Despite monotonous market conditions, Dogecoin’s adoption has not slowed down. In a tweet on Mar. 1, Coins.ph announced that DOGE will be listed on the platform’s Coins Pro arm. Alongside the announcement, the Philippine exchange platform’s tweet also questioned users, “Who let the DOGE out?”

Well, Elon Musk has managed to keep Dogecoin relevant and bring it to the spotlight by tweeting about it time and again. As reported recently, Musk sarcastically confessed that he was the one who let the “Doge” out. Riding on the back of the tweet, Dogecoin’s price briefly spiked. As a result, it wouldn’t be wrong to speculate that the latest listing was influenced by the self-proclaimed Dogefather’s tweet.

Also Read: Elon Musk Makes New Dogecoin-Related Confession, DOGE Spikes

Of late, Dogecoin has been moving horizontally on its price chart. Over the last few days, it has been attempting to break above its EMA resistance cluster, but it has not been successful. However, on the positive side, DOGE has been able to cling on to its Feb. support level of around $0.08 and consistently trade above it.

Also Read: Elon Musk Still Needs Lawyer to Approve Tesla Tweets: SEC

Dogecoin market dynamics

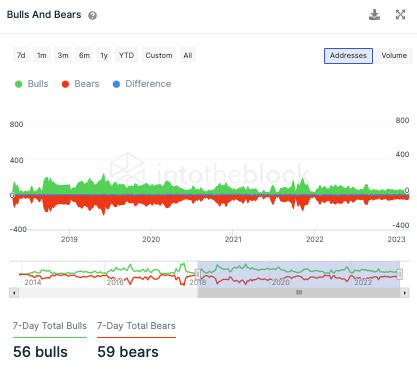

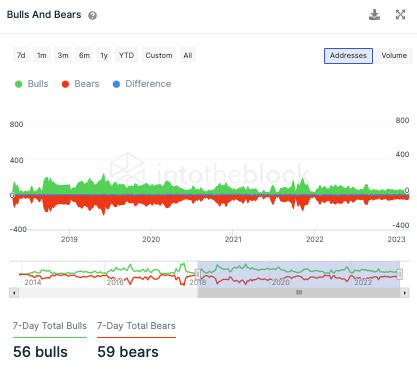

At press time, bulls and bears were seen tussling with each other. Data from IntoTheBlock revealed that the DOGE ecosystem comprised 56 bulls and 59 bears over the past week.

Basically, the bulls and bears indicator tracks the number of addresses that purchased or sold more than 1% of the total amount of volume traded on a given day. So, participants who bought more than 1% of the total volume are considered bulls, while those who sold more than 1% fall under the bears’ category.

In terms of absolute numbers, the bears are currently leading. However, the gap is not quite wide, and it doesn’t essentially give them a sizeable positional advantage.

Market participants have recently been divided, as expected. The buyer-seller trade difference metric depicted the same. As shown below, during the shorter timeframes, buyers have had an upper hand when compared to sellers. However, on slightly longer timeframes, sellers seemed to be racing ahead.

Also Read: HEX Rises 155% In February, Dogecoin Drops 16%

Over the past week, however, the number of new addresses has increased by 12.24%, indicating increased activity. This means that DOGE investors are not sitting idle and are taking part in successful transactions, renewing hope for a bullish flip.

Dogecoin currently shares a positive correlation of nearly 0.8 with Bitcoin. With participants split at this point, Dogecoin and the rest of the market clearly seem to be waiting for a directional cue from Bitcoin. Depending on the largest crypto’s course of action, the rest of the clan, including Dogecoin, would follow suit.