At one point last year, Cardano was the third largest crypto asset in the market and stood only below Bitcoin and Ethereum. Prior to the Alonzo hardfork, it significantly rallied and went on to claim an all-time high of $3.1.

Fast forward to today, ADA’s price has been slashed by more than 10 times. After noting an 11% decline over the past 7-days, the currently 8th-ranked crypto asset was trading at $0.33 at press time.

Weekend Trend: Cardano Edition

In September, weekends were fairly volatile for Cardano and the candlesticks registered had a wider range in price action. This month, however, the trend has been quite the opposite.

As illustrated below, the bodies of all three Saturday candlesticks have more or less been short and stout, with barely any difference between the open and closing price—a classic Doji. Two out of the three Sundays—on the other hand—have been slightly volatile, but not like September’s Sundays.

What To Expect This Weekend?

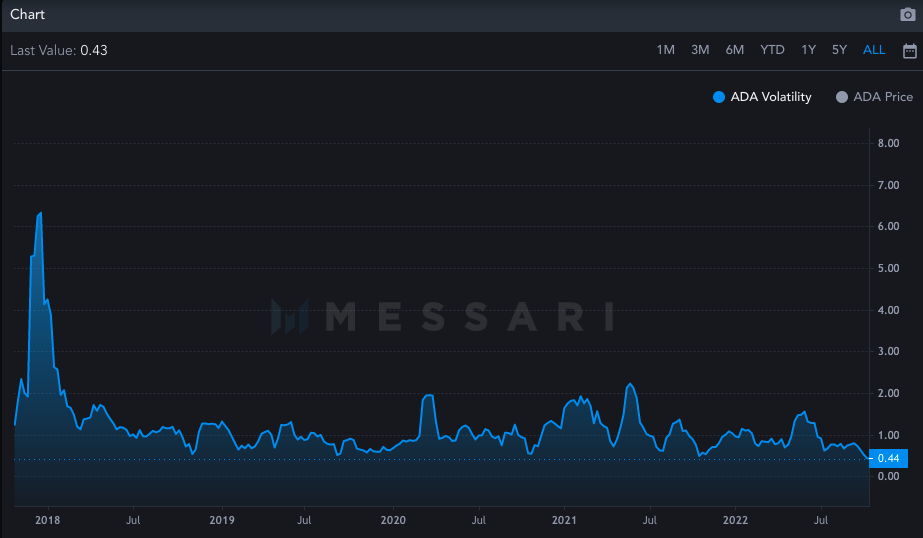

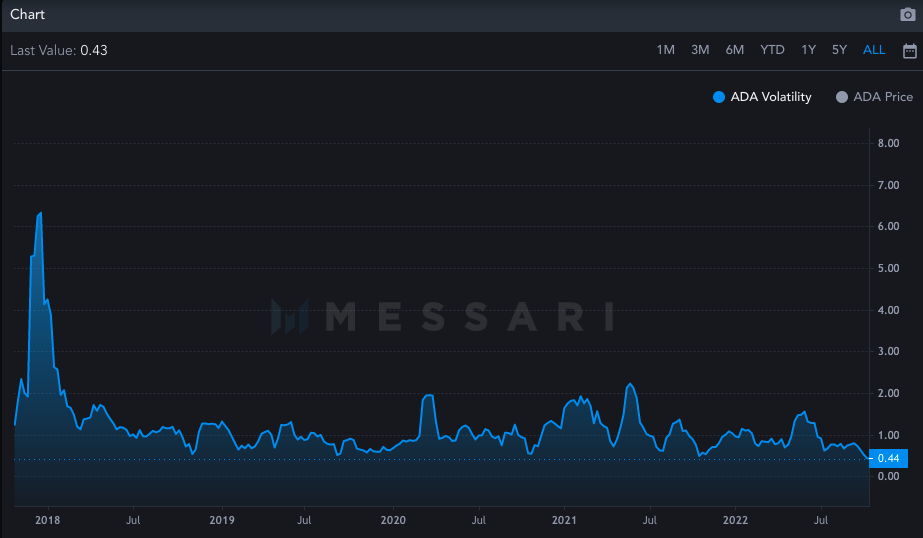

At the moment, Cardano’s volatility is at an all-time low level of 0.43-0.44. Whenever this metric has hovered around similar levels in the past, ADA’s price has remained stagnated. So, per the current state of affairs, ADA’s price should technically not deviate much from its current levels during the weekend.

