There has been a lot of buzz going on around Dogecoin of late. For starters, Elon Musk affirmed earlier during the day that Tesla had not dumped any of its Dogecoin HODLings. The said affirmation managed to rejoice in community members.

Around the same time, Dogecoin revealed that it had released a new core upgrade that intended to make the network even more secure and efficient.

Read More: Dogecoin Core 1.14.6 is out. Here’s what you must know

Resultantly, Dogecoin-related chitter-chatter on social platforms had risen by more than 56% over the past week. As illustrated below, things were dud during the weekend but managed to escalate at a quick pace right after.

No fruitful by-product

Despite the said positives and relatively high social engagement, DOGE’s price has hardly reacted. Even though it took part in the broader market pump during the initial few days of the week, it succumbed to a downtrend on Thursday. Over the past 24 hours, the $9.1 billion market-capped asset has lost up to 7% of its value.

Tricky path ahead for Dogecoin?

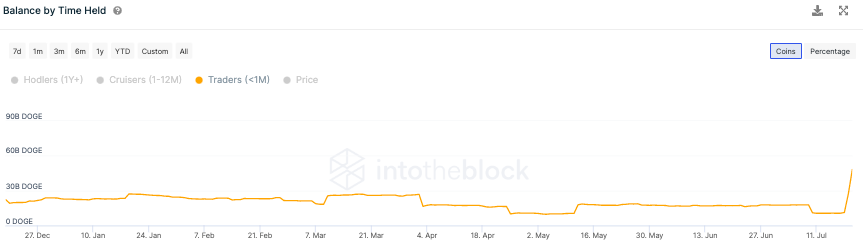

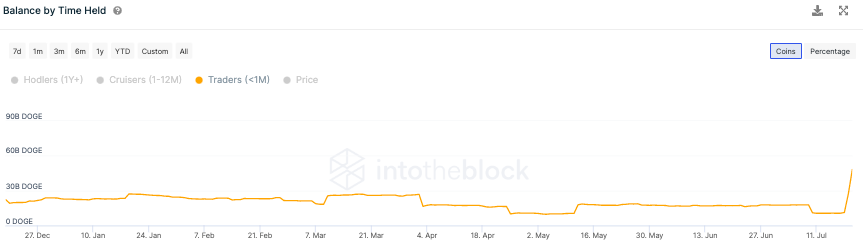

At this stage, it is quite interesting to note that DOGE-related trader activity stands at its yearly high. Per data from ITB, on 18 July, traders collectively held 11.2 billion DOGE. However now, the number stands north of 48 billion, indicating that short-term participants have amassed DOGE en-masse of late.

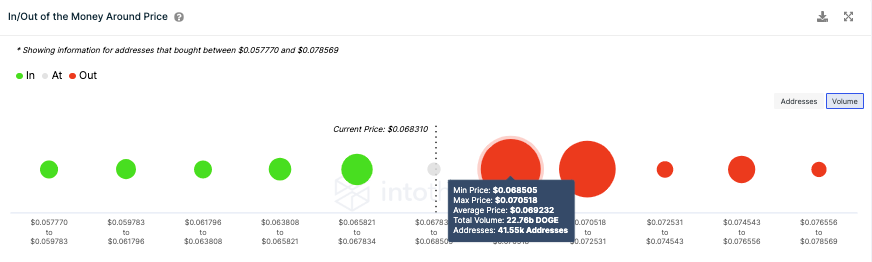

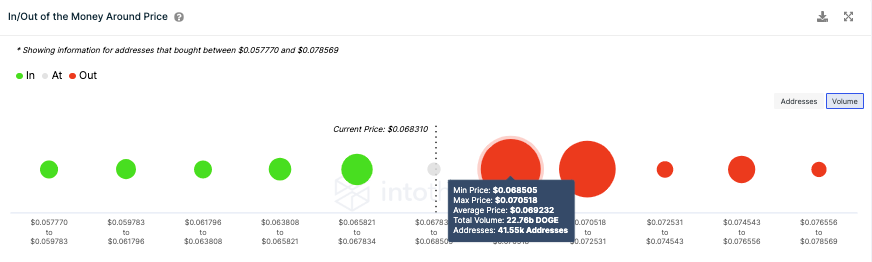

Since such participants dispose off their HODLings within a month, DOGE’s price can be expected to subject itself to harsh volatility. Now, per the in and out of the money stats from ITB, more than 22.7 billion DOGE has been purchased in the price band extending from $0.068 to $0.070.

This basically means that as soon as these participants’ HODLings break even, they’d be triggered to cash out. And with DOGE’s price currently at the threshold of the floor of the said range, the sell-spree can be expected to start soon. And this time, perhaps, traders would be the ones to blame.