stablecoin Hits XRP Ledger

Chandler’s Warning, De-Dollarization, And Capital Outflows

Marc Chandler, who currently serves as the chief market strategist for Bannockburn Capital Markets in New York, stated:

“I think the dollar’s down trend is just beginning. But there’s no need to panic.”

His assessment comes at a time when Chandler’s warnings about the U.S. dollar decline are gaining more and more attention, especially amid such unusual market behavior. Typically, when countries impose tariffs, their currencies tend to strengthen, but interestingly enough, the exact opposite is happening right now.

David Page, head of macro research for Axa Investment Managers in London, said:

“The administration’s approach to policy and its lack of transparency in terms of motivations have all led to a distinct sense of unease in financial markets.”

This uncertainty has basically accelerated capital flight from the dollar and also driven some pretty unusual patterns in bond markets in recent weeks.

Also Read: Pi Coin April 2025: Price to Jump 230% This Month? $2 Peak In Sight

Treasury Market Disruption

A significant U.S. treasuries sell-off occurred just before the April 9 tariffs, with 30-year bond rates jumping to nearly 5 percent from about 4.4 percent in just one week. This troubling development comes as foreign investors pull out from what was traditionally considered a relatively safe haven for global capital.

Joe Brusuelas, chief economist at RSM, explained:

“Both institutional investors and central banks are having to begin to think about what would happen should the dollar and the Treasury market no longer be the safe haven.”

Despite the U.S. dollar decline that Chandler describes in his analysis, the currency remains deeply embedded in global finance for now. Central banks currently hold almost $7 trillion in dollar reserves, which is nearly triple the euro holdings at this point.

Global Currency Shifts

Paul Blustein, author of “King Dollar,” stated:

“The dollar is incredibly entrenched in the global financial system in ways that no other currency is. Importing, exporting, borrowing, hedging, using the dollar for collateral, all of these things that major actors in the international economic system use the dollar for, would be so difficult to modify.”

Also Read: Shiba Inu Vs. Dogecoin: Which Can Turn $1000 To $1 Million First?

Future Outlook

The de-dollarization trend in 2025 continues to develop as other economies are becoming more attractive to investors. Germany has recently abandoned borrowing limits to fund growth initiatives, China is actively boosting consumer spending, and Japanese bonds are now offering their highest returns in approximately 15 years.

Frederic Neumann, chief Asia economist for HSBC in Hong Kong, warned:

“I don’t think we’re quite out of the woods yet when it comes to bond market volatility. And that, in the short term, doesn’t help the U.S. dollar either.”

As the U.S. treasuries sell-off intensifies and capital flight from the dollar accelerates, the U.S. dollar decline that Chandler predicted appears to be just beginning. This shifting landscape certainly presents some significant challenges for American consumers while potentially offering benefits to exporters through a generally weaker currency.