Alongside Bitcoin’s glide to $41.7k on Wednesday, Ethereum as well spiked to $2.73k on its price chart. The incline was, however, quite short-lived as both the coins were back to their respective price brackets where they had been stuck since last week – $39k in Bitcoin’s case and $2.6k in Ethereum’s.

The much needed ‘optimistic’ divergence

Well, the broader market has been correcting itself since the end of last year. With the correction phase extending to four months now, signs of a bullish price reversal have gradually started emerging.

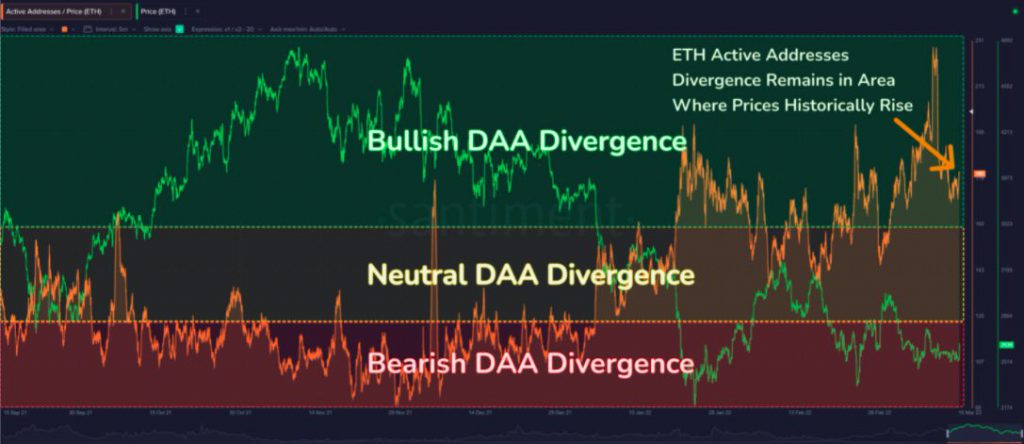

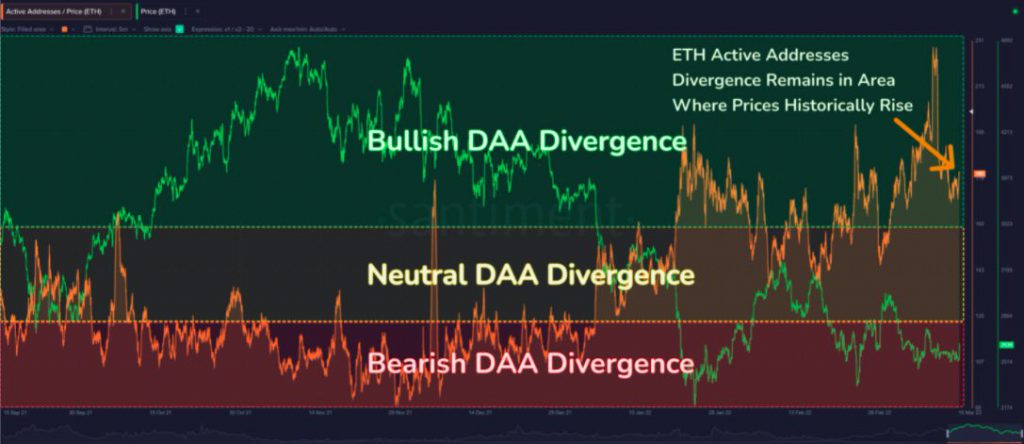

Here, it is interesting to note that the number of daily active Ethereum addresses had not dipped that massively when the assets price dunked. As a result, the price and Daily Active Addresses [DAA] had been able to maintain neutral divergence.

Towards the end of the first week of March, this metric stepped into the bullish territory. The same can be evidenced from the snapshot attached below. This area remains to be quite critical because price inclinations have more or less occurred right after bullish divergences.

Ethereum whales MIA

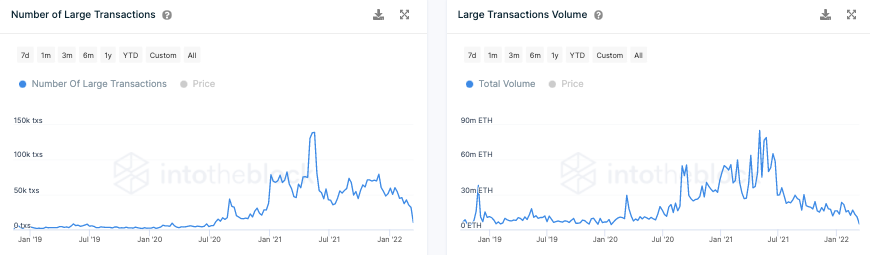

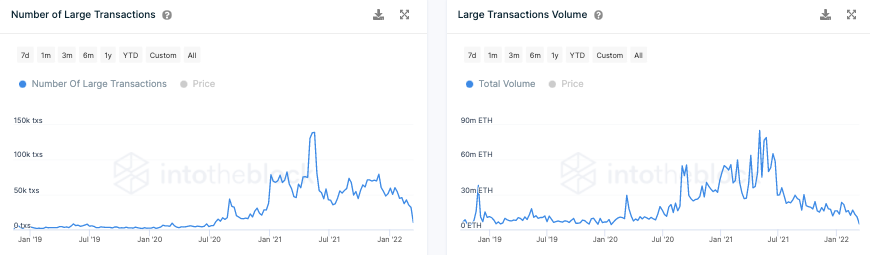

Despite the optimistic outlook on the DAA divergence chart, it shouldn’t be forgotten that whales have been missing in action for a while. As can be seen from the snapshot affixed, both, the number and volume of transactions >$100k have been dipping.

In the past, whenever whales have stepped into the picture and done some heavy-lifting, Ethereum’s price has found it easier to rally. Thus, these large players will have to step up and gradually make their presence felt in the market to foster ETH’s uptrend narrative.

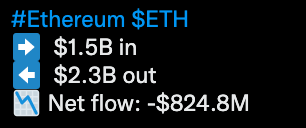

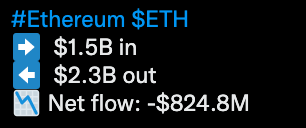

The overall picture, however, doesn’t seem to be that bleak. The exchange net flows have been negative of late. Glassnode’s daily on-chain exchange flow metric highlighted that over the past day, the outflows had outstripped the inflows by $824.8 million. The same, to a large extent, highlights the buying-momentum building up.

Owing to the buy-side bias, Ethereum’s price was already up by 6% on the daily window. For the uptrend narrative to gain further steam, whales would have to get their respective balls rolling too. Else, they might end up haunting the largest alt’s bullish thesis.