Even though the Bitcoin market has pulled back this week after a break-out, the prices have failed to find momentum. The week has not been the best for Bitcoin, as it traded at an opening high of $43,903.02 and dropped to a low of $39,373.06.

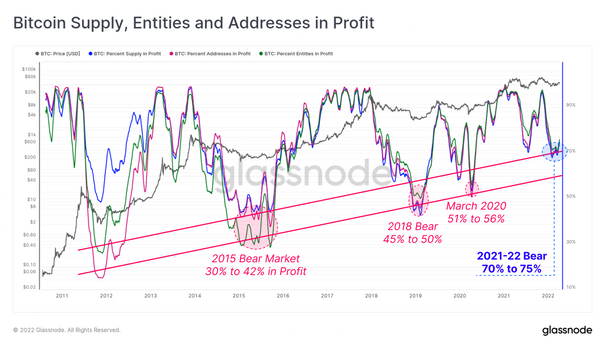

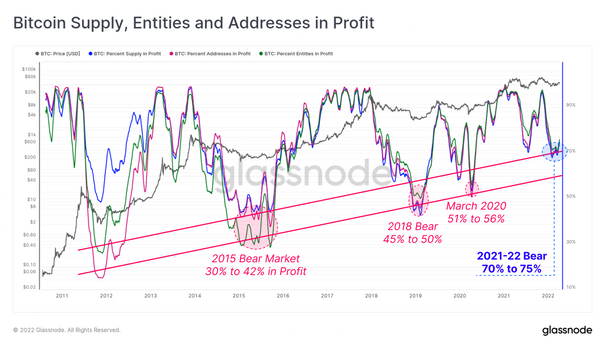

Data provided by Glassnode revealed that 75% of the bitcoin holders are in profit even though bitcoin is not trading at best, considering its all-time high of $68,789.63.

3/4th of the bitcoin holders are in green

Compared to the 2018 bear market, there are 25% more bitcoin holders in profit. Glassnode revealed that since Bitcoin failed to keep up the momentum, there hasn’t been much growth in the user base. The market at present seems to be primarily HODLers.

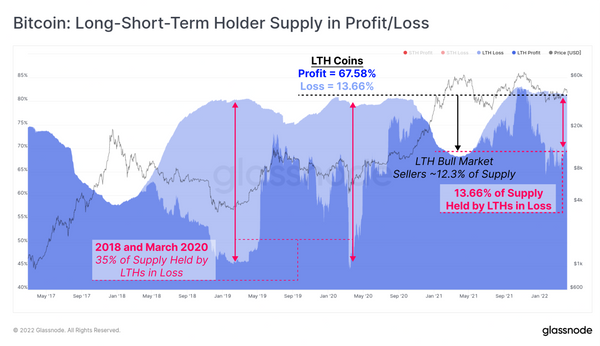

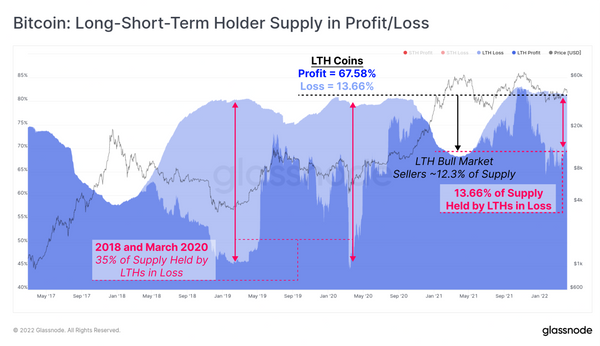

Glassnode reported that almost 58% of transactions are currently in profit. The study shows that even during bear market trends, there has been a consistent growth of the HODLer base who hold the coin and accumulate despite the price and market conditions.

Glassnode addressed that the present bear market is not worse than the previous cycles, which reported higher losses. The current market condition only reports 25-30 % losses.

13.66% of the total supply is held by long-term bitcoin holders, which is at an unrealized loss.

The current spent volume profitability has moved to a greener side as 58% of transactions are currently realizing profit compared to the losses in December.

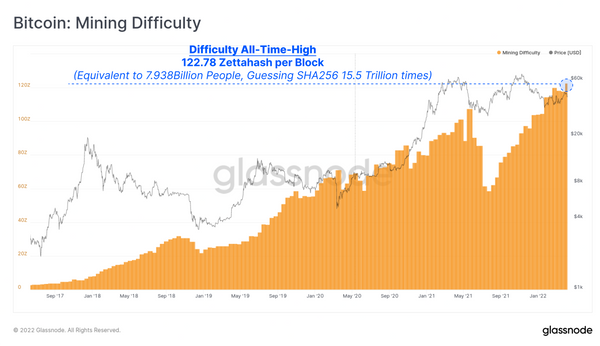

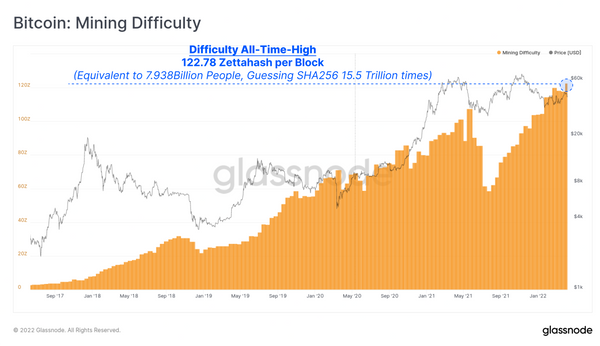

Heated competition among miners

The mining industry seems to be in tough competition, setting an all-time high, even though the lowest transaction fees. The mining difficulty has also touched an all-time high with each block requiring 122.78 Zettahashes to solve.

The estimated has rate has also soared around 20% higher after China’s ban on bitcoin mining.

Glassnode report concludes that even through the not-so-great market conditions, investors have managed to harness reasonable profit. The profit thus far remains stable to the previous bear market.