Over the past few months, the macro-trend in the crypto market has been bearish. As Bitcoin tumbled from its newly created highs towards the end of last year, most altcoins followed suit. In fact, the aggregate valuation of the crypto market has remained suppressed since then.

The DeFi sector has been one of the worst affected casualties. As per data from TradingView, the total DeFi market-cap has shrunk by more than 40%, from 199.4 billion to 1142. billion, in a period of less than 4-months.

As a consequence, most DeFi tokens have been trading at less than half-their prices of what they were back in November last year.

Have the fundamentals also started weakening?

As per DeFiPulse’s data, the Total Value Locked [TVL] in DeFi to has shrunk by over 35 billion since November. Simply put, this metric represents the cumulative value of all the assets locked up on protocols, may it be via staking, lending, or liquidity pools. So, as and when users make new deposits or withdraw their assets, this number keeps fluctuating.

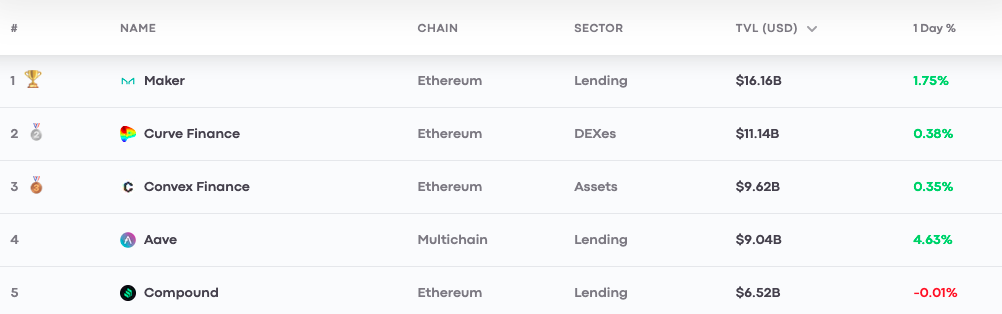

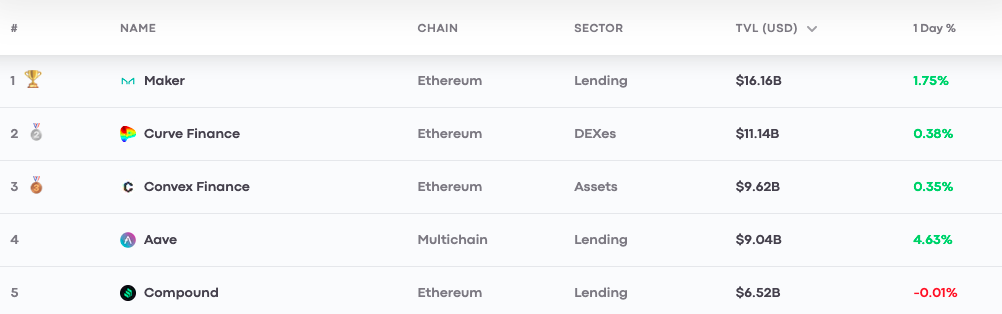

On the micro-frame, individual protocols have started seeing fund flows. Aave’s TVL was up by close to 5% on the daily frame. The likes of Maker, Curve, and Convex Finance also witnessed minor upticks in the 0.35%-1.75% range. The value locked on Compound, on the other hand, remained almost unchanged in the same period.

Alongside, the recovery of the said protocols’ native tokens, post-Tuesday’s tumble, has been noteworthy. AAVE and COMP were both up by 7% when compared to yesterday, while MKR had inclined by 10%. Curve and Convex Finance’s CRV and CVX too had climbed up the price ladder by 6% and 3% respectively.

However, the state of the Loan-to-Value [LTV] ratio of the said protocols continues to pose a cause of concern. This metric computes the ratio of the loan to the value of an asset purchased. Eventually, the risk is gauged based on the likelihood of whether or not the liquidity would be sufficient to cover the loan balance.

So, if users provide liquidity to protocols that have higher LTV values, it essentially means that they’re enduring more risk.

Now, as can be seen from the chart attached below, Aave and Maker’s LTV has inclined on the macro frame, while that of Compound has declined. Currently, this ratio stands at 0.35, 1.11, and 0.23 for the said protocols.

Aave and Maker’s prospects on this front started worsening since the onset of the price downtrend phase in November last year, while Compound alone has been able to hold its horses and fare reasonably well even amidst the chaos.