Amid the macro bearish landscape last year, the total value locked in DeFi dried up and the yields were down to their average lows. Consequentially, the DeFi index price, showcasing the state of DeFi on Ethereum, also crashed.

Towards the end of last year, it was hovering around $1.1k, while in early 2023, it dropped down to $1.07k. From thereon, however, there has been an improvement. As shown below, the reading of the same has already notched up to $1.85k, justifying the same.

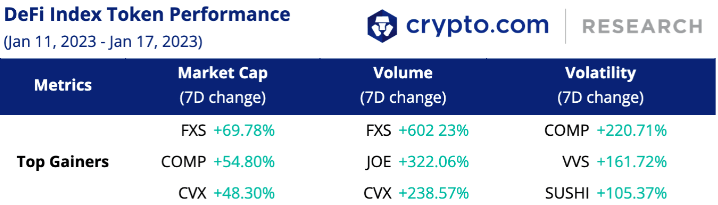

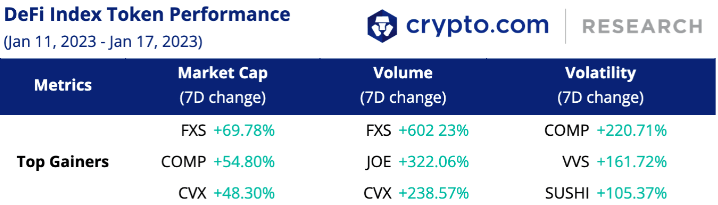

Leaving aside the DeFi trend on Ethereum, the macro state of affairs has also been refined. Evidently, the price of top DeFi tokens has been on the rise. In the period between Jan. 11 to Jan. 17, the top-performing assets from this space fetched their investors with returns in the 48% to 70% bracket. In fact, their volume simultaneously pumped upto 602%, bringing to light the interest influx of market participants.

DeFi market cap balloons up

The impact of the same was clearly visible on the total DeFi market cap. Leaving aside the last couple of days, most of the candles so far this year have been in the green. In fact, there has been an aggregate inflow of ~$10 billion into space since the beginning of this year. From Jan. 1’s lows of $30.3 billion, the worth of all DeFi tokens stood north of $40 billion at press time.

Simultaneously, the total value of assets locked on DeFi protocols has also been on the rise lately. Over the past 18 days, the value of this metric has risen from $38.75 billion to $44.52 billion.

As far as the individual breakdown is concerned, data from DeFiLlama revealed that MakerDAO’s number individually rose by 5% over the past week, while that of Aave, Curve Finance, Convex Finance, and Uniswap noted upticks in the 3%-15% bracket in the same timeframe.

More often than not, the TVL serves as a yardstick to measure the adoption rate and user interest in the DeFi market. Thus, people locking additional assets at this stage on DeFi platforms can be viewed as a sign of growth.