The increasing popularity of cryptocurrencies has led them to become more and more accepted as a method of exchange. Unfortunately, this also reflects in the acceptance of cryptocurrencies for illicit services or goods, and criminal activity. As per a report by Chainalysis, crypto currency-related crime reached a new high in 2021, with unlawful addresses collecting $14 billion in the year, up from $7.8 billion in 2020.

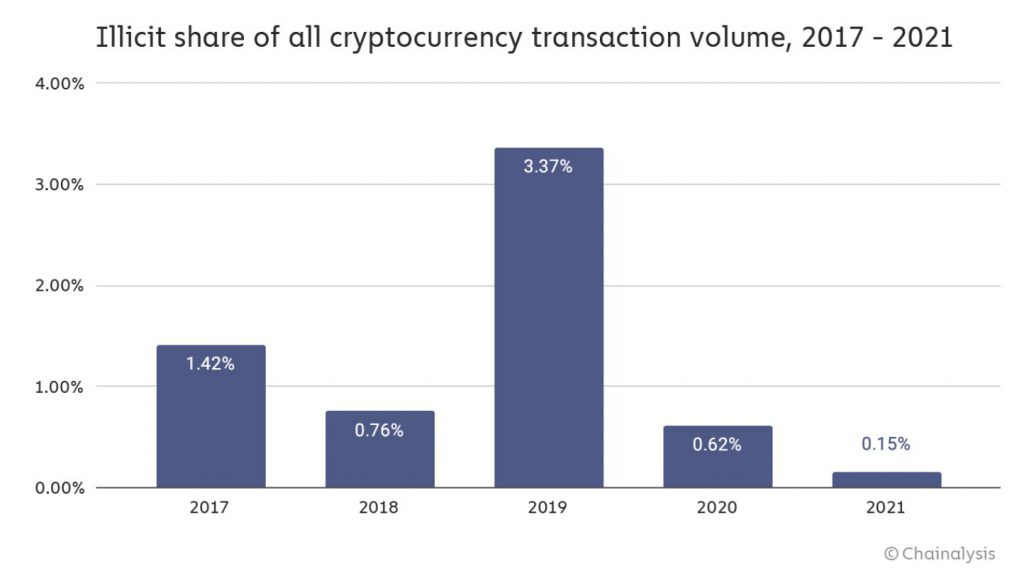

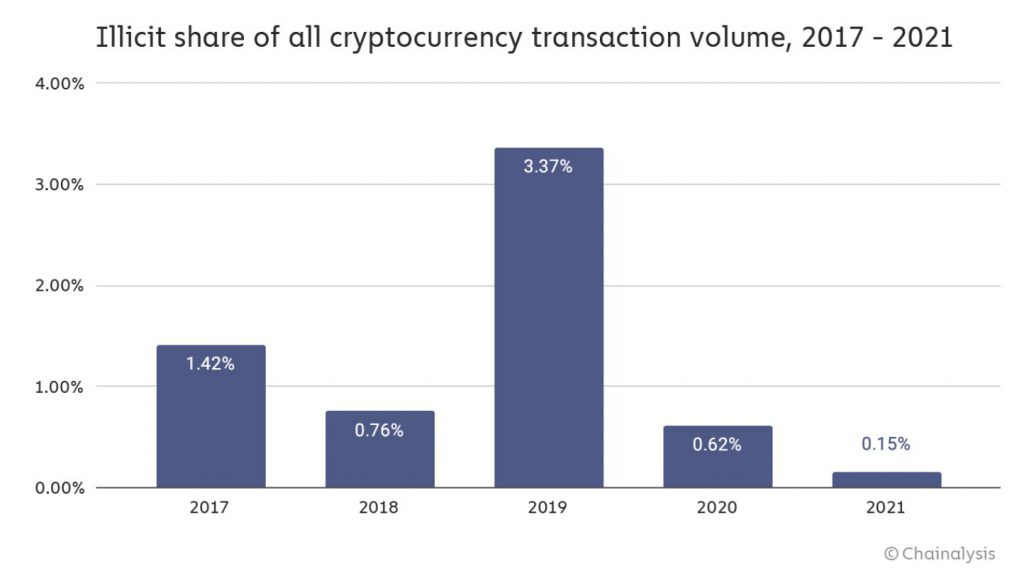

However, such figures do not convey the whole story. Cryptocurrency adoption is increasing at a quicker rate than ever before. The total transaction volume across all cryptocurrencies tracked by Chainalysis climbed to $15.8 trillion in 2021, up 567% from the number in 2020. Given its rapid growth, it’s no surprise that more fraudsters are utilizing cryptocurrencies for illicit purposes.

