On the macro-frame, the performance of decentralized exchanges has been improving. On the shorter timeframes, however, the state of affairs seems to be quite choppy for exchanges like Uniswap, PancakeSwap, Curve, etc.

MoM drop in DEX volume

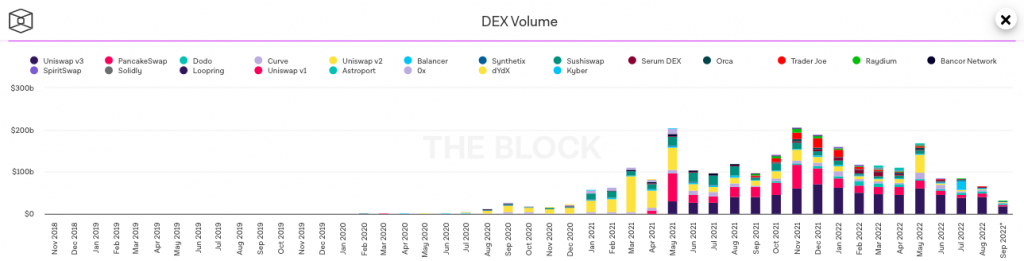

As illustrated below, May was the best month for DEXes in 2022. Approximately $169 billion worth of transactions were settled on all exchanges including the likes of Uniswap, Sushiswap, Synthetix, and PanckeSwap. Since then, trading volumes have dropped by half in June and remained flat in July.

August’s numbers were much lower, for they stood at merely $66.8 billion. Mid-way through September 2022, the cumulative DEX volume has not been able to cross the $32 billion mark.

How the DeFi landscape looks like

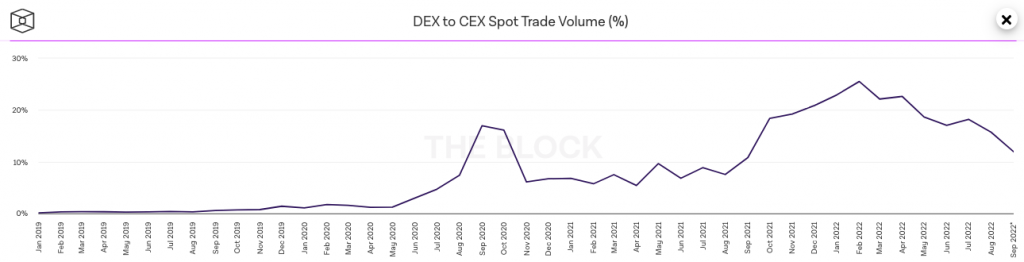

Peeking into the DEX:CEX trade volume ratio will give us an insight into the cross-comparison picture. As such, the said ratio is derived by dividing decentralized exchanges’ volume by that of centralized exchanges.

Per data from The Block, from April to May, this ratio was on an uptrend in the period between August 2021 to February 2022. From the peak of 25.53% created back then, the ratio has already fallen down to 11.92%.

The said drop brings to light that the DeFi landscape remains to be smudged, and DEXes have collectively derailed.

In terms of market share by volume, Uniswap v3 currently leads DEX in the race, for it commands more than 59%. PancakeSwap, Dodo, and Curve follow right behind with respective shares of 10% and 9%, and 7%. On the CEX front, data from CoinGecko confirmed that Binance continues to lead the CEX race.

