Towards the end of last week, DeFi tokens were collectively rallying. Right from Compound to Curve and Yearn Finance, almost all tokens had registered massive gains. Even though Aave traded in the green, it stood slightly behind its counterparts.

Read More: DeFi tokens’ daily RoI rises upto 25%: YFI, CRV, AAVE gain focus

However, the narrative has already flipped, thanks to significant ecosystem-centric development. An Aave community proposal to launch a native crypto-based stablecoin, GHO, was passed over the weekend. Per the governance page, the said proposal managed to amass 99% of votes in favor.

The said development aided AAVE in extending its green-streak phase, and on Sunday, the DeFi token went on to clinch a monthly high of $107.

Aave’s on-chain activity improved, but…

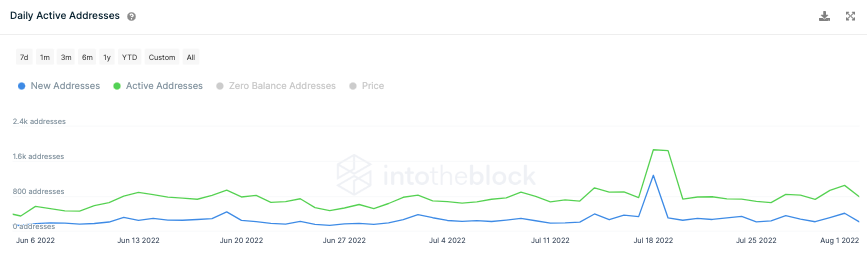

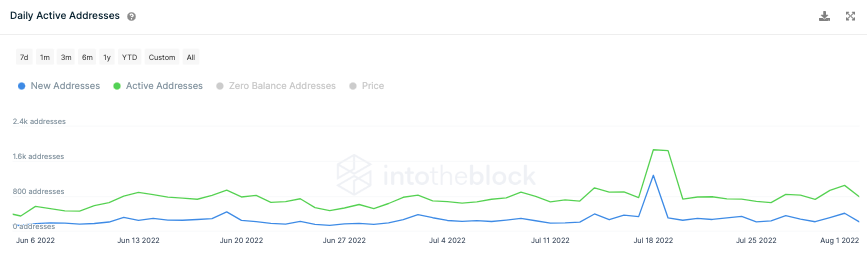

Analytics platform IntoTheBlock highlighted that Aave’s on-chain activity was on an “up-trend” of late, and the token’s price was up by 114% from its recent bottom. As highlighted below, the daily active addresses created a high yearly mid-July —a few days after Aave submitted its GHO Request for Comment proposal.

However, when the latest stats were viewed on the website, there were early signs of retracement already. From reflecting 4-digit readings, this metric is back to the 3-digit territory. At press time, merely 782 addresses were active compared to 31 July’s 1.05k and 18 July’s peak of 1.86k.

The new address numbers have also followed suit and are on the decline currently. Aave was placed in the bearish territory by ITB’s net-network growth signal at press time.

What next?

When the network activity blossomed, AAVE’s price enjoyed a fruitful rally. However, with pull-backs being noted, it looks like market participants should brace themselves for a potential correction.

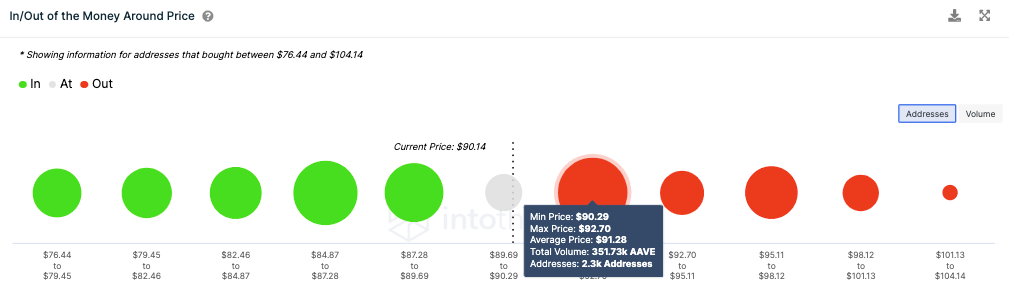

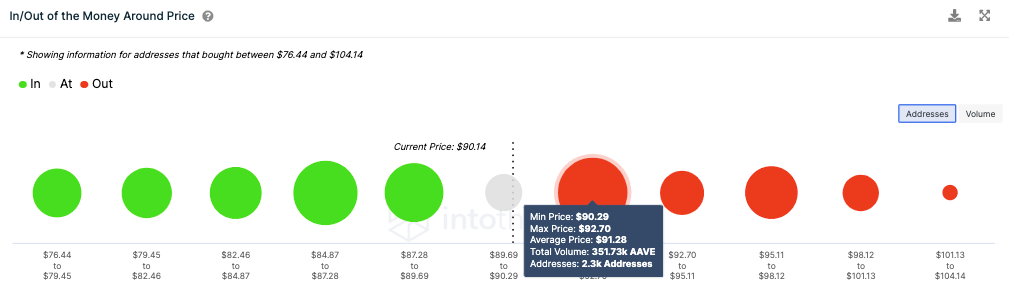

At press time, the DeFi token was trading at $90.14. The current price range has acted like an attractive accumulation zone in the past. In the narrow band between $90.29 to $90.70, more than 351k tokens have been purchased by the largest cluster comprising 2.3k addresses. This means these participants are on the brink of being triggered to sell their tokens as soon as their buy price and the market price break even. So, this puts Aave’s native token at the risk of depleting in value.

Furthermore, the token shares a high correlation of 0.8 with Bitcoin. With the bearish sentiment taking shape in the broader market, AAVE will likely subject itself to a correction before heading up further. In the event of a downswing, market participants can expect a 16% decline to $75.5 over the short term.

However, if it successfully manages to collect liquidity around $90-$93 over the subsequent few trading sessions, then $111.6 and eventually $128 would be feasible targets.