What do the illicit crypto numbers look like?

In 2021, scamming earnings increased by 82 % to $7.8 billion in cryptocurrencies stolen from victims. Rug pulls accounted for roughly $2.8 billion of this amount, nearly matching the rise over 2020’s total. Rug pulls are a new scam in which developers create what look to be credible cryptocurrency projects — that is, they do more than just set up wallets to collect crypto for, say, false investing possibilities — before taking investors’ money and vanishing.

In 2020, little under $162 million in cryptocurrencies was stolen on DeFi systems, accounting for 31% of the overall amount taken for the year. That was a 335% rise above the total amount of money taken on DeFi platforms in 2019. In 2021, that amount increased by another 1,330%. To put it another way, as DeFi has grown, so has its problem with stolen funds.

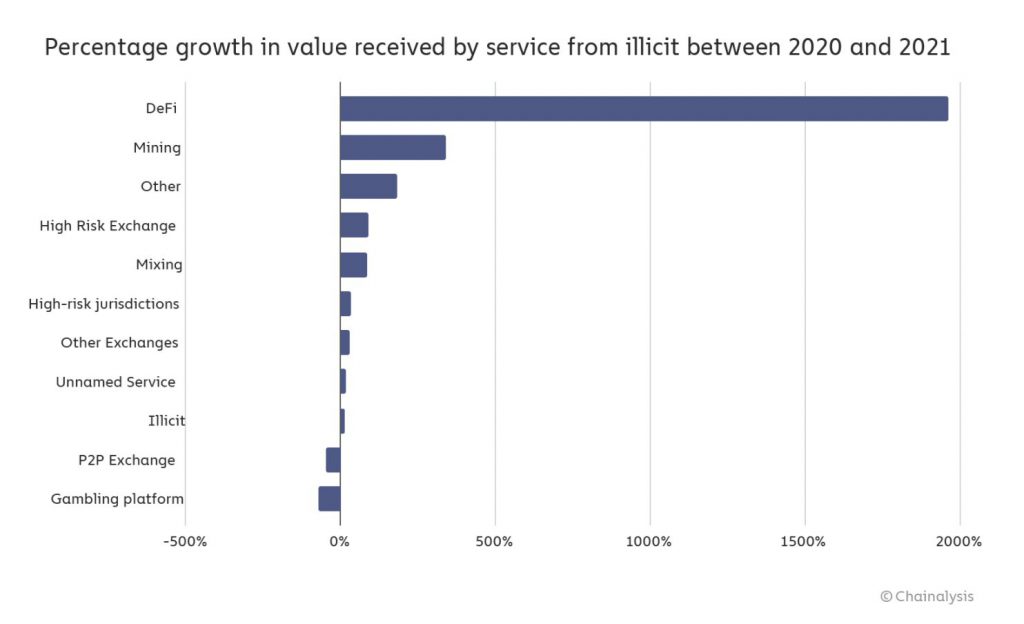

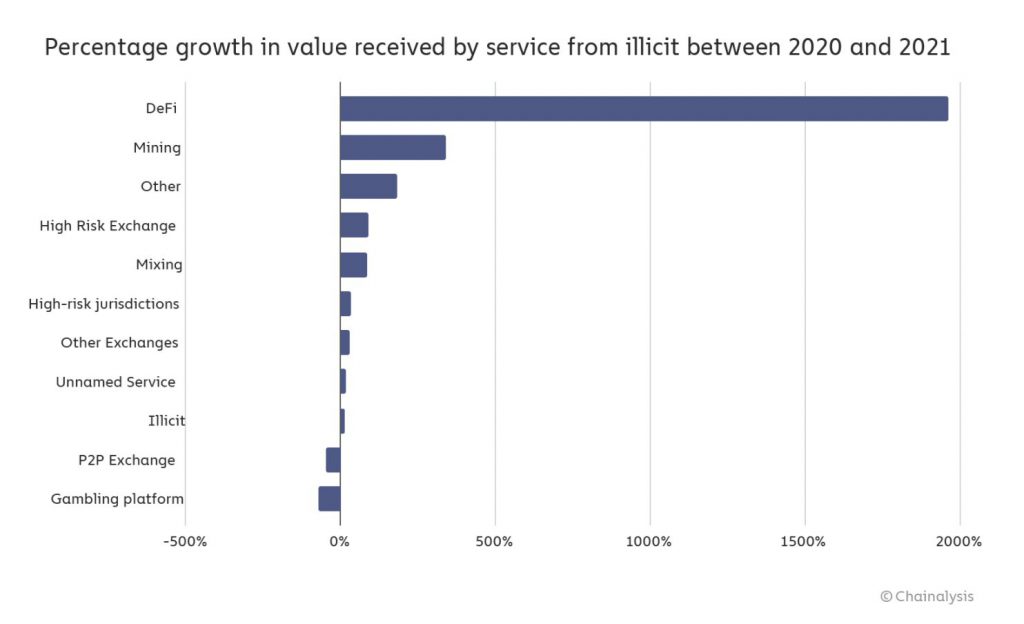

There was also a large increase in the use of DeFi protocols for laundering illicit cash, which noticed sporadic occurrences in 2020 but became more common in 2021. DeFi protocols experienced the greatest significant increase in use for money laundering, with a 1,964% increase.

Cryptocurrencies theft increased even further in 2021, with nearly $3.2 billion worth of cryptocurrency stolen, up 516 percent from 2020. DeFi procedures were responsible for almost $2.2 billion of the funds, or 72 percent of the total for 2021.

How are these criminal activities carried out?

Approximately 90% of the entire value lost via rug pulls in 2021 may be ascribed to one fraudulent centralized exchange, Thodex, whose CEO vanished shortly after the exchange’s capacity to take cash was suspended. On the other hand, all other rug pulls documented by Chainalysis in 2021, featured DeFi projects. A majority of these examples involve developers duping investors into acquiring tokens linked with a DeFi project then emptying the tools given by those investors, thereby reducing the token’s value to zero.

