In a recent thread of Tweets, Robinhood CEO, Vlad Tenev, shared his thoughts on whether Dogecoin(DOGE) truly is the future currency of the internet, and of the people. Tenev says that from the moment Robinhood had listed Dogecoin (DOGE) on its platform, he had been thinking about what it would take for a currency like Doge to really become the currency of the internet.

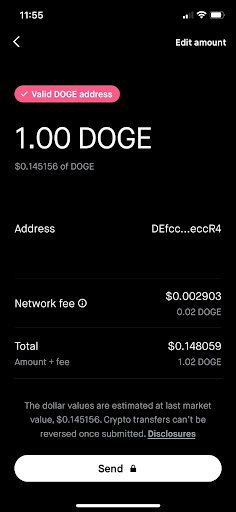

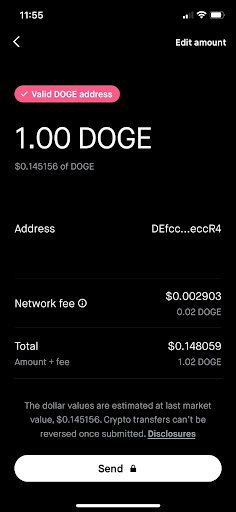

According to the Robinhood CEO, firstly, transaction fees have to be vanishingly small. According to Tenev, we’re almost there. As of last November’s 1.14.5 update, typical transaction fees have been approximately $0.003 on the Robinhood platform, compared to the 1-3% network fees that major card networks charge.

Second, the block time (the amount of time it takes for successive blocks to be added to the chain and for a transaction to be verified) should be short enough that the transaction can be recorded in the next block in less time than it takes to pay at a point of sale terminal.

However, according to Tenev, it should not be so quick that miners create too many rival chains and waste too much energy establishing consensus. The current block time for Doge is 1 minute. For payments, a ten-second block time would be more acceptable, as it would be less than the average time spent completing a debit card transaction.

Dogecoin (DOGE) has a throughput of roughly 40 transactions per second (tps) with a 1MB block size and a 1 minute block time.

Visa’s network, on the other hand, can theoretically accommodate 65,000 tps. Doge would have to be able to greatly beat Visa, which would necessitate a 10000x increase in throughput. Fortunately, increasing the block size limit is a simple solution.

For the near future, moving to a 1GB (and later 10GB) block size limit would supply all of the throughputs a global currency would require. Tenev claims that L2 solutions aren’t required to tackle this problem.

Criticism for Dogecoin

According to Tenev, critics argue that increasing the block size will come at the expense of hobbyists being able to run a full node at home on a Raspberry Pi. Processing 10GB in 10-minute intervals will necessitate more advanced technology. And Tenev believes that it is a reasonable trade-off.

Another critique of Doge is that it is inflationary and has an indefinite supply, unlike Bitcoin, which has a finite amount of 21 million coins. Every year, 5 billion new Doge are created, with a current supply of over 132 billion. This translates to a current inflation rate of 5%, which is lower than the US dollar.

Furthermore, because of the fixed issuance, inflation actually decreases over time, and it will be below 2% in a few decades.

According to Tenev, Dogecoin developers should concentrate on one thing: developing a good procedure for gradually increasing the block size limit.

Tenev’s Tweet received replies from Dogecoin founder Billy Markus, as well as Dogecoin proponent, and billionaire Elon Musk.

Musk said “As I was saying”, implying that he had been a supporter of Dogecoin becoming the currency of the internet for some time.

Regarding increasing the block size, Musk replied,

“..block size & time should keep pace with the rest of the Internet.”

At press time, Dogecoin (DOGE) was trading at $0.144890