Decentralized exchange Uniswap has been in the news over the past day for successfully settling an aggregate of $1 trillion in cumulative trading volume.

Elaborating on the same, the protocol’s official tweet noted,

“Over the past three years, The Protocol has Onboarded millions of users to the world of decentralized finance (DeFi), Introduced fair and permissionless trading, Lowered the barrier to liquidity provision.”

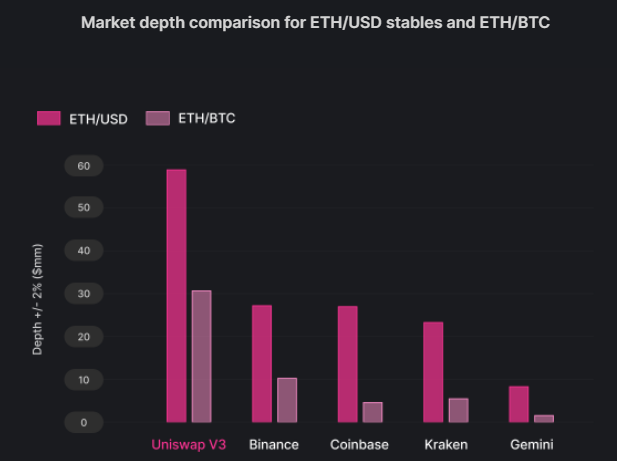

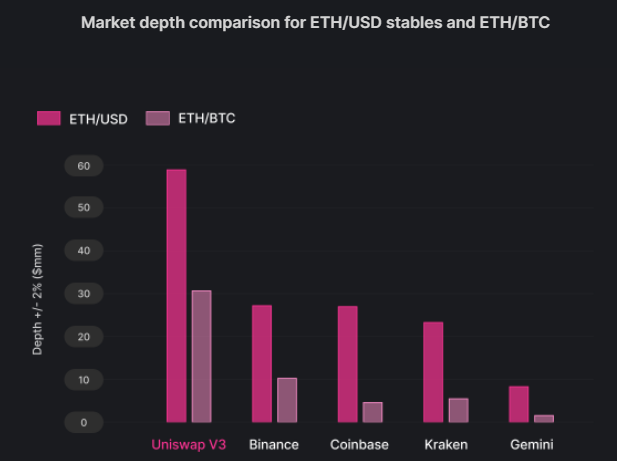

Adding to the aforementioned feat, it is quite interesting to note that Uniswap v3’s liquidity in ETH/USD, ETH/BTC, and other ETH pairs is currently higher than most leading centralized exchanges.

Per recent research, for the ETH/USD pair, Uniswap has 2x more liquidity than both Binance and Coinbase. On the other hand, for ETH/BTC, Uniswap has 3x more liquidity than Binance and 4.5x more liquidity than Coinbase.

Further, as far as ETH and other mid-cap pairs are considered, Uniswap has on average 3x more liquidity than other major centralized exchanges.

The report also brought to light,

“Uniswap v3 also has higher market depth across all price levels, which means it’s even more advantageous for users to execute larger trades on Uniswap v3 relative to centralized exchanges.”

The gray lining

Just like how every coin has two sides, even this has. Uniswap has been able to achieve the said growth on the back of quite a small user base. Per the official website, the DEX’s number of aggregate addresses merely surpassed 3.9 million earlier in May – after approximately 3 years.

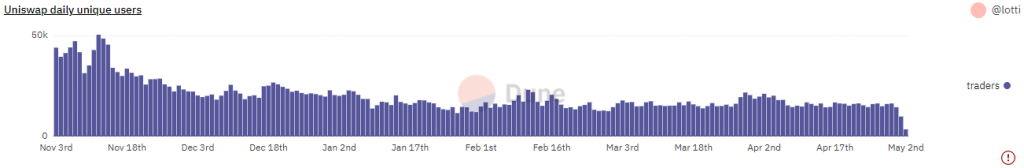

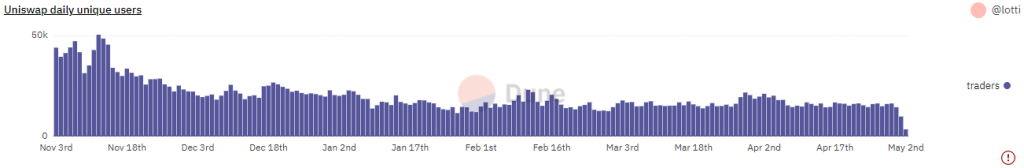

Data from Dune Analytics brought to light that the number of daily unique users has been on a downtrend since November last year. As can be seen from below, the reading of this metric reflected values of around 50k then, but now has straight away fallen to the 10k-20k bracket.

This essentially means that the limited user base has been carrying the burden of growth on its shoulders. Only when that changes and more users step into the Uniswap ecosystem, would the protocol end up reaching its potential.