Dog-themed coins have not been having a great week. DOGE, SHIB, and ELON, for starters, have all shed 10%-13% each in the last 7 days. In fact, even at the time of writing, all the three coins were down by more than a percent each.

Nevertheless, the 14th ranked meme-coin DOE or Dogs Of Elon, proved to be an exception and was seen defying the broader trend. Up by 8% over the past day, DOE was seen trading at $0.0586 at press time.

Red flags

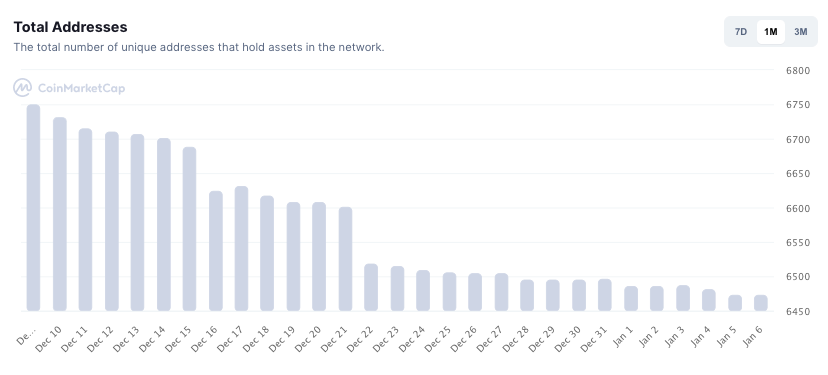

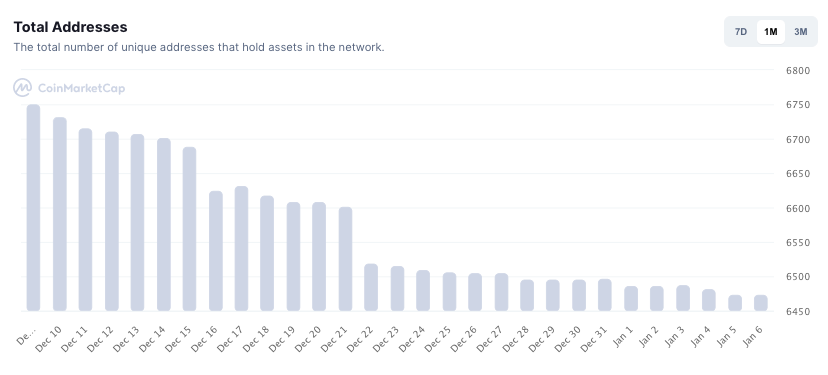

Despite the attractive daily gains, the Dogs of Elon market currently doesn’t offer short-term investors many reasons to stay back. The number of unique addresses HODLing assets in the network, for starters, have been falling on the monthly time window.

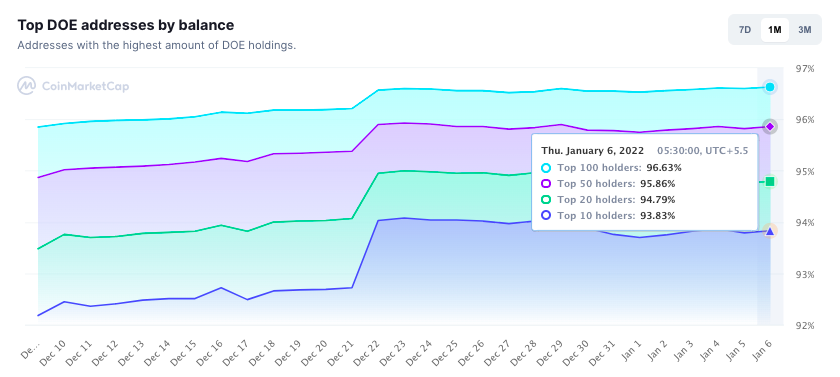

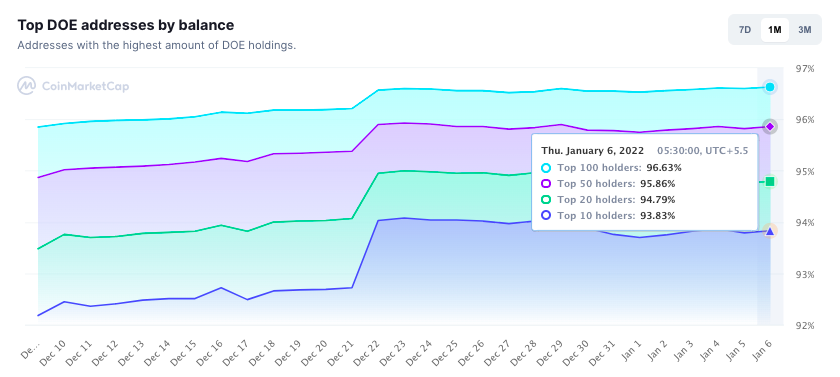

Now even, amongst the remaining addresses, the top 10 HODLers possess more than 93.83% of the supply. The concentration of the majority of tokens in just a few limited hands ain’t healthy for the price. More so, because it opens up the door to manipulation.

To make things even worse, the social footprint has also not been that that impressive of late. There is hardly any hype created by community members on crypto-related social media nor has their Twitter following count been increasing.

Before moving forward, it is important to note that DOE also has its own native NFT collection going by the same name. Their CryptoPunks essentially represent the meme-coin HODLers. Their description on OpenSea highlighted that they had created 10,000 unique NFTs in celebration of the “power of the meme coin community and its strength which has universally defied experts.”

However, of late, their sale numbers on OpenSea have dried up.

Despite the not-so-glossy short-term prospects, things can be expected to pick up the pace and improve with time. For now, the project is focussing on the whole decentralized and community governance aspect. In effect, deployer funds are set to move into a time a locked wallet. Such a move has the potential to make DOE deflationary and aid its long-term valuation.