Rug pulls are often used in DeFi for two reasons. One is the increasing interest in the area. In 2021, the amount of DeFi transactions increased by 912 %, and the spectacular gains on decentralized tokens like Shiba Inu have enticed investors to bet on DeFi tokens. Secondly, anyone with the necessary technical expertise can easily manufacture new DeFi coins and have them published on exchanges, even without undergoing a code audit.

How is the law catching up to crypto crimes?

The increased capacity of law enforcement to seize illicitly obtained cryptocurrencies is a step ahead in the battle against cryptocurrency-related criminality.

The IRS seized $3.5 billion dollars of cryptocurrencies in 2021, all from non-tax-related investigations. The Department of Justice confiscated $56 million in a cryptocurrency fraud investigation, $2.3 million from the ransomware gang behind the Colonial Pipeline attack, and an undisclosed sum from Israel’s National Bureau for Counter Terrorist Funding in a terrorism financing prosecution.

In a recent development, on the 6th of January, 2022, the SEC charged Australian citizen Craig Sproule and two firms he formed, Crowd Machine, Inc. and Metavine, Inc., with making materially false and misleading claims in connection with an unregistered offer and sale of digital asset securities. The ICO revenues, according to Sproule, would be used to build a new technology that will allow Metavine, Inc.’s existing application-development tools to function on a decentralized network of users’ personal computers. Instead, Crowd Machine and Sproule began channeling more than $5.8 million in ICO funds to South African gold mining companies, which was never disclosed to investors.

As cryptos become more popular, it’s critical that the public and private sectors collaborate to guarantee that consumers can safely interact and that criminals can’t take advantage of these new assets.

So what is the bigger picture of things?

Although crypto-related crimes were at an all-time high, the larger aspect of things is not nearly as bad as you may think. Despite the fact that the raw value of criminal transaction traffic reached its greatest level ever in 2021, transactions employing illicit addresses accounted for just 0.15 percent of transaction volume. In reality, with legal cryptocurrency usage significantly surpassing criminal usage, the fraction of cryptocurrency transaction volume devoted to unlawful activities has never been lower.