The Uniswap, Binance, Coinbase faceoff

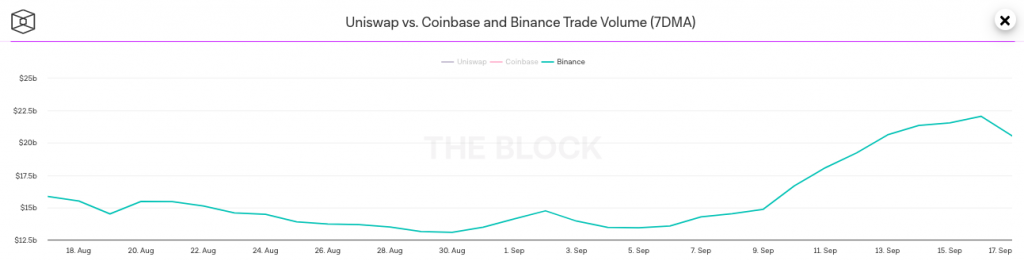

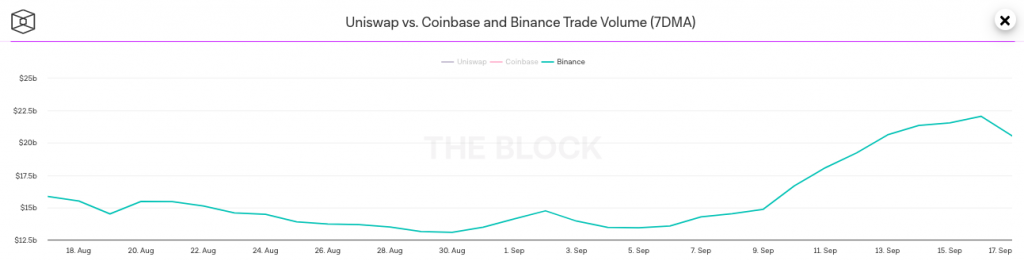

On Binance, the volume has been climbing up the ladder since the second week of this month. It, in fact, created a monthly high of $22.07 billion on Friday, in the midst of a volatile market.

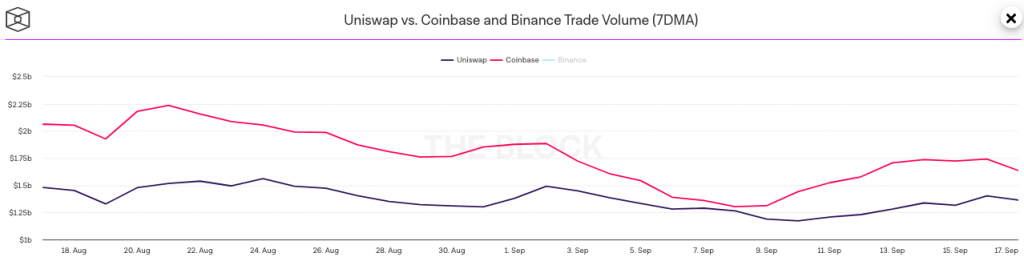

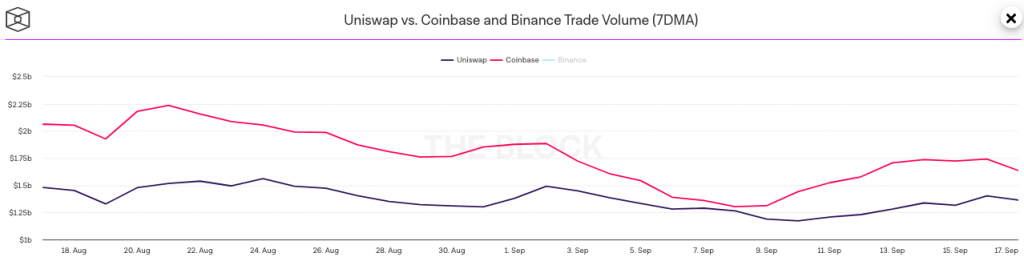

On Coinbase and Uniswap, the directional bias remained similar but did not peak to create monthly highs. On Friday, Coinbase settled $1.7 billion in volume, while Uniswap stood quite close at $1.4 billion.

In the past, there have been a few instances where Uniswap’s volume was close to Coinbase’s activity. In fact, as illustrated below, they were competing neck-in-neck on 8 September.

The drop in the cumulative DEX volume and the DEX:CEX ratio is a gray lining, but the bridging gap between Uniswap and Coinbase re-kindles optimism for DeFi.