Despite being in a macro sluggish phase, most top protocols from the crypto space have been building. While networks like Cardano, Ethereum, and Monero’s actions have been more development-centric, Polygon has been playing the role of a good host.

Earlier in the week, the platform revealed that it entered into a partnership with South Korea-based video game development and online publishing giant Neowiz Corporation. In conjunction, they’re now set to launch a brand new web 3 gaming platform.

Read More: Polygon to launch Web3 gaming platform

Polygon’s DeFi expansion

Polygon has evidently been showing resilience in the face of adversity. Polygon Studios’ CEO Ryan Wyatt, recently took Twitter to announce that the team has been having “quite a year.”

Per the latest data from Alchemy, more than 37,000 dApps have been built on the platform. Notably, that’s almost double the number in March and a fourfold increase since the beginning of the year.

Alongside, on the developer activity front also, Polygon has seen a considerable improvement. The platform’s latest blog post highlighted,

“The number of monthly active teams, the most direct measure of developer activity on the Polygon PoS chain, clocked over 11,800 at the end of July, up from just over 8,000 in March.”

While 74% of teams integrated exclusively on Polygon, merely 26% deployed integrations on both Polygon and Ethereum. Highlighting the same, the executive revealed that many projects were “increasingly” choosing to “solely” build on Polygon.

Furthermore, Polygon’s post revealed,

“With over 142 million unique user addresses and $5 billion in assets secured, Polygon PoS has processed more than 1.6 billion transactions till date.”

Two grains of salt and one grain of sugar

Well, the aforementioned numbers clearly bring to light Polygon’s DeFi expansion and network growth over the past few months. However, there’s a gray lining too.

The cumulative number of unique transactions to Matic’s PoS might have crossed the 1.6 billion thresholds on the cumulative front. However, when broken down, its current levels fairly remain to be deflated when compared to the levels noted during the December to February period. From a rough average of 6k registered at that time, the number of transactions has slipped down to the 1k-2k bracket already.

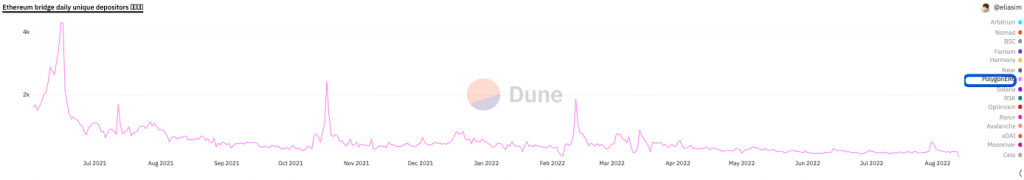

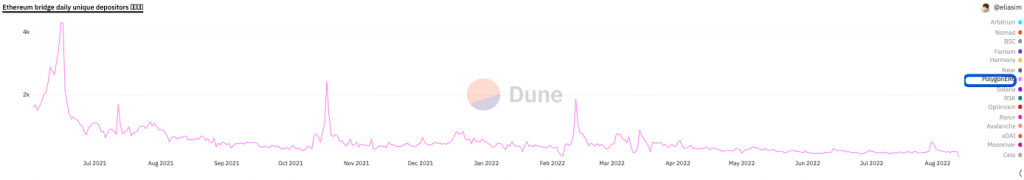

Alongside, the number of daily unique depositors on the PolygonERC bridge has also been on a decline. From the end of July’s local peak of 531, the daily depositor on the bridge merely stood at 63 at press time. When zoomed out, the landscape looks even more gloomy.

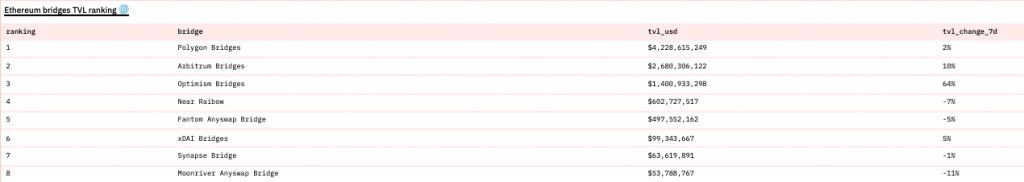

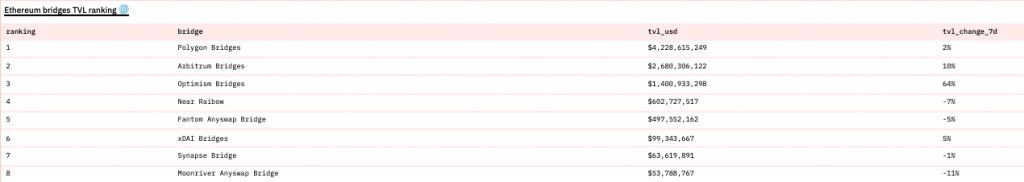

Even so, it is interesting to note that the aggregate value locked on all Polygon bridges has been able to notch up. Data from Dune Analytics brought to light that the same rose by 2% in the past 7 days. Alongside, it is interesting to note that, the TVL on Polygon remains to be the highest among other Ethereum bridges, indicating that the majority of current DeFi users are using Polygon over other platforms.

The overall picture does seem to be quite constructive. However, owing to the gray lining, the same ought to be taken with a pinch of salt.