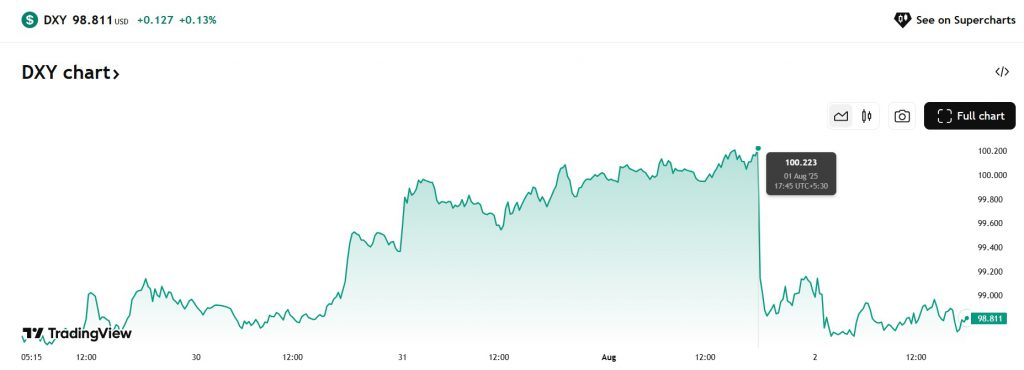

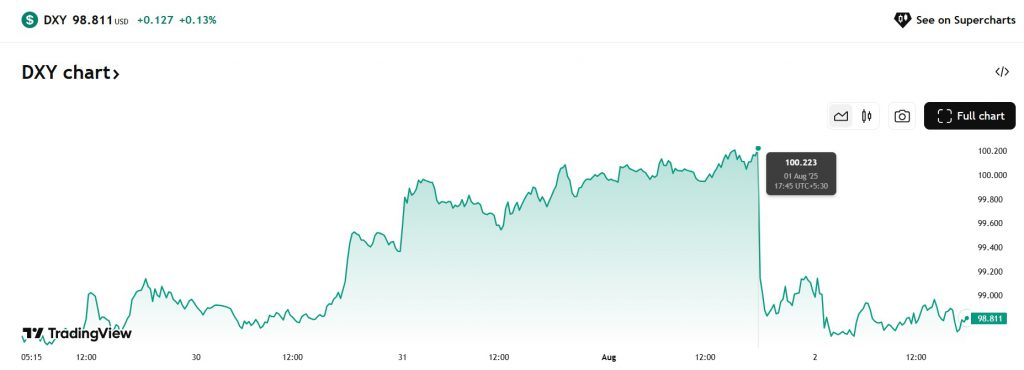

Oil refiners around the world are now demanding the US dollar for payment settlements and not local currencies. The development helped push the DXY index to the 100.20 level in August for the first time in three months. The last time the DXY index fell below the 100 mark was in May 2025. It took more than three months for the currency to reach the triple-digit range in the indices.

Also Read: De-Dollarization Rose Under Biden, It’s Dying Under Trump

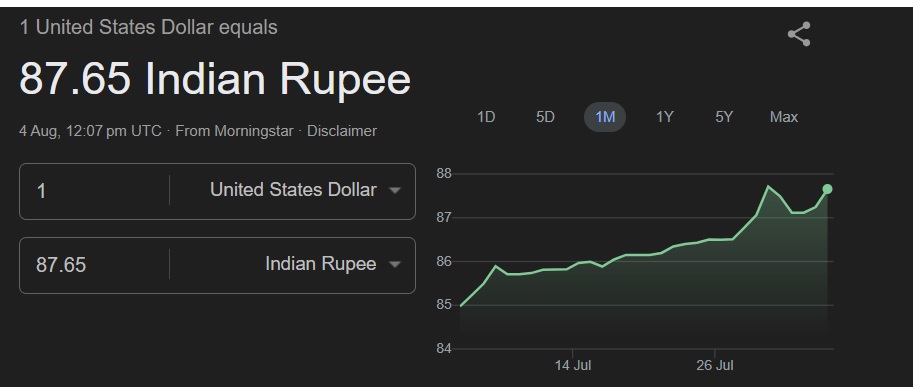

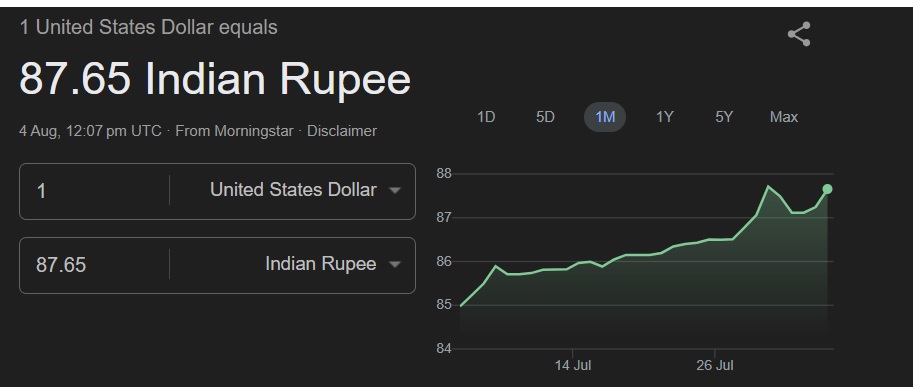

The surge came after oil suppliers were persistent in demanding the US dollar from importers for settlements. The Indian rupee was the hardest hit as it dipped 2.7% in a month. The USD/INR trading pair shows the greenback dominating the charts since July. The rupee has fallen to a low of 87.70, displaying broader weakness in the indices. However, the rupee is up nearly 2.40% year-to-date.

Dollar Demand From Oil Companies Rises, Local Currencies Fall

The strong US dollar inflows to oil refiners strengthened the DXY index, according to a US dollar report from the Economic Times. “Consistent foreign outflows from local stocks and elevated corporate dollar demand are likely to keep the rupee under pressure,” said a trader at a private bank.

Also Read: Ruble Overtakes Dollar In Russia’s Trade With Asia

However, the DXY index saw a decline on Monday’s opening bell, falling from 100 to the 98.80 range. The fall stems from the tariffs placed by Trump on India and Brazil for going against the dollar. Trump’s policies are eroding the recent gains of the US dollar, which came from the oil sector.

The oil sector was mainly dominated by the US dollar for decades until developing countries took a different course recently. India, Nigeria, Brazil, China, South Africa, Russia, and Iran, among others, started using local currencies for settlements. Oil firms cannot handle the inflow of local currencies as it affects their balance sheets and eats into their revenues.