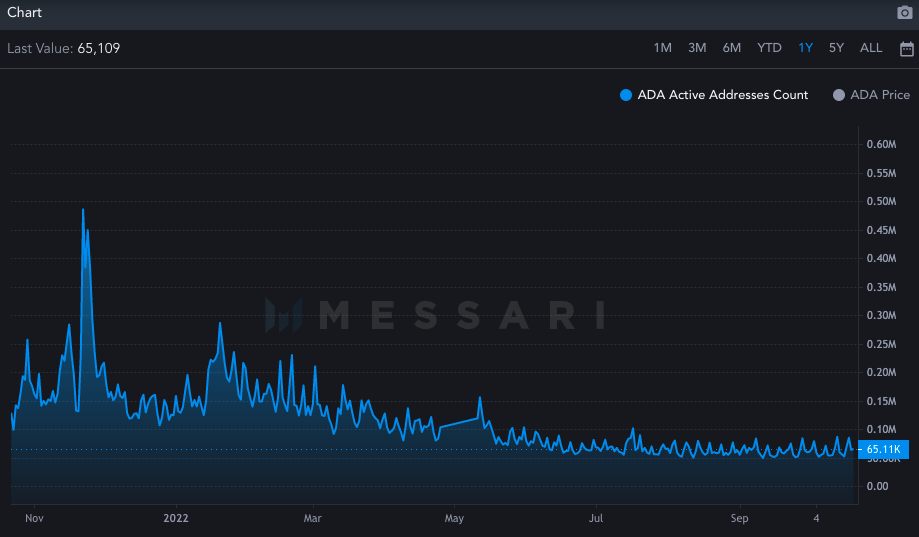

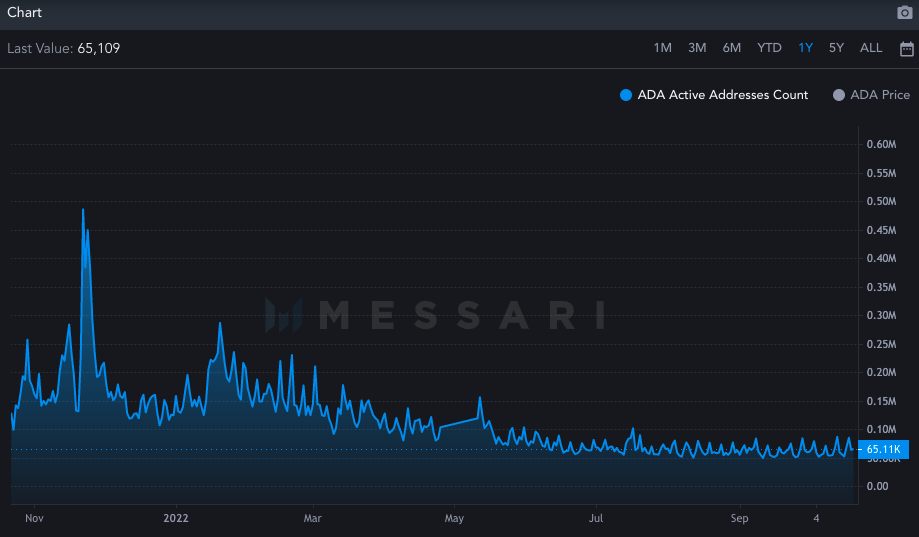

Furthermore, there’s hardly any support on the on-chain front to change the narrative for Cardano. The active addresses continue to remain flat.

An address, as such, is considered to be active when it becomes a direct participant in a successful transaction. Per the thumb rule, low numbers ain’t looked-forward to, for it hints towards lackluster participation by traders/investors.

On the daily, Cardano’s RSI reading has been hovering around 20 [ref. chart 1], indicating the oversold state of the market. Right around the current price, ADA has strong support from where it began rallying in 2021. So, if it manages to clasp onto it, the damage would be under control. If not, the sixth largest crypto could fall down to $0.30 during the weekend. Thereon, if not rescued by bulls, it could eventually drop to $0.21.

If the broader market ends up posing a collective recovery during the weekend, Cardano can be expected to tag along, for it shares a high correlation with both Bitcoin and Ethereum. In such an event, it has upside room to glide upto $0.42 over the short run before being tested.